Market Is Processing New Information

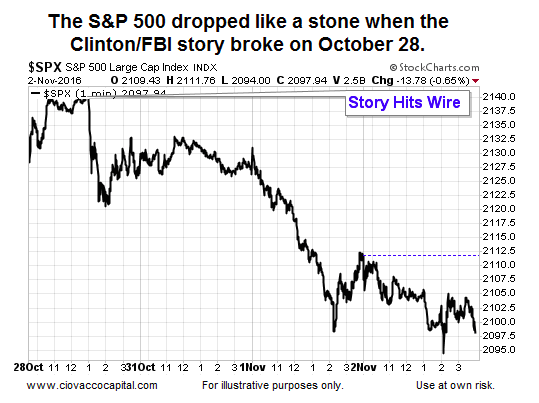

Following an above expectations GDP report last Friday, the S&P 500 Index (INDEXSP:.INX) rallied 8 points. However, shortly after 1:00 pm, with stocks green for the session, the Clinton/FBI news story broke.

And the stock market reversed course.

The market quickly dropped 21 points turning an 8-point gain intraday into a 13-point intraday loss. As of the close on Wednesday, November 2, the S&P 500 is 43 points below the pre-Clinton news high.

Market Is Operating As It Always Does

Given the sharp drop since the story broke, it is reasonable to surmise the market was pricing-in a Clinton victory. Therefore, every chart we reviewed prior to the moment the FBI news hit the wire was based on what is now dated information and dated assumptions. This concept is not new; it is how markets function. Markets make short, intermediate, and long-term forecasts based on the information in hand. When new information comes to light, markets (and charts) adjust their forecasts as needed.

Allocation Strategy

Given the concept of markets/charts adjusting to new information is standard operating procedure, our market approach does not need to be altered to deal with what is now a more uncertain outcome in the U.S. presidential election. If the markets sell-off sharply before the end of this week, we will make the necessary adjustments, just as we would at the end of any other week.

Thus, prior to election day, our task is to remain allocated in line with the evidence we have in hand. On Monday evening, the evidence may be worse than what we have today, about the same, or it may be better.

If the market does not like the outcome of the election, we will adjust as needed and at a rate in line with the rate of change in the evidence. If the market likes the outcome on November 8, we will adjust as needed and at a rate in line with the rate of change in the evidence.

Binary Events

Since the election could be a binary market event followed by significant gains or significant losses, it is extremely important we are ready to respond to any form of new information (favorable or unfavorable). It is important to note, the market does not care about our personal view of either candidate or our opinion about what the election outcome will mean. The net aggregate opinion of all market participants determines the value of our investments.

If the market thinks something is relevant, it is relevant. If the market thinks something is irrelevant, it is irrelevant. Thus far, the market is telling us it believes the narrowing gap between the two major presidential candidates is relevant. And tightening presidential election polls simply mean uncertainty into next Tuesday.

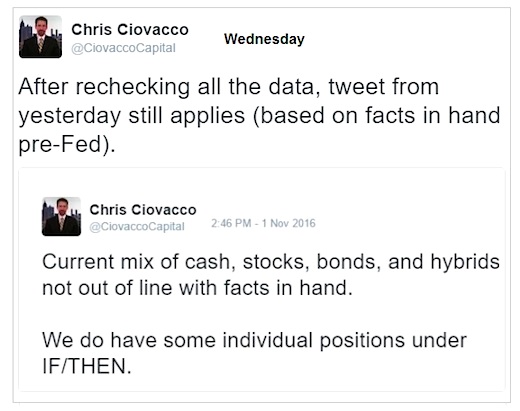

Current Allocation In Line

As noted earlier this week, the market’s intermediate-term profile falls into the “needs to be watched closely” category. We will continue to check our portfolio’s risk-reward profile relative to the facts we have in hand. Thus far, we remain in line with the facts; something that is subject to change in the coming days.

Thanks for reading.

Read more from Chris over on CCM.

Twitter: @CiovaccoCapital

The author or his clients may hold positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.