I hope everyone had a wonderful holiday and has a very happy and successful New Year.

I spent time with my family and of course watched the key stock market etfs carefully.

If you have not seen my Outlook 2025, you should. I wrote it for myself, our clients and for you, my readers.

It will be extremely useful as I do what I do-combine fundamental, logical analysis, along with tips to execute trades with expert timing using technical analysis.

As far as our key stock market etfs, we love the January Trend Trade, but we can also speculate based on the weekly charts what the stock market is saying day one of 2025.

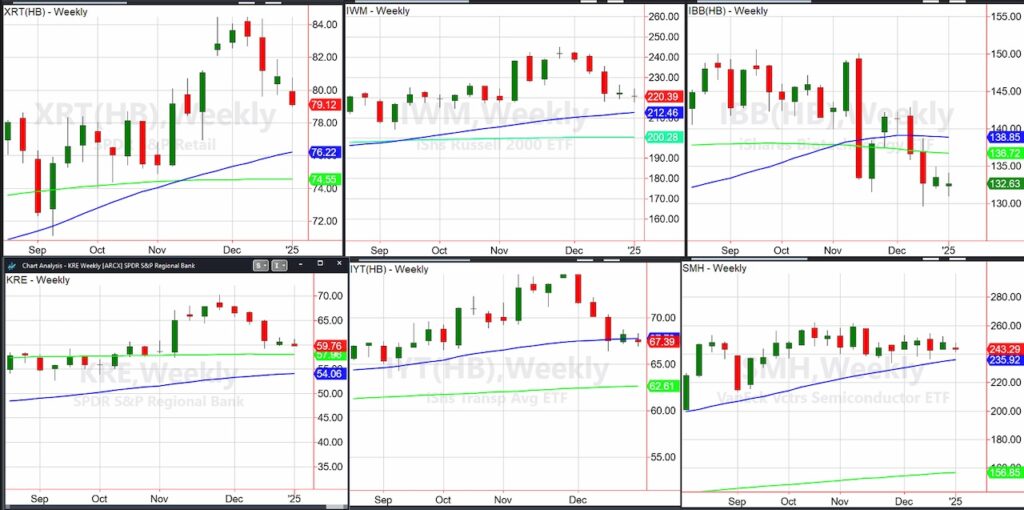

The Retail Sector etf (XRT) remains a key player. While we would like to see XRT regain leadership, for now, the main thing is holding around $78, or where the massive consolidation breakout began last year.

The Russell 2000 etf (IWM), has a few key points of support to hold. $217 is one. The 50-week moving average at around $212.45 is another. If IWM has any legs at all, it must also clear back above $227.

The Biotechnology sector etf (IBB) starts the year with issues. However, if IBB can manage to hang on to $130 good. Over $135 even better.

Swinging over to Regional Banks etf (KRE), the 200-week moving average (green line) at $58 if good, should offer support. Right now, a move back over $65 seems like a Herculean task.

The Transportation Sector etf (IYT) literally dances on the 50-week moving average after making new all-time highs back in November. For you Dow theorists, IYT must do something better than this. Can it? Over $70 would be way better, but under $66, no fun.

Sister Semiconductors SMH has been the savior for years. Can she do it again? SMH has not traded under the 50-week moving average since January 2023 when the fun began. And the January trend trade showed us the way! Now, we wait for her to do her magic and lead OR, a $35-40 drop from current levels is quite likely.

The weekly chart of BITO the ETF looks so much better than everyone else. While bitcoin fell to around $90,000, that it held and now trades back above $97,000 most likely means it will retest $108,000 and go higher still. BITO must hold the converging 50 and 200-week moving averages.

To see more click on Outlook 2025.

We will continue to monitor important stock market etfs of course. Please note that the calendar range will be huge!

In the meantime, we have risk parameters for our existing positions and are taking a patient stance on executing new trades.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.