A new month is upon us. The month of June typically ushers in the summer doldrums when it comes to stock market action. So now is a good time to take a look at some stocks and etfs that show strong and weak June seasonality trends.

A new month is upon us. The month of June typically ushers in the summer doldrums when it comes to stock market action. So now is a good time to take a look at some stocks and etfs that show strong and weak June seasonality trends.

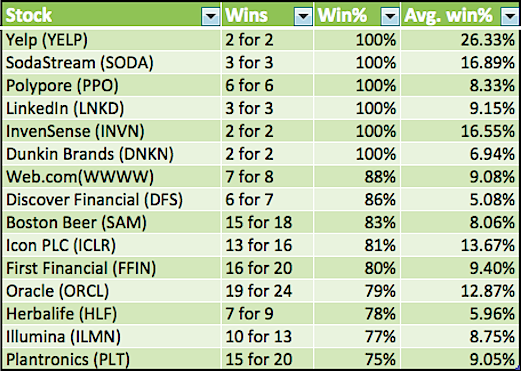

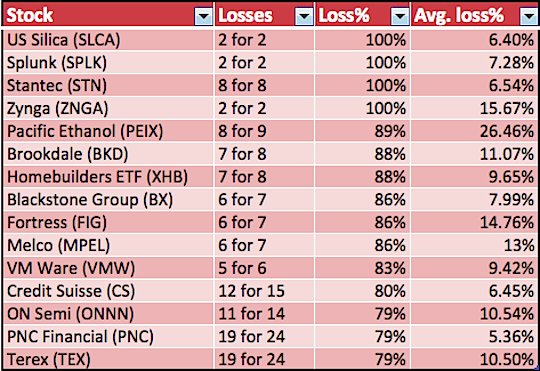

Let’s take a look at the data tables below and provides some highlights.

Strong June Seasonality — A couple items worth noting: Stocks like Oracle (ORCL) and Boston Beer (SAM) have shown strong June seasonality trends over the years. ORCL has been higher on 19 of 24 occurrences with an avg. win percentage of 12.87%. SAM has been higher on 15 of 18 occurrences with an avg. win percentage of 8.06%.

Stocks and ETFs with Strong June Seasonality Trends:

Data for tables sourced from paststat.com

Weak June Seasonality — A couple of items worth noting: Pacific Ethanol (PEIX) has shown consistent weak June seasonality trends over the years. It’s been lower on 8 of 9 occurrences with an avg. loss percentage of 26.46%. Stantec (STN) has never had a winning June in its history. It’s been lower on 8 of 8 occurrences with an avg. loss percentage of 6.54%.

Stocks and ETFs with Weak June Seasonality Trends:

The past is not necessarily a predictor of the future, so there should definitely be more due diligence done. This post is simply intended to generate some trading ideas for further vetting for the month of June. Thanks for reading.

The author is short XHB via in-the-money puts and long DFS and ORCL via in-the-money calls at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.