Lowe’s Companies (LOW) fell 8% on Wednesday morning after a mixed earnings report.

While the company beat on revenue and same store sales, it missed by $0.13 on earnings per share (EPS).

LOW reported adjusted EPS of $0.74 and total revenue of $15.49 billion, compared to the market’s expectations of $0.87 and $15.33 billion. Same store sales increased by 4.1%, compared to estimates of 3.1%.

The stock recovered to -5% after CFO Marshall Croom provide a favorable assessment of the company’s improving margins. Nonetheless, the market continues to weigh as of the time of this writing.

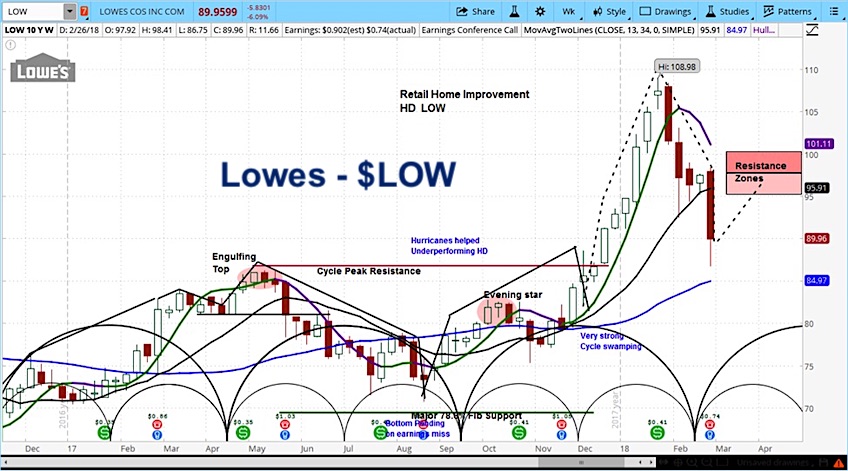

Our analysis of LOW market cycles on the chart below shows this week as a probable low. We see it likely rebounding over the coming month to $98. This may prove to be a “sell zone” for nimble traders.

The market cycles are designated by the black semicircles at the bottom of the chart.

Lowe’s (LOW) Chart with Weekly Bars

For a more detailed look at cycle analysis for a broader selection of futures, watch the askSlim Market Week every Friday afternoon, or subscribe to our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.