The Transportation Sector ETF (IYT) continue to warn investors that not all is well under the surface.

No this doesn’t mean that this is the sell-off to be worried about… maybe it is, maybe it isn’t. But if the oversold Transports continue to lag, then something more serious is likely coming later this winter.

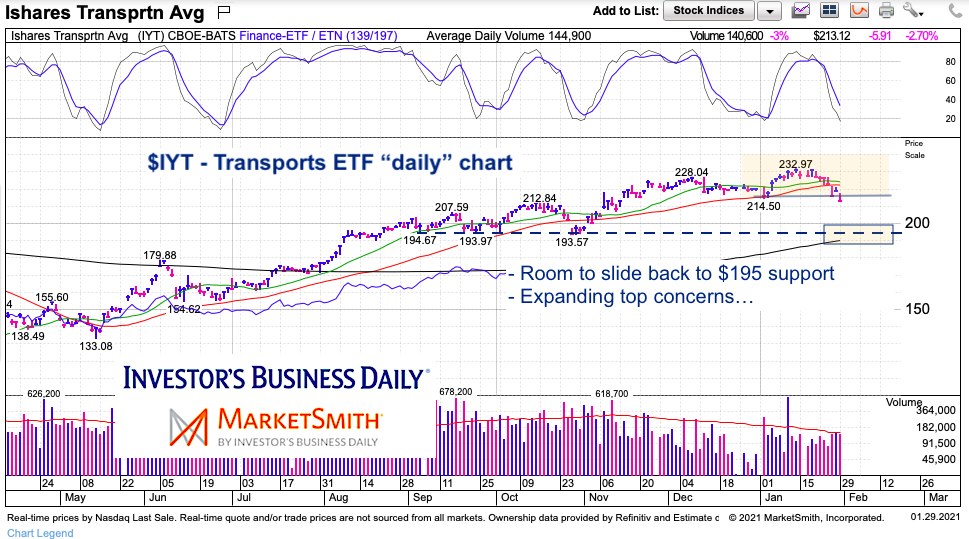

This week, the Transports ETF (IYT) broke its 20-day and 50-day moving averages, on its way to making a lower low. That type of action technically weakened IYT and put it on a growing list of broad market concerns as we head into February.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

$IYT Transportation Sector ETF “daily” Chart

The break of prior lows a warning to investors to be careful here. Yes, IYT is oversold. But it is technically weak here and only an immediate recovery back above the 20 and 50 day moving averages would neutralize the damage.

$IYT Transportation Sector ETF “weekly” Chart

The weekly chart is showing the loss of two important trend lines. The $200 breakout level is the next support level (if lower yet). Note that the rising 40-week moving average is just below this area.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.