The following article is a part of my Gone Fishing Newsletter that I provide to fishing club members each week to identify macro inflection points and actionable micro trade set-ups.

Reflections and Inflections

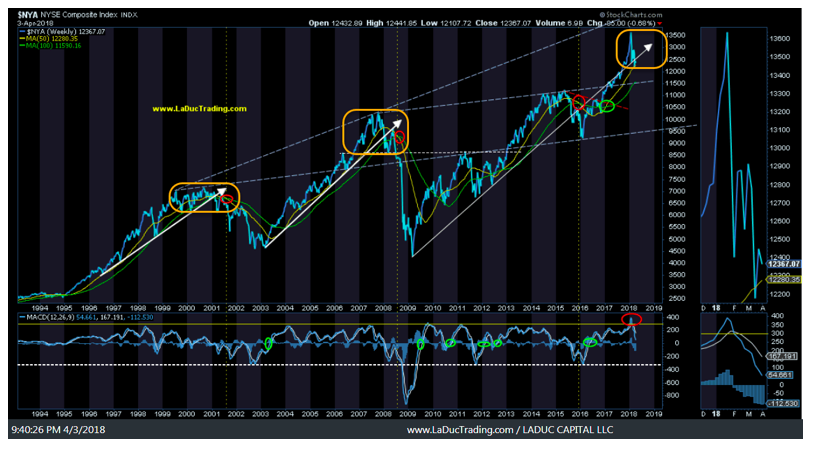

The daily island reversals on the SPY QQQ and IWM on Tuesday April 17 (think SPX $2717) led many bulls to get excited, thinking the March pullback of 7% was over and a melt up was due. Unfortunately for them, the Fed decided to rebalance its balance sheet which caused a liquidity drain and market pullback – when market participants least expected it! One week later on Tuesday April 24th (100 points on the low at SPX $2617), the bears were giddy with the thought that the 200D might not hold.

It held (so far), even if many of the stellar earnings next day (GOOG/GOOGL, CAT, LMT) didn’t. But then CMG and FB reported Wednesday night and the market is in intraday melt-up mode once again, while the 10-yr pauses after a sprint to its quarterly resistance at 3.03% – with USD/JPY and USD running hard along side as well.

With fewer trade war headlines and geopolitical drama to interrupt, the market should be on a tear higher especially with AMZN, MSFT, INTC reports and U.S. GDP print and a Fed-induced liquidity pull not likely until sometime in May. But bulls are not charging … So what has changed? Are they waiting on $AAPL next Tuesday May 1st, or is this a classic bull trap?

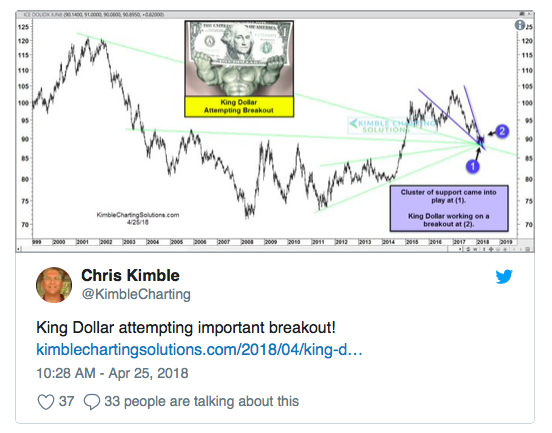

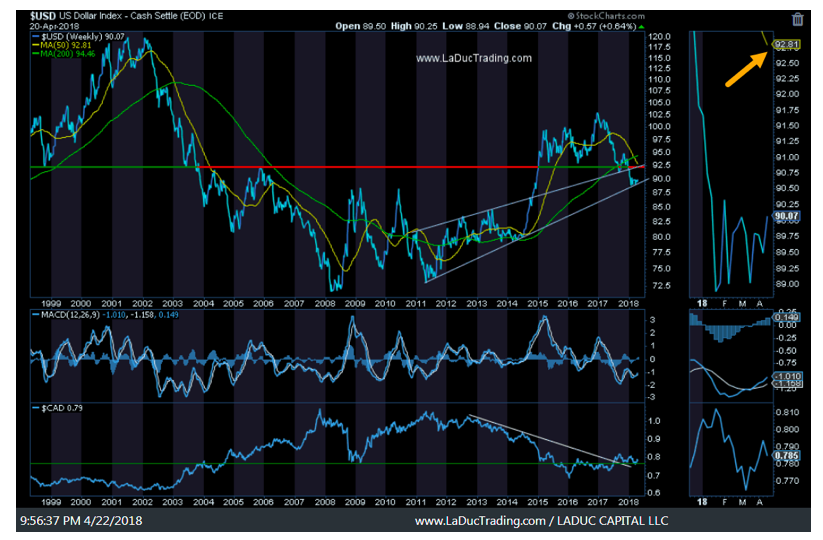

My thesis from a swing trading perspective was to generally wait until through these Big Tech reports and Friday’s US GDP print, which would give us a better read on how those tax refunds have been spent by consumers. My thinking for GDP: Surprise Beat, Retail will Pop – especially the oversold kind. As for the US Dollar, it has already started to soar with the market paying little attention as they focus on their favorite stocks ‘du jour’, but my warning has been Don’t Look Away! In fact, the +2% USD move in one week equated to a 5% pullback in QQQ and this US Dollar short trade unwind can increase as the large funds cover (as I have written about for a few weeks now). That, and earnings reports have been sold off in large part as future profit expectations have started to shrink.

