Mish’s Economic Modern Family which consists of 7 symbols that help guide us through the market has much of the same problems the major indices are stuck with currently.

Fairly tight trading ranges that keep investors worried about quick selloffs and volatile market conditions.

With that said, extending Monday’s article about the importance of waiting on the sidelines for the right opportunity to appear still looks like a good idea as we could be running right back into a major resistance area.

Additionally, not only can we look at some of the Members of the Modern Family, but let’s bring back our High Yield Corporate Debt (JNK) indicator for extra insight.

Even some of the strongest Modern Family members including the Transportation (IYT) and Regional Banking Sectors (KRE) are showing that on Wednesday, we could be right back into a pivotal resistance area as seen by the black lines in the above chart.

Others in the Family including the Russell 2000 (IWM) and the Retail ETF (XRT) seem to be showing similar price action.

This is good news as it makes a clean resistance area in multiple symbols to watch for a breakout over.

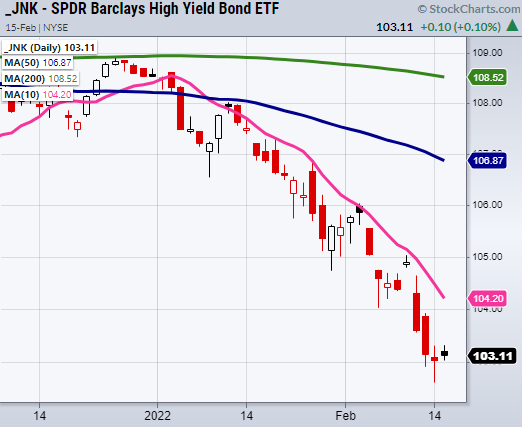

For an extra layer of confirmation, if the market decides to run higher let’s look at the High yield corporate debt ETF (JNK).

We frequently watch JNK as a risk-on or off indicator to see if investors are courageous enough to take on such risky debt.

Recently, not so much, however that is why we can look for buying to flood back into JNK as an indication of market strength.

Right now, JNK can’t seem to clear its 10-Day moving average (pink/magenta line).

Therefore, as an extra piece of confirmation to the upside, we can watch for a breakout over the 10-DMA at $104.20.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) Flirting with the 200-DMA around 444.

Russell 2000 (IWM) 209.05 new pivotal level to clear.

Dow (DIA) 350 to clear and hold.

Nasdaq (QQQ) 356.90 the 10-DMA.

KRE (Regional Banks) 76.24 next resistance.

SMH (Semiconductors) Able to hold over the 200-DMA at 2170. 290 next main resistance.

IYT (Transportation) 266.80 the 50-DMA to clear.

IBB (Biotechnology) needs to hold over 129.

XRT (Retail) 83.56 resistance.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.