The books have closed on 2nd quarter performance and investors are now turning their attention to the month of July. And this means that it’s time to take a look at July seasonality trends and some stocks and ETFs that show strong and weak performance trends during July.

The books have closed on 2nd quarter performance and investors are now turning their attention to the month of July. And this means that it’s time to take a look at July seasonality trends and some stocks and ETFs that show strong and weak performance trends during July.

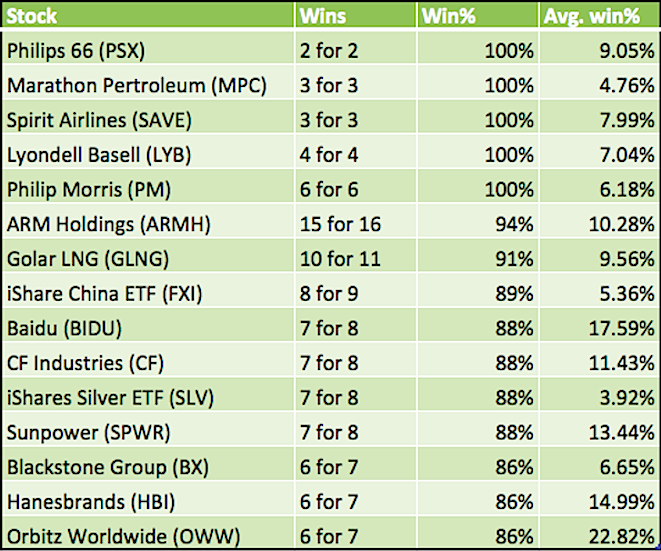

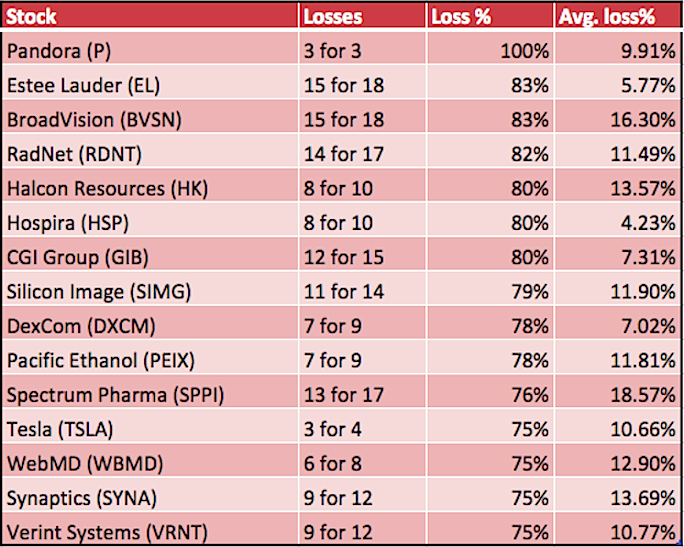

Below are some highlights, as well as the data tables.

Strong July Seasonality — A couple items worth noting: Stocks like Baidu (BIDU) and Golar LNG (GLNG) have shown strong July seasonality trends over the years. BIDU has been higher on 7 of 8 occurrences, with an average win percentage of 17.59%. GLNG has been higher on 10 of 11 occurrences with an average win percentage of 9.56%. Data sourced from paststat.com for tables below.

Weak July Seasonality – A couple of items worth noting: Stocks like Estee Lauder (EL) and BroadVision (BVSN) have shown weak July seasonality trends over the years. EL has been lower on 15 of 18 occurrences, with an average loss percentage of 5.77%. BroadVision has been lower on 15 of 18 occurrences, with an average loss percentage of 16.30%.

The past is not necessarily a predictor of the future, so there should definitely be more due diligence done. This post is simply intended to generate some trading ideas for the month of July. Thanks for reading.

Author holds a position in SPWR, LYB, PM, and OWW at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.