While the stock market has put together a nice rally of late, it’s the boring, watch paint dry, dividend driven utilities sector that is attempting to bring sexy back.

Wow, that was a mouthful to write… and read! But it’s true – the Spdr Utilities Sector ETF (XLU) has been on fire.

Today, we look at the recent move higher and why it’s due for a pause. We’ll also highlight what to signals/indicators to watch to see if the Utilities move is for real.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

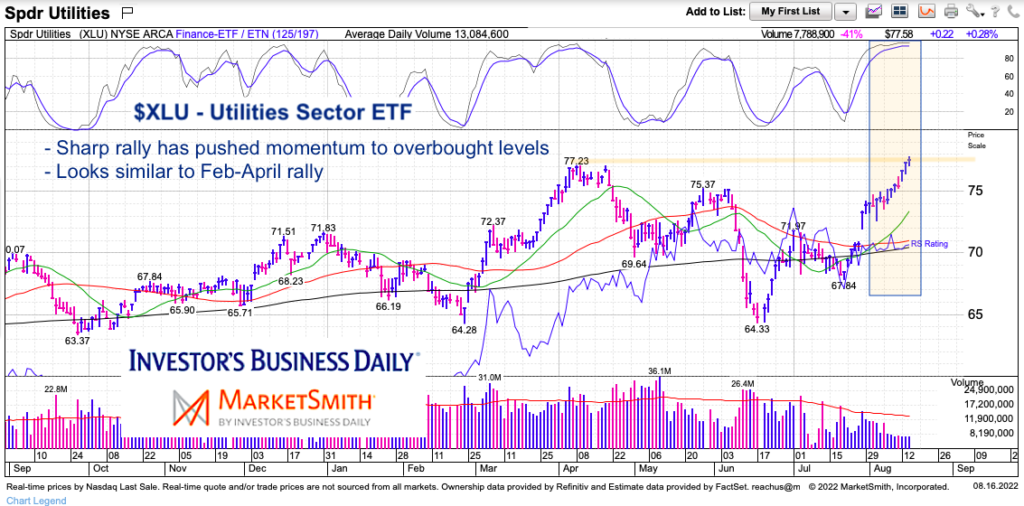

$XLU Utilities Sector ETF “daily” Chart

Short-term, two things immediately come to mind. Price is testing the April high and momentum is overbought. While this doesn’t mean new highs are unlikely, it does mean that this leg of the rally is likely closer to the end and needs a pullback/consolidation refresh.

The good news is that the 200-day moving average is trending higher. As well, the 50-day and 20-day moving averages are curling higher. Price is, however, well above its moving averages and could use a breather.

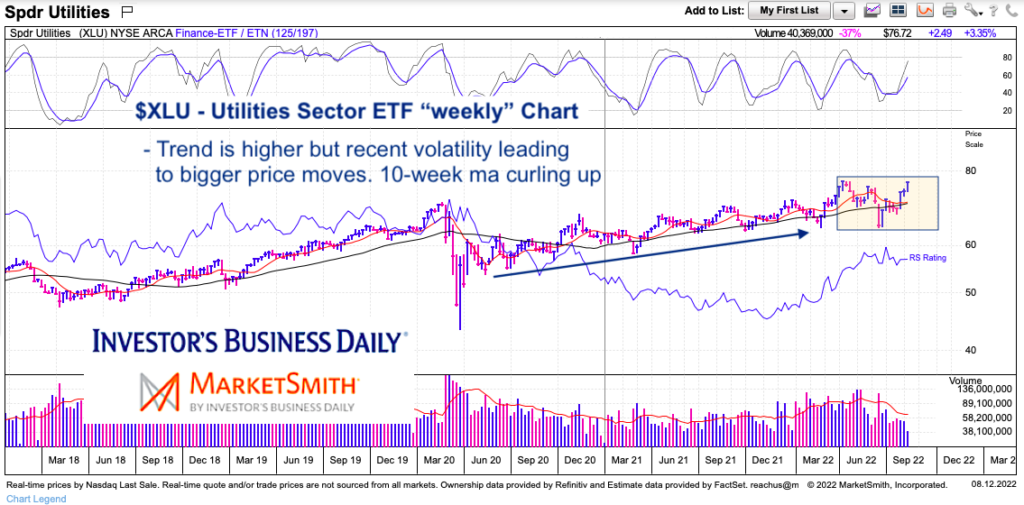

$XLU Utilities Sector ETF “weekly” Chart

On the intermediate-term chart, we can see that price was slowly trending higher in boring style. Then March saw a big rally into April, followed by an equal sized decline, followed by an eerily similar rally (to March-April) occur recently. Suddenly, the Utilities Sector is volatile, tradable, and sexy! Well, maybe we shouldn’t get carried away. BUT, price is trading at the top of this recent price range. Bulls would like to see a slingshot like breakout here. Big moves like this aren’t all that common so expecting a rally this sharp to continue in similar fashion is probably risky. Guessing sexy turns to boring again soon;)

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.