The Most Important Macro Currency Charts

Eventually I think we are headed here for the USD:

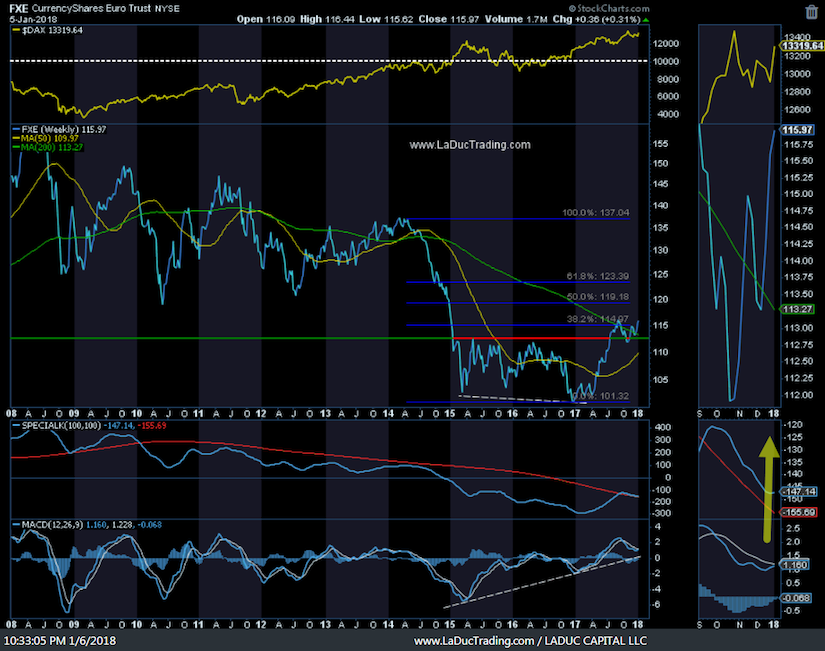

Eventually I think Euro heads higher:

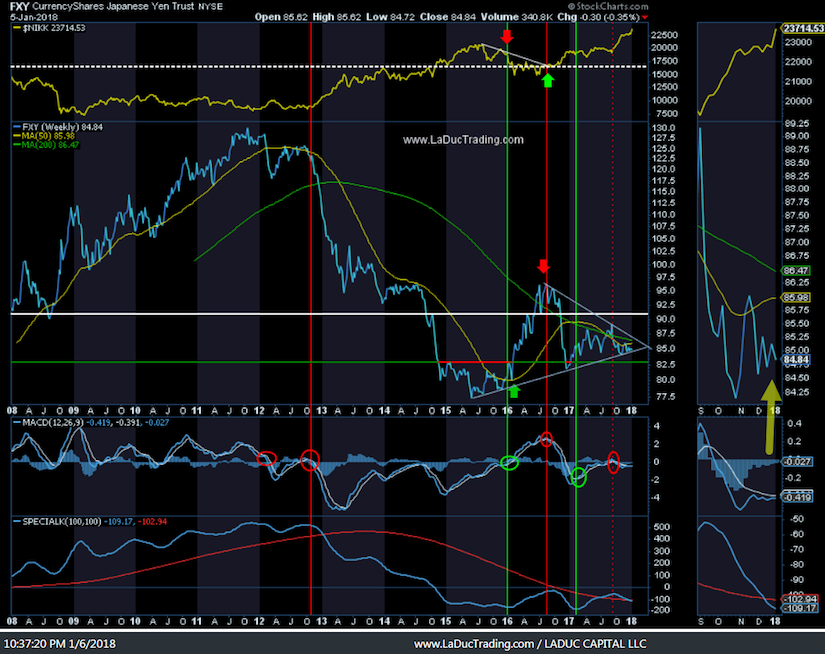

Eventually the Yen is going to move out of this wedge:

Upcoming Events

Seeking Alpha’s latest Stocks to Watch article for a preview of next week’s busy calendar of events.

Expected Move

Last week market makers priced in a ~$30 SPX expected move. We got $70+ last week, which is a 2 standard deviation move! This week, market makers are pricing in a ~$20 move up or down and volatility is again suppressed to all-time-lows.

Economic Releases

Monday – Eurozone sentiment indicators and BoC Business Outlook.

Tuesday – ECB minutes which could reverse recent Euro move above $1.20.

Wednesday – UK trade data.

Thursday – ECB minutes and hints of further QE unwinding could be volatile for the Euro. Australian Retail Sales could move AUD.

Friday – US inflation print could move TNX and USD. This is a big deal as the Oct CPI print disappointed. In fact, six out of the last seven times CPI has disappointed. US Retail Sales are also up.

