There have been several events that have occurred in the last days and weeks that, in my opinion, signify that the inherent market risks around the globe are increasing. When a risk manager uses the term ‘risk’, what he or she is really talking about is uncertainty. If I own a 10-year US Government Bond that is paying 2% then I expect to receive the interest on it and for the principal of the bond to be paid back when it matures. I realize that the value of the US Dollar can fluctuate, but my expectation is that it should be minimal.

There have been several events that have occurred in the last days and weeks that, in my opinion, signify that the inherent market risks around the globe are increasing. When a risk manager uses the term ‘risk’, what he or she is really talking about is uncertainty. If I own a 10-year US Government Bond that is paying 2% then I expect to receive the interest on it and for the principal of the bond to be paid back when it matures. I realize that the value of the US Dollar can fluctuate, but my expectation is that it should be minimal.

Last Thursday the Swiss Central Bank surprised the world by announcing that they would no longer peg the Swiss franc to a fixed exchange rate with the Euro. The impact was akin to dropping a bomb into a normally calm lake and the reverberations quickly affected markets worldwide. There was a near immediate 30% surge in the value of the Swiss franc relative to the Euro. Just as quickly, currency traders became insolvent and many lost all of their trading equity. Major Swiss corporations saw losses in their stock as they were re-priced based on the new currency valuations—some of the largest companies in the world lost over 10% in a single day.

Then, the news came out yesterday that China was clamping down on the margin requirements to reduce speculation that has been running rampant. The Shanghai Composite Index had surged 67% in the past 12 months because people were borrowing money and pouring it into the market. The surprise move yesterday resulted in a panic 7.7% single day loss in a major market index. That is significant!

In addition to that, economic indicators continue to show that countries around the world are slowing. The IMF just cut its global growth forecast again. Germany reported falling producer prices—that’s a way of saying that prices are deflating. Crude Oil prices have plunged and now we will be hearing news of job cuts in the Energy Sector.

And are you ready for the ECB’s announcement?

What does all of this mean? I started by talking about owning a 10-year UST bond. Can you see how the surprise announcements by the Swiss and the Chinese have changed the way I need to view that traditionally safe investment? The assumptions were that the markets would behave similar to what they have in the recent past. Perhaps China’s actions were just a one-time event. Perhaps other countries won’t seek to counter the Swiss move by changing the value of their currencies. Or are we seeing the start of a series of currency wars? There’s no way to know for sure, and that’s the point. It’s a sign of increasing uncertainty, as well as a sign of increasing market risks.

I continue to believe that we are in the end stages of a Bull market that started in March of 2009. The systemic risk, according to James Rickards, is orders of magnitude greater than what existing in 2008.

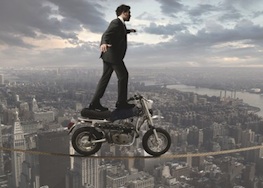

I am not scared, I am not fearful. My job is to identify market risks – especially those risks that can significantly impact my client’s standard of living – so that I can take proactive measures to mitigate that risk, find opportunities and seek to safely navigate them through it. And that’s what I’m doing.

Last week I mentioned that I expected to be adding to my equity exposure. I have added some small positions as the market pulled back last week. Those should be viewed as trading positions, not long-term investments. With the trending indicator that I use signaling we are in a downtrend, I will remain cautious on equities. I continue to own long term US Treasury bonds. I took profits in half of those positions about 10 days ago. The remainder of those positions have continued to do well.

Even in the midst of greater global uncertainty, there are still places that we can invest. The key, in times like this, though is first protecting what you have then trying to get some prudent profits.

My Trending Indicators

US Stock Market Trending Down*

Canadian Stock Market Trending Down

US Bond Yields Trending Down

We are living and investing in a different period of time – manage your risk accordingly. Thanks for reading.

Follow Jeff on Twitter: @JeffVoudrie

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.