The stock market has been trading sideways for about 15 months now. Within that time frame, we have seen 3 very quick market corrections. The latest stock market decline has seen the S&P 500 fall to a low of 1812 (15 percent from last year’s highs).

And after the jagged price moves off last week’s market lows, it is clear that the decline is nearing a crossroads.

In short, if bulls are going to step up, they need to do so soon.

Here are a few reasons why:

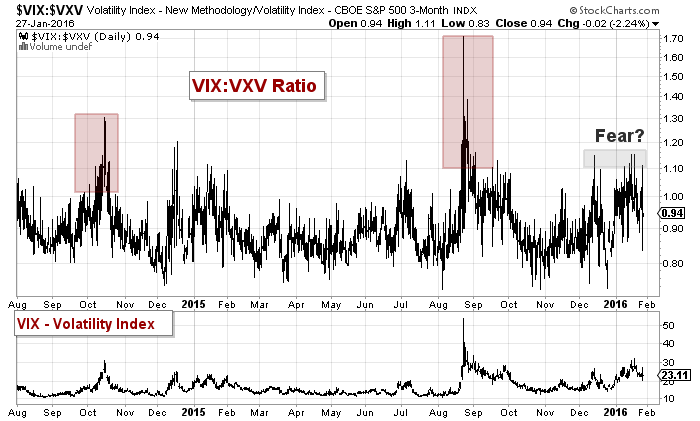

1. The markets are uncertain, yet complacent.

Dan Neagoy penned a a couple of great pieces on the current divergence in volatility. In short, while the market was declining, volatility land wasn’t indicating near as much fear as one might expect. The stock market decline, by and large, has seemed controlled. Was last week’s brief move above 30 on the VIX enough to help carve out a bottom? We’ll know soon enough.

Sentiment has fallen and bulls have gone into hiding. This is historically a good thing from a contrarian perspective. But markets are still at risk of dislocation with low sentiment and a lack of capitulation.

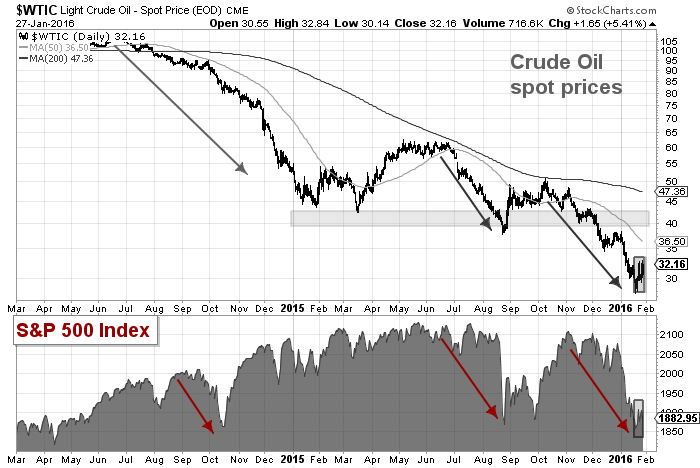

2. The commodities sector is a mess.

Crude Oil prices traded down to $26 per barrel. Make no mistake – all is not right in the world. In fact, as fellow contributor Mike Zaccardi wrote yesterday, the CRB Commodity Index is at 43 year lows!

Now this doesn’t necessarily correlate to the equities market, but such a dislocation has to be accounted for (and we’ve seen our share of commodity dislocations this decade). When crude first dislocated in 2014, it preceded a very scary market correction and “V” bottom in equities.

Are commodities wreaking havoc in the credit (energy) and equities world again? Prolonged stabilization in crude oil prices would go a long ways in halting this stock market decline. Will last week’s lows hold? Even the brief bounce in crude seems to be coincide with some relief in equities selling.

3. The blame game is en vogue

Lots of blame to go around (insert sarcasm). Is China bringing down the global markets? While we blame them for the glut in oil, we might as well blame them for the decline in equities. We already have the Fed in our crosshairs, so adding China to the mix makes things that much easier to cope with.

Kidding aside, what’s happening in China surely is part of the problem. As is the market adjusting to a potential Fed rate hike cycle. But singling out and “labeling” declines has been going on for years and seems kind of pathetic to me? Narratives have a way of growing and as confidence declines, so do credit and equities. Kind of how contagion works.

For better or worse, “credit” makes the world go around – And there’s no better person to follow on this front then fellow contributor, Fil Zucchi.

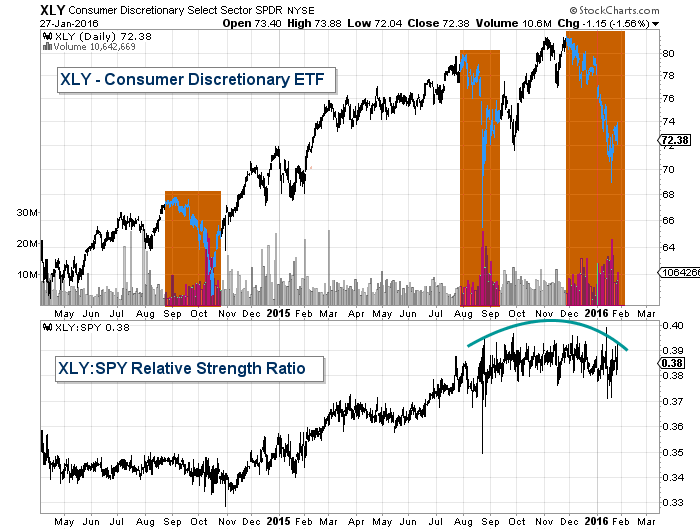

Weakness with “the consumer” seems to be flying under the radar (read my post from January 4). Add this to the list of things to blame.

I’ll have a follow up piece on the S&P 500, looking at the stock market decline from a “price” perspective. And guess what: that also confirms that the market is near crossroads. We will soon know if this is just another market correction or a bear market.

Thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.