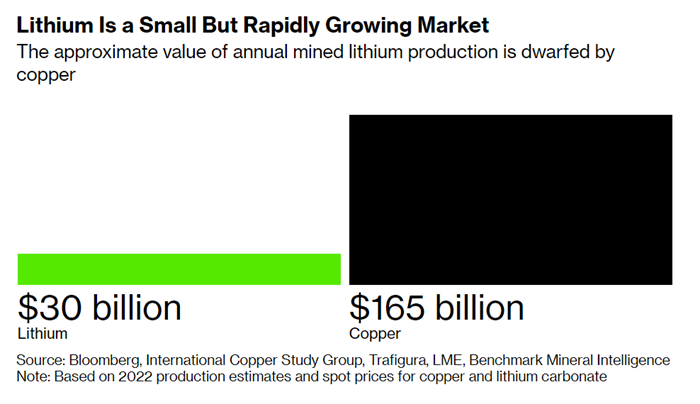

The lithium market is insignificant in comparison to more established commodity markets – yearly global oil output is worth more than $3 trillion at present rates.

The race to secure lithium supplies is on.

While lithium demand multiplies, geopolitical concerns between China and the West have made securing a reliable supply of lithium more difficult.

Lithium is becoming one of the world’s most sought commodities, yet the annual amount globally is still tiny.

Battery makers and EV manufacturers have been rushing to lock in supplies.

The electrification of transportation, tight supply, and robust EV sales are causing prices to skyrocket.

Do you know the best way to trade Lithium profitably? Or how to position your trading in anticipation of this secular trend?

Global X Lithium & Battery Tech ETF (LIT) broke out above the 50-day MA

and is looking to take out the 200-day MA.

The Global X Lithium & Battery Tech ETF (LIT) provides investors access to companies involved in the entire lithium cycle, from mining and refining to producing lithium batteries.

Lithium’s importance to the global economy will only increase in the coming years as we move towards a more electrified world.

LIT is displaying strong price leadership, as seen by the MarketGauge Triple Play Leadership indicator, with the blue line above the red line indicating that LIT is leading the market.

LIT also displays improved price momentum in the MarketGauge Real Motion Indicator. The Real Motion Indicator and the Triple Play Indicator aid trading performance by validating price direction and momentum strength.

LIT is an ETF that offers global exposure to the Lithium market, so if you’re looking to position your trading for the future of transportation, consider adding LIT to your portfolio holdings.

We expect strong demand coupled with Lithium’s restricted supply to sustain a favorable pricing environment for the foreseeable future.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 375 support and 383 resistance; same as before

Russell 2000 (IWM) 177 support and 183 resistance; same as before

Dow (DIA) 328 support and 333 resistance

Nasdaq (QQQ) 266 support and 273 resistance

KRE (Regional Banks) 62 support and 65 resistance; same as before

SMH (Semiconductors) 197 support and 204 resistance

IYT (Transportation) 212 support and 217 resistance

IBB (Biotechnology) 127 support and 132 first resistance; same as before

XRT (Retail) 58 support and 63 resistance; same as before

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.