The week right after the election, the stock market and investors were downright jubilant.

This past week, the best word to describe them as is disappointed (for many outside of bitcoin investors).

Disappointed is not as bad as say, dismayed. Nonetheless, all the stock market gains after the elections dissipated.

Some of the responsibility lies with the Fed after the bit hotter CPI and PPI numbers and Powell’s statement that he sees no hurry to lower rates.

Important stock market sectors want lower rates. And sectors and investors like certainty.

Adding to the uncertainty Powell’s statements created, the onslaught of changes henceforth with the new administration is confusing as well.

The Biotechnology sector (IBB) suffered the worst blow with the announcement of RFK Jr head of Health and Human Resources.

However, each one of the sectors, including the Russell 2000 (IWM) empathized to a degree.

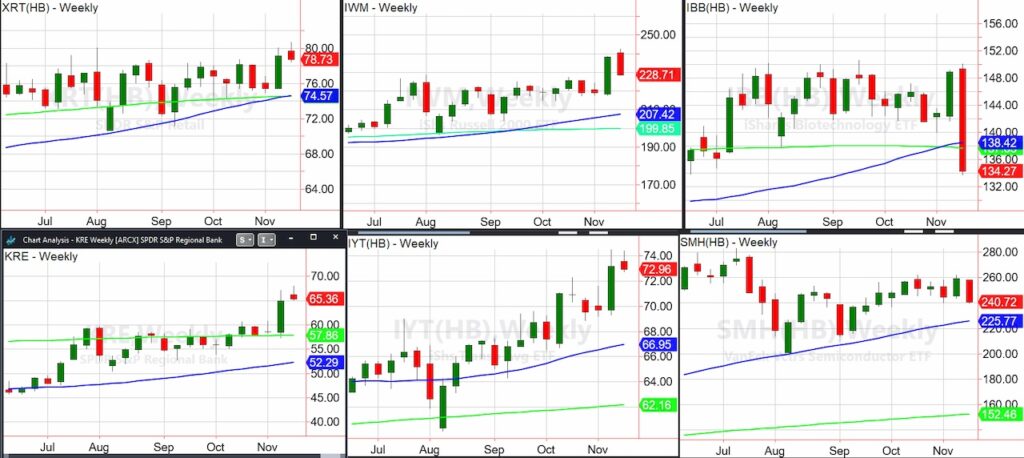

The 6-chart screenshot is of weekly charts. The 50-WMA is in blue, the 200-WMA in green.

Starting with the Retail sector (XRT), I am totally sticking with the notion that the consumer will tell us all.

Speaking of disappointment, XRT failed to rally above the $80 level, the top of the 10-month consolidation.

XRT though, did at least hold above $78 and could easily reverse higher this week.

The Russell 2000 (IWM), if you zoom out, failed to make a new all-time high from the one IWM made in 2021.

Double top? Maybe. IWM must fail 200 first. That’s a long way down.

The Biotechnology sector (IBB) never took out 150 to the upside so it never had a true range breakout.

Now, this week it gave up 23 weeks of price action! I thought we’d not see 132 support levels again for a long time, but here we are.

The Semiconductors sector (SMH) also disappointed. Though we must remember that she has underperformed since the July peak. This week Nvidia (NVDA) reports. Could that save this sector?

One important thing to note-SMH has not failed the 50-week moving average since early 2023. And a move over 260 would be healthy.

Moving on to the rest of the Family:

And the winner is our newest member of the Family: Bitcoin and Crypto! Bitcoin represents the millennial for starters. And he loves a Bitcoin and the new pro-crypto administration.

Firing on all cylinders, Bitcoin looks poised for 100k before we reevaluate.

Not quite as exciting, the Transportation sector (IYT) did have an inside week after the spectacular move to all-time highs the week prior.

That is good news should IYT hold above 69 and clear 74.00.

It also means that the Dow theory is alive and well with the optimism of a more robust US economy. This is why we are watching the retail sector so carefully.

Finally, Regional Banks (KRE) held the breakout area or $65.

Also a good sign if that continues this coming week.

This week watch the Retail sector (XRT) first and foremost. Then of course, NVDA and what the tech sectors does after it reports.

As mentioned at the start of the Daily, disappointment can switch back to joy before it becomes dismay.

Both joy and dismay are infectious.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.