Note that this post went out to my “Gone Fishing” newsletter subscribers this weekend. You can subscribe here.

Reflections and Inflections

The Bloomberg Commodity Index started the year by setting a fresh record for consecutive gains, pushing it up more than 4% over the past month. This helped bring the US 10-year Treasury yield back toward 2.5%, which brings the 10-year break-even inflation rate above 2% for the first time since March. Unless raw-materials costs keep on climbing, the impact on inflation could be short-lived.

Remember, it’s not real inflation unless it shows up in CPI. Housing costs, health care premiums, education expenses rising at multiples of your income is all counteracted by your smartphone having more features for the same price. – @charliebilello

Every global market did well in 2017 and a rally in commodity prices contributed to a flatter Treasury curve. Rising commodity prices will eventually pull bond yields higher but keep in mind that rising commodities and yields, at a time global central bankers are either reducing their bond holdings (like the Fed) or buying less (like the ECB), will put pressure on company PE expansion, which can limit growth. And even though investment grade credit spreads are at 98 basis points – the tightest since June 2007 – there may be a lot of downside in high yield debt given the spread is the 4th lowest in the past 20 years.

Trading Themes

Long Gold/Miners from December 12 into FOMC was a great trade. Case in point: Gold closed higher Jan 5th for the 11th day in a row, the longest up streak in history (data back to 1970). Wish I had stayed with this trade/theme all the way, but now I see reasons for a pause and fall, so I have initiated shorts in GLD and GDX for a trade. (I know I’m early.)

No commodity rally is truly sustainable without Gold so here is a reminder just how in-tune the CRB index and Gold can be:

I also believe commodities will pause/pull back now after out-sized runs: $JJC, $SLX, $XME, $WTIC. See that $CRB reversal Friday – another reason I went short GLD and GDX. (I know I’m early!)

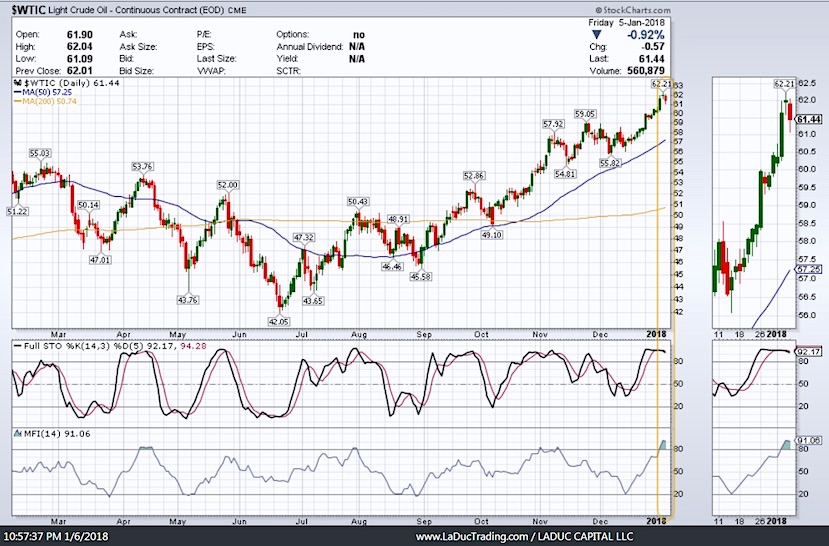

Crude has that morning star reversal candle look and is very overbought – see Money Flow, also overbought. #CrowdedTrade

We caught this recent move up in XLE from $70 to $75 (playing OIH, SLB, MRO… strongly suggesting PXD, HES, XOM…) back on December 19th, but now it may be time to consolidate and could even pullback to $66 around the 200D if we get a market downdraft.

