Last year, we shared the lesson from 1987 and the lead/lag relationship of oil and equities. This lesson played out again in 2015, highlighting the lead/lag relationship between factor markets (labor and commodities) and the equities market (goods and services).

What do we do with this information?

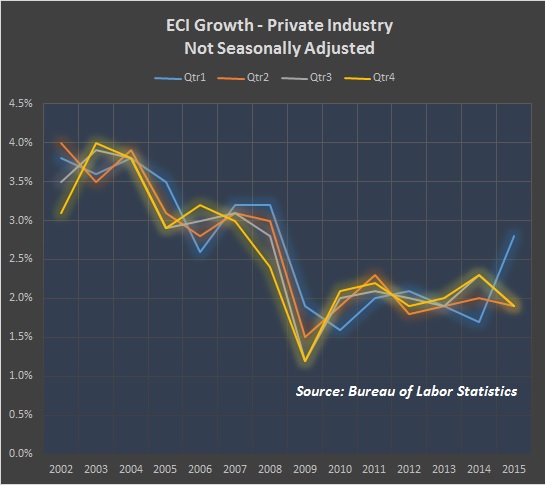

We can use it to contrast the data from companies reporting earnings. In fall 2013, anemic wage growth data helped us key in on potential problems in retail. Retail peaked in 2014 and the market moved into the latter part of the business cycle. Today, a snapshot of the labor costs updated with today’s Employment Cost Index Report from the Bureau of Labor Statistics, offers an interesting comparison to Fall 2013. Note, the sharp uptick in the first quarter of 2015, followed by decline in the 2nd, 3rd, and 4th quarters (year over year).

Wages seemingly stalled again, but a critical difference is that commodities are also at all-time lows. Contrast this to 2013, when wages stalled but commodities prices were near all-time highs.

Low Commodity and Low Employment Costs and the Early Stages of A New Growth Cycle

The Great Rotation from bonds to equities that began in 2013 has seen its share of false starts. However, if history is telling us anything about what’s coming next, the coincidence of both historically low factor costs in labor and commodities means we may be at the front end of a new growth cycle.

That said, the beginning of any new cycle is mired in uncertainty. For example, the US 10 Year Treasury is testing the 2% floor and the Market is rightfully wary. While this drama has yet to play out, the larger trend in the factor markets is standing behind the scenes, waiting to emerge.

Figure 3, Employment Cost Index (2002-2016), by Bureau of Labor Statistics

Thank you for reading and have a great week.

More from Maria: Why Investors Should Be Watching 2 Percent On The 10 Year Treasury Yield

Twitter: @rinehartmaria

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.