And what happens if the US Dollar really starts to cut into their profits?

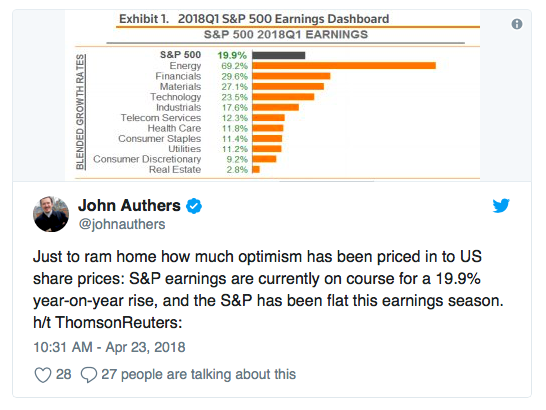

What is clear, there is a lot of ‘risk premium’ baked in to share prices and I am worried how sky-high valuations can be sustained.

Having said that, US GDP growth may give the market bulls a much-needed short-term boost of confidence even though GDP is slated to decline into the back half of 2018 and will eventually get priced in to the whole market structure. Also, if interest rates rise much further with USD and oil prices continue to climb, profits will be hit from both the revenue and cost side, especially for companies with a lot of debt. The economy can stand mild inflation, but not high inflation, and global slowing is likely to dampen U.S. multinational profits and even create a profit recession. But I get ahead of myself. Let’s review the main points I tried to make in my TDA Network Interview on Tuesday morning: Macro Outlook: Peak Earnings?

EARNINGS AND GDP

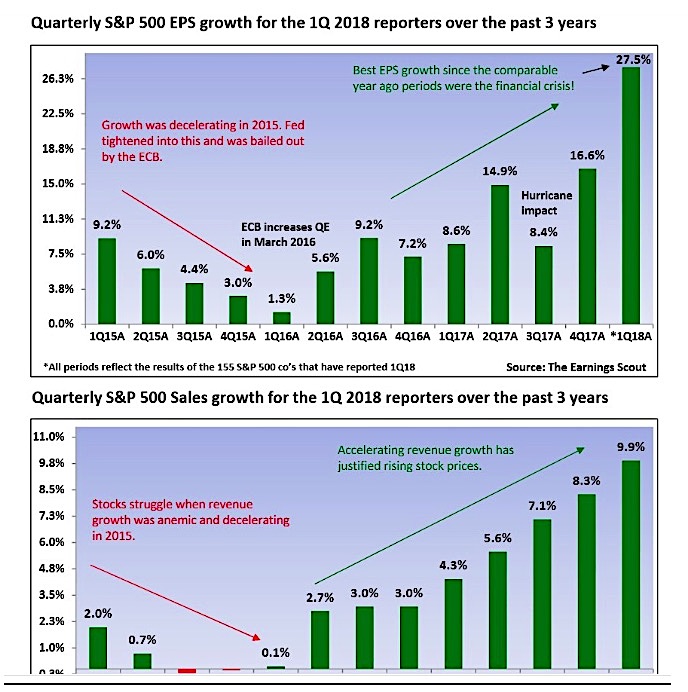

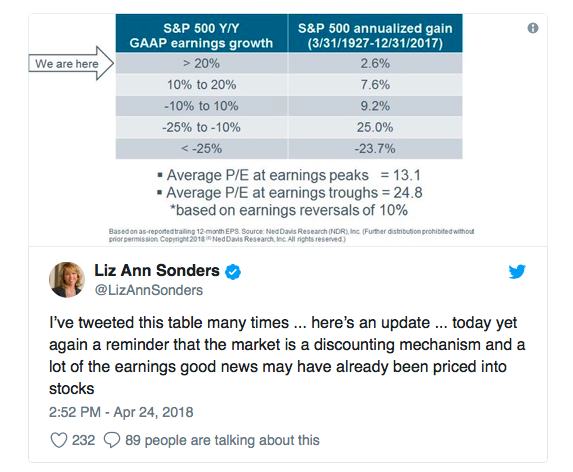

Earnings last quarter 2017 saw double-digit earnings growth but stocks fell on great earnings – the opposite of late 2016 when the earnings trough showed companies with negative earnings had stopped falling after they reported. So here we are in Q1 2018 and FactSet has the estimated earnings growth rate for the S&P 500 coming in at 17.2%. For Q1, all sectors are expected to show growth in earnings. And companies have been ratcheting up EPS guidance at the highest rate on record.