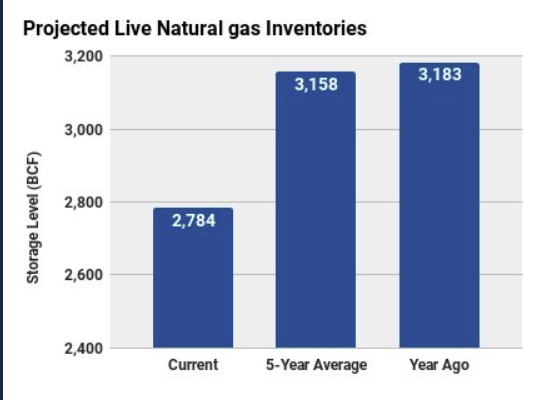

Despite planning to position short oil plays, I’m long UNG, CHK and DVN since the 21st of December because Nat gas was way oversold while demand is at its highest level with inventories collapsing to 5 year lows. This one chart foretells likely higher prices for NatGas plus UNG has pulled back 61.8% of its recent move for a LRE (low risk entry) long. If that wasn’t compelling enough, COT report showed potential for nice short squeeze at 49% which is the highest since Sept. 2016.

China, does not look weak. Think BABA, BIDU, JD, BZUN of late.

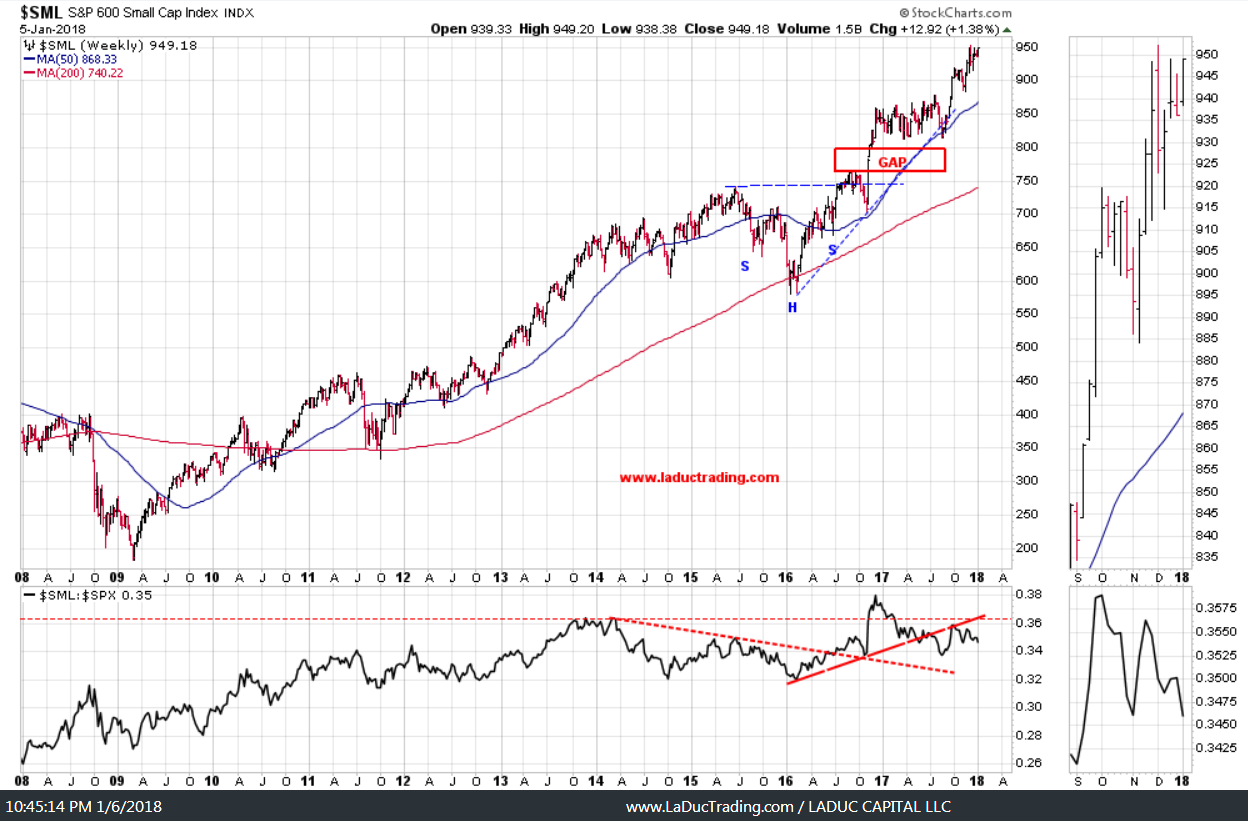

Reminder that even though small caps look strong with their price action, their relative weakness to SPX (see bottom panel) is a divergence that foretells weakness.

