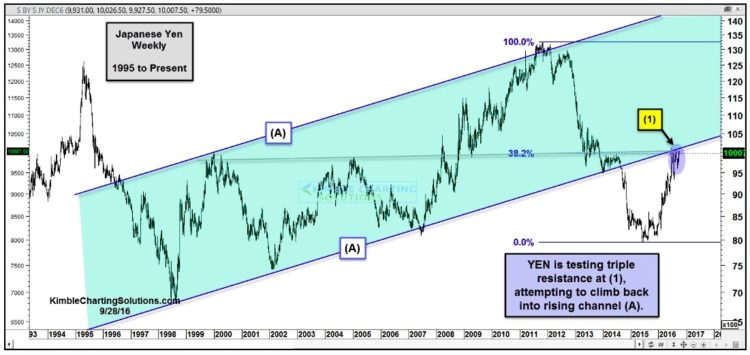

After experiencing a very newsworthy decline from 2012 to 2015, the Japanese Yen has recovered strongly in 2016.

But the Japanese Yen rally is “running” into resistance. You can see this in the chart below.

The chart looks at the past 20 years. As you can see, the Yen spent the majority of the time inside of a rising trend channel (point A). After breaking down and out of that very trend channel in 2014, the Yen found a bottoming in 2015 and has spent the past several months in recovery mode. And further, the Japanese Yen rally has brought the currency back to test the underside of the trend channel.

Currently, the Yen is facing triple resistance at point 1. Many investors follow the Yen closely as its moves often impact the flows and price moves in the equities space.

Investor sentiment toward the Yen shows roughly 70% of traders are currently bullish. As sentiment is typically used as contrary indicator, that’s clearly a bearish headwind for the Yen.

I humbly believe that what the Japanese Yen does here (point 1), could impact the global financial markets.

More from Chris: Commodity Index Rally At Critical Juncture

Thanks for reading.

Twitter: @KimbleCharting

The author may have positions in related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.