Yen and Gold are Due For A Bounce… But Then What?

The Yen Short thesis corresponded well with not just the Bond/Gold Short thesis but with the rise in the US Dollar and US Yields.

Now where to? The Yen and Gold are both at an important technical level of support, we technicians call the 61.8 Fibonacci Retracement level, so I would not be surprised to see some pretty nice bounces in all correlated assets.

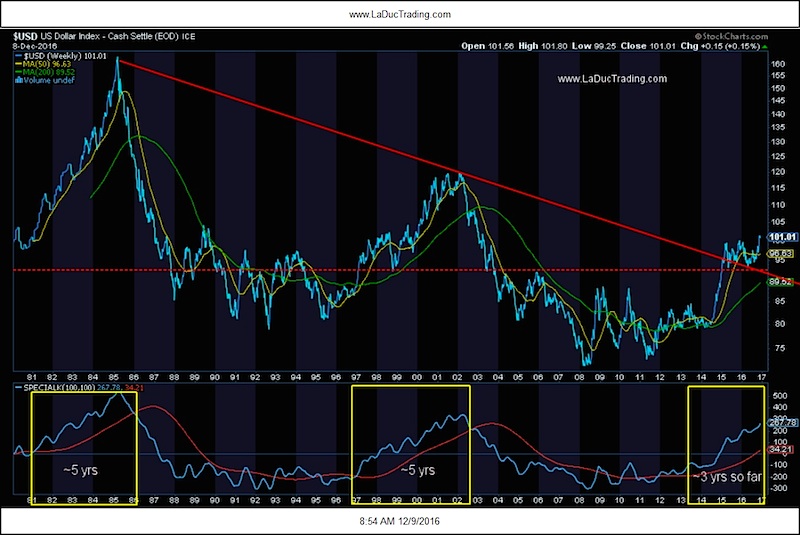

Having said that, I also believe the ultimate move down is not done. With Japan keeping its long-term rate pegged to zero, it appears they see no alternative to inciting inflation, spending freely, and devaluing the yen in an effort to monetize their huge and unsustainable debt burden. Not sure how else to view this besides dollar bullish. Also, a rising USD is de facto tightening for our FED, while they wait for US growth metrics to justify more rate increases. And the chart of USD has time on its side based on past cycle analysis.

With China devaluing their Yuan on purpose and the Euro falling by default, and the US rates and dollar rising…why wouldn’t the Yen continue to have pressure especially since their government is throwing billions at it to make it so? Since I would much rather swim with the current than against it, I will continue to follow Japan very closely before trading its correlated assets of Bonds, Gold and Currencies.

Thanks for reading and happy trading.

To receive Samantha’s Free Fishing Stories/Blog, it’s easy to subscribe.

Twitter: @SamanthaLaDuc

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.