Both VXX’s short interest and non-commercials’ net shorts in VIX futures comprise potential fuel for short squeeze. Whenever that is.

For now, longs get a reprieve if VIX:VXV at least unwinds the oversold condition it is in (INDEXCBOE:VXV).

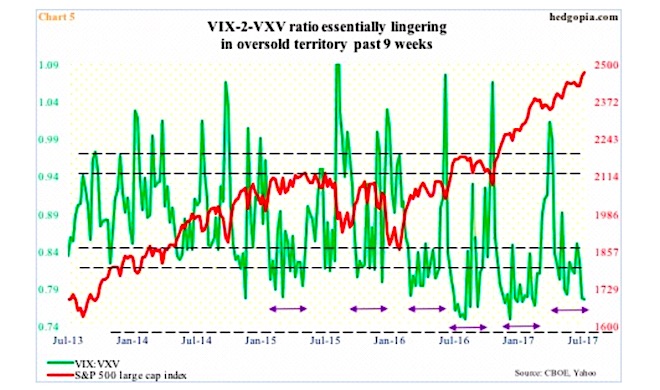

Except for a rise to the mid-.80s toward the end of June, the VIX-to-VXV ratio has lingered in oversold territory for the last nine weeks, four of them in high .70s, including the last two (chart 5 below).

Several times in the past two and a half years, after going sideways for several weeks, the ratio has shown a tendency to shoot higher toward overbought territory and then quickly retreat.

At least near term, odds of unwinding have grown.

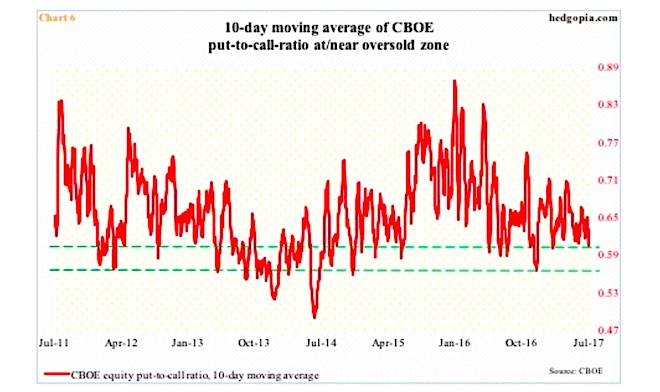

For the past three sessions, the CBOE equity put-to-call ratio was 0.56, 0.53 and 0.56. The last time the ratio was in the .50s for three consecutive sessions was June 21-23 this year. Soon followed a quick pop in VIX, which shot up to an intraday high of 15.16 on the 29th that month.

Too soon to say if things will resolve in a similar manner this time around. But historically the P2C ratio does show a tendency to mean-revert. Chart 6 (below) plots the ratio using a 10-day moving average. At .598 last Friday, it is approaching a zone off of which it can swing back up. Unless “it is different this time”.

Thanks for reading.

Read more from Paban over at hedgopia.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.