Long dated US treasury bonds have been rising as economic data continues to be soft.

When bond prices rise, it means yields (interest rates) are falling.

But the run higher in the 20+ Year US Treasury Bond ETF (TLT) appears to be pausing… and pulling back.

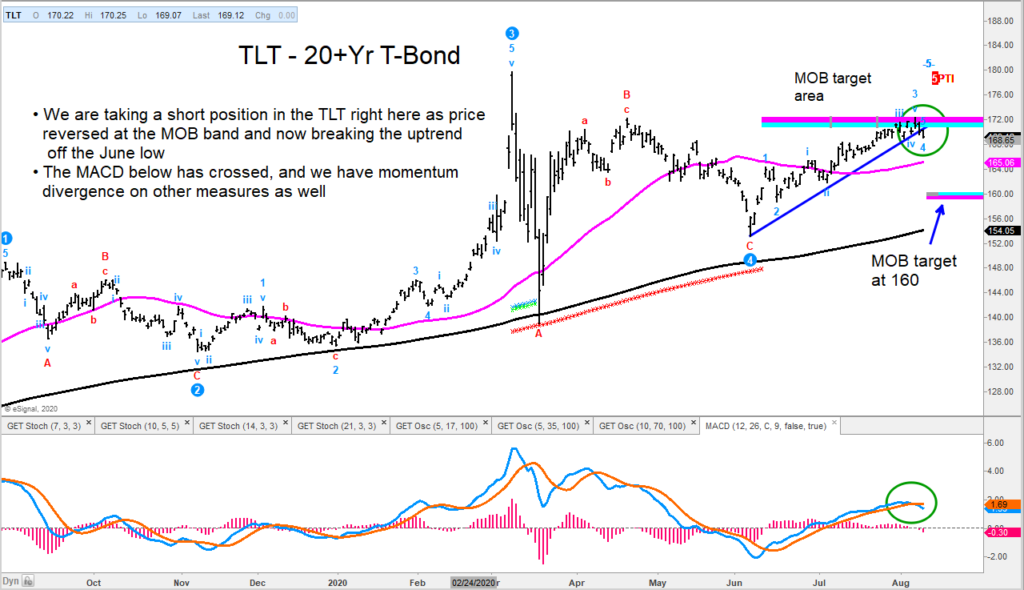

As you can see in the charts below, TLT reversed lower last week after hitting a MOB price target.

MACD is crossing over (bearish) and it appears TLT could be headed toward $160.

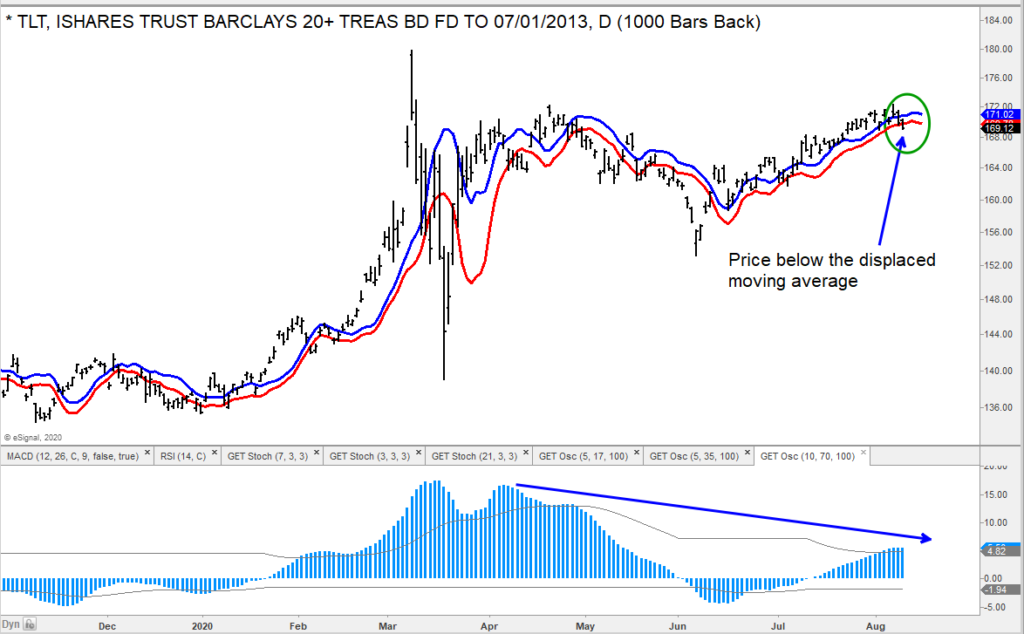

As well, price fell below the displaced moving average. We are bearish on TLT and treasury bonds over the near-term.

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.