KLA-Tencor (KLAC) traded 4% lower on Wednesday morning, after Goldman Sachs downgraded Micron Technology (MU), which is one of KLA’s customers.

Goldman analyst Mark Delaney’s downgrade from buy to neutral was based on soft pricing for flash memory based on NAND technology.

Other analysts had previously identified this trend, which led to a selloff in affected stocks. KLA is a supplier of process control systems that improve manufacturing efficiency for technology firms such as Micron.

“Memory downturns usually last for several quarters and can see an acceleration in price declines, as customers delay procurement to wait for lower prices,” explained Delaney.

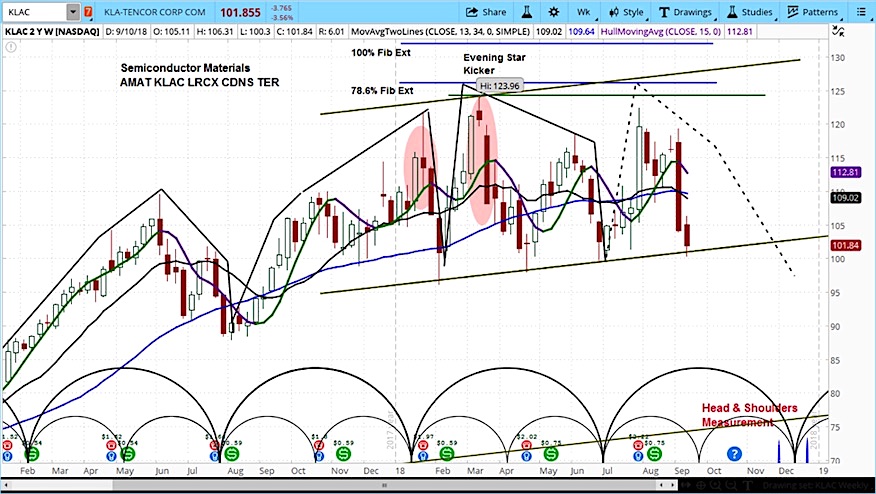

In analyzing the market cycles for KLAC, we can see that the stock is trading in the declining phase of its current minor cycle.

As we previously showed, KLAC has formed a major head and shoulders top. It is now trading at the neckline, and thus a breakdown could be imminent. Our target is $77 by year-end.

KLA-Tencor (KLAC) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.