Kohl’s Corporation (KSS) opened 7% lower on Thursday morning, after trading 5% higher in the premarket session.

The stock $KSS initially rose after posting strong holiday sales that helped beat Wall Street earnings estimates. The stock then reversed hard and sunk after providing weaker than expected guidance.

Kohl’s reported adjusted earnings per share of $1.99 and total revenue of $6.78 billion, compared to expectations of $1.77 and $6.74 billion respectively. The company also reported same store sales growth of 6.3% versus expectations of 5.7%.

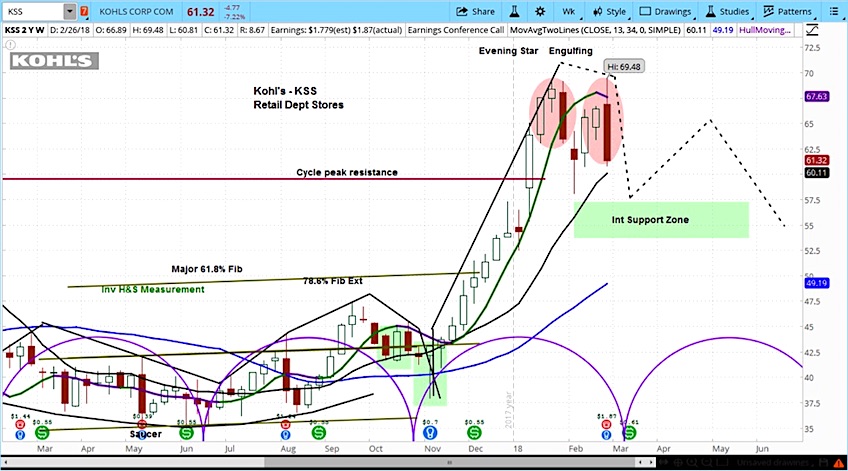

Kohl’s Stock Cycle Outlook

Our analysis of KSS market cycles indicates that a major top may be forming. We see a likely drop to below $57 in the coming weeks, followed by a false rebound.

The market cycles are designated by the purple semicircles at the bottom of the chart.

Kohl’s (KSS) Stock Chart with Weekly Bars

For a more detailed look at cycle analysis for a broader selection of futures, watch the askSlim Market Week every Friday afternoon, or subscribe to our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.