This is from Samantha’s Daily column. You can sign up for The Daily Market Catch here.

The One Big Thing

I’m back – from ‘Early Christmas’ with Delilah and Moe.

Top Charts

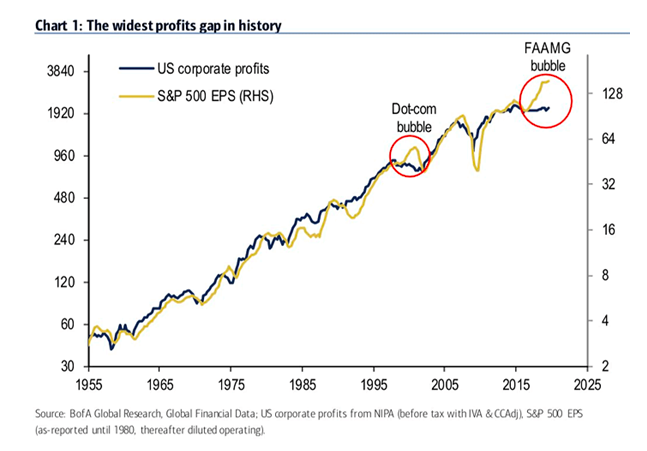

Add this chart to the list of ’01 similarities with housing picking up into the recession.

ISM is also at lows and close to bottoming while the Industrials Sector $XLI is near highs, lumber is recovering, 2yrs trading identically, tech bonanza, Emerging Markets $EEM on the verge of multiple years of out performance. @TeddyVallee

Top Tweets

A Goldman study from Q3 said Americans have only absorbed 2% of the tariff impact so the following push-back from China has merit. In addition, last week Global Times reported that China will release an “Unreliability List” of US companies ‘soon’. Trade War resolution and Market direction will likely hinge on whether Trump will remove, delay or increase tariffs on December 15th. Place Your Bets (and before the weekend!)

Top Trades

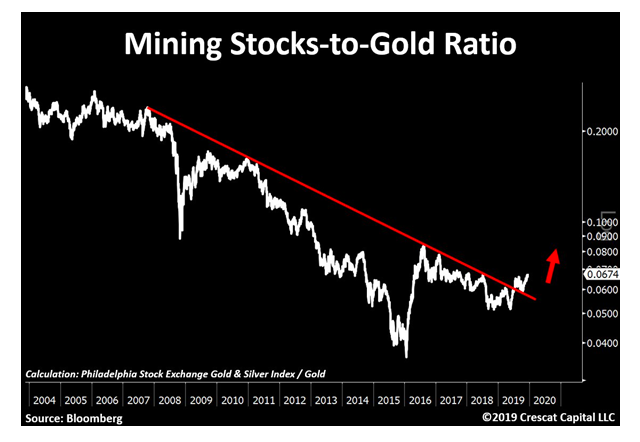

This 12-year breakout in mining stocks relative to gold now as solid as a rock. Couldn’t be more bullish for such a historically depressed industry. Exactly how the early stages of a precious metals bull market should look like. @TaviCosta

Top Reads / Videos

GREAT thread: Lower earnings has always led to fewer buybacks. And a recession will do just that…

Samantha LaDuc is the Founder of LaDucTrading.com and the CIO at LaDuc Capital LLC.

Start with FreeBait! Then take the next step: Come Fish With Me.

Twitter: @SamanthaLaDuc @LaDucTrading

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.