NASI is Neutral but I’m leaning higher than a hard roll-over. Think XLK, SMH, QQQ.

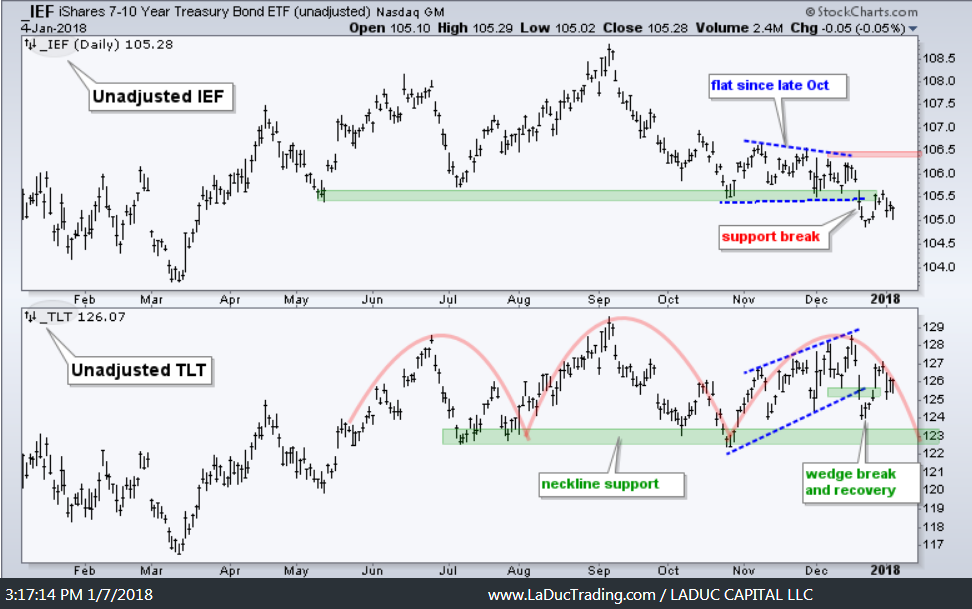

Thanks Arthur Hill. Yes, IEF is starting to roll over and this foretells likely weakness in TLT to $122 area, which I am expecting, along with a Gold pullback, before both bonds and metals reverse and move higher – probably Feb time-frame when new Fed Chair Powell takes office. Just a sense at this point but Gold may serve as an index short hedge while Powell makes his intentions ‘known’. This didn’t help him.

Dollar and Euro are at extremes.

SPECULATORS RAISE NET SHORT U.S. DOLLAR BETS TO HIGHEST SINCE MID-DECEMBER IN LATEST WEEK – CFTC, REUTERS

Non-commercial selling of dollars in the week leading to Jan 2 was primarily driven by a 39% surge in EUR longs – a fresh record of 128k lots (€16 billion). My bet, this isn’t sustainable up here and USD is likely to bounce soon, pulling GLD, SLV, GDX down. Also note, AUD net-short is near a 2-yr high, often where reversals occur, which may time with a pullback in the out-sized-commodity run of late.

About that USD weakness, it sure has helped large-cap US companies like Catepillar and Deere, but is a 50X earnings multiple on CAT sustainable? I’m more than curious who will buy up here; how they could make good on that expectation; and, how quickly this will pullback with a USD bounce/commodity pullback! Just saying.

Volatility of Volatility has been basing better part of a year come February and that apex does look rather squeeze-worthy.

Continue Reading On The Next Page…