U.S. Bonds:

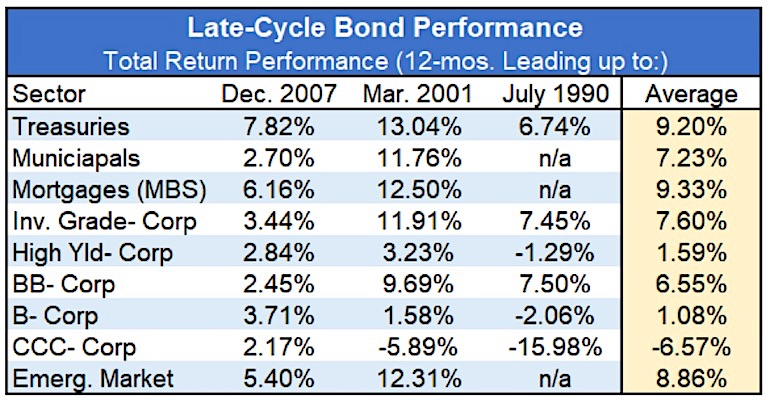

Using the same framework, we looked at various bond categories in the period leading up to the three prior recessions (due to limited data, some categories do not have return information for the 1990 period).

Data Courtesy Bloomberg

The important takeaway is that investors prefer lower risk bonds leading into a recession. This is also evident across the rating categories of the high yield bond market. Note how much better BB-rated bonds perform relative to lower-rated B and CCC bonds.

The quality of the securities within both the investment grade and high yield market is so poor in this cycle (highly levered, high percentage of covenant-lite structures, high percentage of BBB-rated securities in the IG sector) that we urge a very conservative position in both cases. Indeed, the “up-in-quality” theme holds for any credit instrument in the late stages of the cycle.

Commodities:Despite the rise in oil and gas prices in 2018, commodities remain the most undervalued of all major asset classes. Some soft and hard commodities have been hurt by the tariffs initiated by the Trump administration, but there is a reason they are characterized as “commodities.” We need them, and they are staples to our standard of living. Supply fluctuations will occur between nations as trade negotiations evolve, but the demand will remain intact.

Additionally, global central bank interventionism remains alive and well as demonstrated by recent actions of the Peoples Bank of China (PBOC). To the extent that central bankers continue to take the easy route of solving problems by printing money to calm markets when disruptions occur, natural resources and agricultural products will likely do well as a store of value – much like gold. They all reside in the same zip code as a means of protecting wealth.

Cash is King: In addition to the ideas illustrated above, it is always a good late-cycle idea to raise cash. As American financier and statesman, Bernard Baruch said, “I made my money selling too soon.” Although the low return on cash is a disincentive, the discipline affords opportunity and peace of mind. Having cash on hand is also a reflection of the discipline of selling into high prices, a skill at which most investors fail. Cash is an undervalued asset class heading into a recession because most investors panic as markets correct. Those with “dry powder” are better able to rationally assess market changes and more clearly see opportunities as certain assets fall out of favor and are cheap to acquire.

Investment Tourist

Many investors elect to leave the “serious” decision-making to their investment advisors on the assumption that the advisor will make the right decision “on my behalf.” They delegate with full autonomy the task of adjusting risk posture, when the advisor ultimately bears far less risk in the equation. Being inquisitive, asking good questions and challenging the “hired help” is a proper prerogative. One should always operate and engage with humility but never on blind faith.

Given the complexities and the risks of the current environment, investors should not be silent passengers on the journey. One who has wealth and takes that responsibility seriously should have valid questions that are both difficult to answer and enlightening to debate. Iron sharpens iron as the proverb says.

Summary

The Fed has now taken eight steps in their path to normalizing interest rates and trying to set the economy on a sustainable growth path. Although he probably did not consider its application in the realm of monetary policy, Sir Isaac Newton’s law of inertia states that a body in motion will remain in motion unless acted upon by an outside force. Rate hikes are in motion and likely to remain so for the foreseeable future unless and until some outside force comes in to play (crisis).

Given the extreme nature of past policy actions and the likely impact of their reversal, forecasting future events and market behavior promises to be more difficult than usual. Reliable guideposts of prior periods may or may not hold the same predictive power. Although unlikely to afford investors with prescriptive solutions this time around, there is value to doing that analytical homework and gaining awareness of those patterns. Finally, as the cycle unfolds, successfully navigating what is to come and preserving wealth will also require investors to apply sound decision-making using clear guidance and input from those who dare to be contrary.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.