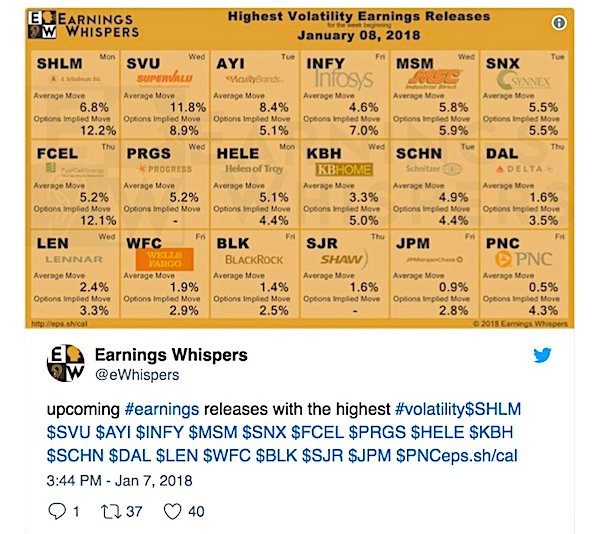

Earnings Releases

via Earnings Whispers:

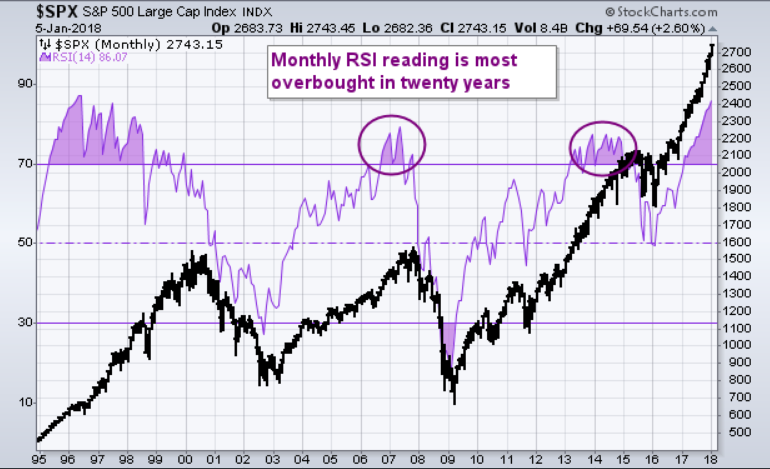

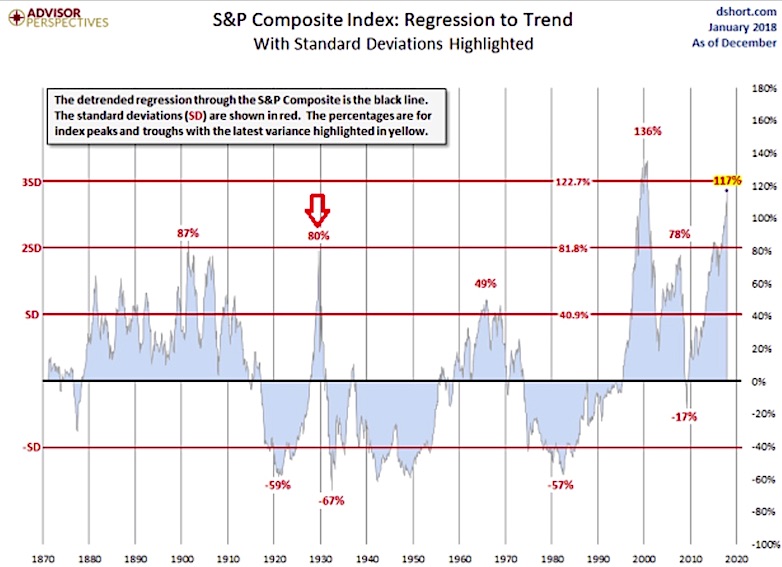

Macro Take: Market is Overbought on SO Many Levels

Here’s one from John Murphy.

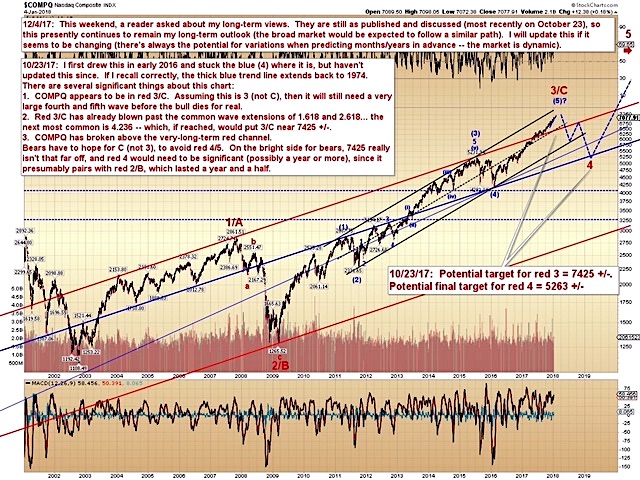

And another from an Elliot Wave expert who predicted a potential target of $7425+/- in Nasdaq with potential final pullback target of $5263.

Doug Short maintains this often tweeted chart:

Great Reads

Charlie Bilello’s excellent 2017 Year in Charts blog post.

Klendathu Capitalist’s 2018 Predictions: Party On

Come join me… I made it super easy for you to trade with me: 1. Pop into my LIVE Trading Room any time you want. 2. Get real-time Portfolio tracking of my trades with SMS/Email. 3. Think big picture with my macro-to-micro investment newsletter. You can also subscribe to my Free Fishing Stories Blog/Videos and find me @SamanthaLaDuc. Thanks for reading and Happy Trading!

Twitter: @SamanthaLaDuc

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.