Analysts have basically given companies a pass in 2018, thanks to tax cuts, so beating isn’t the question – as of Friday April 20th, 80% of the S&P 500 companies that had reported had beaten earnings estimates and 72% had beaten revenue estimates – it’s guidance and what happens when they don’t guide higher than expected that matters (aka TSM, largest AAPL supplier, dropped 10% in breathtaking fashion on weak guidance).

So all eyes will be on US GDP print this Friday. And at a 2% consensus, we’re setting up for a positive surprise on US GDP Friday but….Recently, GDP was revised down by Morgan Stanley for Emerging Markets and China – by as much as half for 2019. Why it matters: slowing growth around the world will hurt U.S. multinationals, and China is a major source of U.S. multinational sales growth.

Chinese yield slide may pose greatest danger to emerging markets: Morgan Stanley cut its estimates for emerging-market earnings in a separate note earlier this month, and is now expecting growth of 10 percent in 2018 and 5 percent in 2019. That compares with consensus estimates of 23 percent and 11 percent respectively, according to data compiled by Bloomberg.

That’s the theme it seems: any firm that doesn’t have stellar 2019 guidance likely gets hit. And when is the last time they had to reach THAT far out to impress? Color me skeptical, but I liked buying into that Earnings trough in 2016, and as such, I am less excited about buying the earnings peak now, even after a 10% pullback – twice. I will trade it, however, after the risk premium is out with the economic growth for Q1 on April 27th. That’s the bull’s hope for a better read on how tax cuts have impacted growth and the growth number will likely beat, in comparison to last year’s soft quarter. And my guess, market participants know that, just like they ‘knew’ banks would beat and still bank sold off anyway. Is Tech next?

BANKS AND RATES

Combined Q1 earnings of GS WFC JPM BAC and C rose bigly thanks to lower corporate tax rates BUT Wells Fargo would have seen earnings decline from a year ago, and Citi and BofA would have seen no growth, if tax cuts were stripped away. Without banks participating however, the current rally will likely fail. Even with commodities screaming higher. Especially with commodities screaming higher as they foretell higher rates, inflation, costs that will squeeze debt servicing and profits. And a continued climb in market interest rates could slow this bounce in stocks – at least until we get a better read on GDP growth data, where we can weigh the evidence for higher or lower.

FANG FUMBLES

Amazon and Netflix are stocks with little or no profit but terrific growth – rallying in a parabolic fashion. Apple and Facebook, on the other hand, post solid earnings and have to date pulled back dramatically. GOOG/GOOGL announced strong growth last night but hasn’t held the AH move, selling off perhaps as $3.40 of the EPS beat was due to accounting changes.

There is the bullish argument … that hotter earnings triggers hotter economic growth. But let’s face it, this post-correction period has been very choppy – not V-shaped – and I expect more headline risk and policy mis-steps and guidance disappointments as we migrate from monetary to fiscal stimulus. We just need Q1 earnings and economic data to confirm and right now they look to be getting ahead of themselves.

P/E MULTIPLES AND REAL GROWTH

It is assumed companies will use little of their tax cut/repatriation money on wage growth or capex and more on stock buy-backs and dividends. And with P/E multiples dropping of late, exciting some bulls, what is appropriate multiple to pay for post tax-cut earnings almost 9 years into this economic expansion? Does it make a lot of sense to forecast aggressive future growth as the FED raises rates and rebalances its portfolio taking liquidity out of the market? Does it make sense to pay peak multiples for stocks when real growth is slowing, globally? Can real growth exceed expectations?

2018 PREVIEW

We ran up post Presidential election on the rumor of deregulation, tax cuts and repatriation of USD. Ever since we got the news, we have been selling off, helped by a depreciating US dollar. The Trump Bump turned into the Trump Dump in February, but we are not at price levels last seen at the 2017 US Presidential election. Still, I can’t help but wonder if the earnings season ‘high bar’, helped by Q1 2018 tax cut impact, along with potential tech regulation and political/currency shocks, creates an environment ripe for a revisit to SPX ala Nov 2017 – another 10% lower.

Outliers with Velocity Revert

I have written here for several few weeks, I expected USD to break UP not down. It has. And with that, Peak COT data in USD shorts, EUR longs could cause a larger-than expected unwind…If US Dollar gets going, it could go up to its 50W ~$92.80 or even 200W around $94.50.

As excited as the Bulls may be with their double-digit earnings beats, there is caution – historically speaking:

If that wasn’t discouraging enough:

S&P 500 returns have been negative when yields have risen more than one standard deviation in one month (20bps), bond yields have risen by 24bps this month. Goldman

With that, don’t forget to hedge.

Come join me… I made it super easy for you to trade with me: 1. Pop into my LIVE Trading Room any time you want. 2. Get real-time Portfolio tracking of my trades with SMS/Email. 3. Think big picture with my macro-to-micro investment newsletter. You can also subscribe to my Free Fishing Stories Blog/Videos and find me on Twitter. Thanks for reading and have a great weekend!

Twitter: @SamanthaLaDuc

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.