Heading into the New Year, global stock markets appeared vulnerable to a correction given elevated valuations, strong momentum and frothy sentiment.

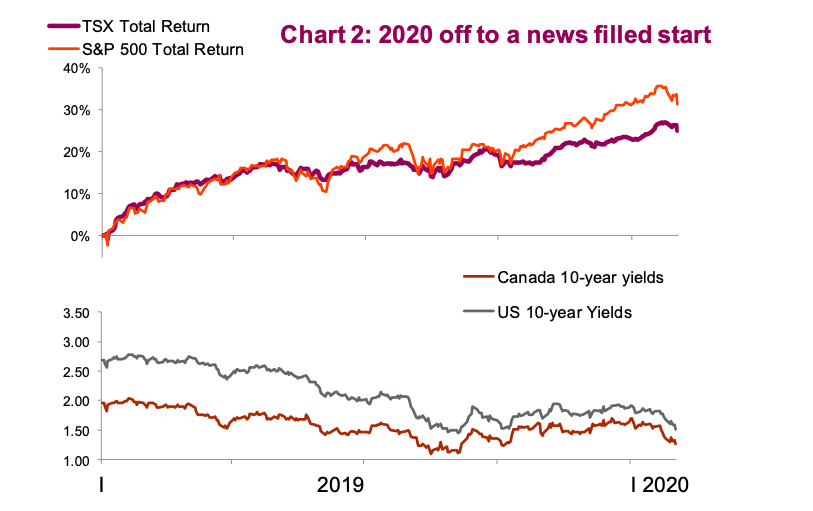

January started as December finished: with stock markets continuing to make new highs. The S&P 500 Index surged past 3300.

There is always a temptation in our industry to find a fundamental rationale for everything that happens. We had the signing of the U.S./China Phase One trade deal, signing of USCMA and some improvement in economic data.

The lone blip was the brief escalation in geopolitical risks with the tit-for-tat confrontation between the U.S. and Iran; but this was largely ignored by markets, which showed a surprising sense of resiliency. Embracing good news, while generally ignoring bad news, can only last so long before a reversion.

Then a sudden burst of market-moving events happened – the emergence of the coronavirus – producing the first stumble of the year and with it a surge of fear and some hysteria.

Following the impressive start, markets are essentially where they started. One critical question remains: is this the start of something more ominous, or just another blip in this 11-year-old bull market?

One month into the new year, and we are still waiting for the expected resurgence of global growth, but muddying the situation is the still yet

unknown economic ramifications of China essentially shutting down to combat the virus’ spread. Markets fear what they cannot see and measure – especially, it seems, when the culprit is microscopic. The unknown is constant in investing, but the degree of uncertainty has risen and with it so has volatility.

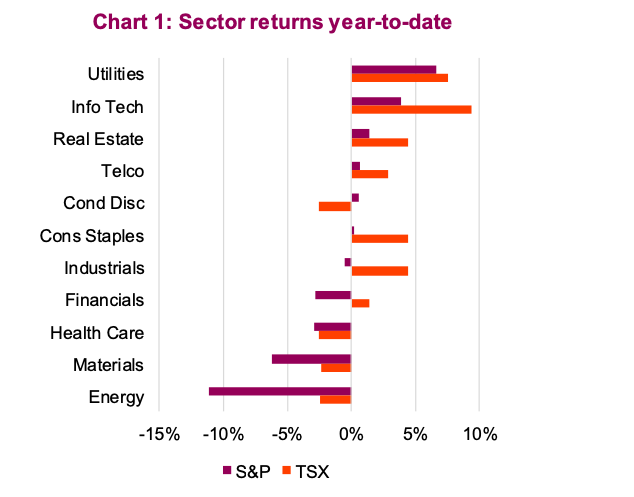

From a factor perspective we’re seeing a rare contrast. Momentum is having a strong run, but there has also been relative outperformance across high-quality stocks, as well as defensives. Utilities (+6.6 lifted by falling yields) and Technology (+3.0 lifted by good earnings results) are typically at the opposite end of the spectrum; however, so far this year they are the two top-performing sectors – a rare occurrence.

New highs were the dominant trend for most of the month. The recent sell off has left the S&P 500 in negative territory – it fell 0.2%, while Canada’s S&P TSX Composite, which rose 1.5%, was one of the few indexes to remain in positive territory. European shares tumbled amid renewed concerns about global growth – the Euro STOXX 50 index dropped 2.8% in January.

The whipsaw was most evident in the commodity markets, particularly oil. Supply disruptions along with tensions in the Middle East caused oil prices to reach their highest level in nine months in early January. However, this was soon overtaken by demand concerns, which led to a subsequent 22%

decline. Commodities in general have had a tough month: the Bloomberg Commodity Index fell 7.3% in January, it’s worst month since July 2015. In contrast, gold and other precious metals had a strong month, rising 4.4%.

In a strange premonition of the recent risk-off events, bond yields have been falling since the start of the year. Yields are nearly back down to their August lows with Canadian 10-year yields falling 43 basis points (bps) to 1.27% and U.S. yields falling 38 bps to 1.53%. The yield curve is also once again inverted. Policy makers have held rates steady but remain accommodative with a dovish tilt, which has proven to be a backbone of support for equities.

We expect stocks to be much more volatile and continue to be at risk to corrective forces so long as fears of global economic disruptions remain. China will have to deal with a significant economic loss and, unfortunately, this limits the immediate economic benefit of the trade resolution.

What markets may not be fully discounting is the chance that any near-term disturbance will be made up for with a subsequent rebound in pent-up demand. Economic fundaments have been good – we saw better-than-expected Q4 GDP in the U.S. and jobs numbers remain strong. The U.S. consumer remains key. So far, the coronavirus remains primarily an acute and local market event, but the situation is still fluid and there remains risk of further contagion. Meanwhile, investors are using it as an excuse to sell.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.