Despite the ongoing conflict in Ukraine and expectations of aggressive monetary tightening, equity markets have had an impressive bounce.

The S&P 500 Index has gained over 10%. And growth has revived with the FANG+ index rallying by more than 25% since the low on March 14.

Is it a bear-market rally? Perhaps for the Nasdaq, but the S&P did not get to bear market territory. Though it may be premature to declare the end of the correction at this point, the worst appears to be over. It’s very rare to see a rebound occur at a faster pace than the initial drawdown. The S&P 500 took over two months to hit the March 14 low yet has already made back nearly 2/3 of what was lost in just a couple of weeks.

The volatility of volatility

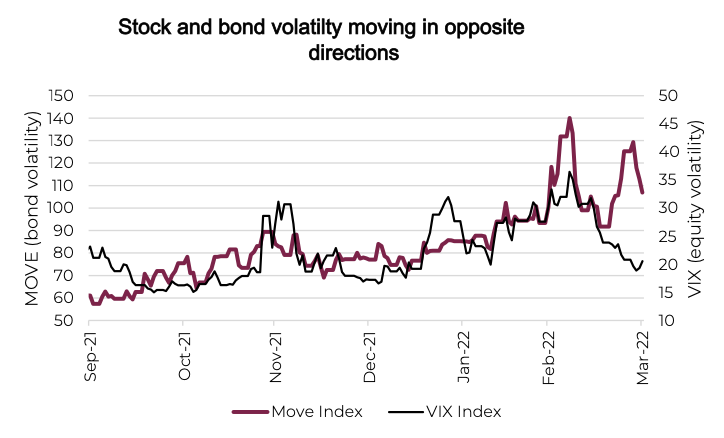

Outside of the initial pandemic months in 2020, the past quarter has been the most volatile period for investors in years. Cross asset volatility continued to rise over the first quarter led by the bond, commodity and currency markets and while equity volatility spiked, the VIX is now back below 20.

This divergence in cross asset volatility is certainly strange, and rather rare. The last time we saw this market behavior to this magnitude was back in the taper tantrum of 2013. The chart below plots the

spread between the Move Index (bond volatility) and the VIX Index. After reaching a high a few weeks ago the VIX Index started a smooth descent. Volatility itself is typically volatile, and this orderly retreat is abnormal, particularly as bond yields are surging. Aspects of the market appear broken – normal relationships are not behaving as we would expect.

Steep and bumpy path

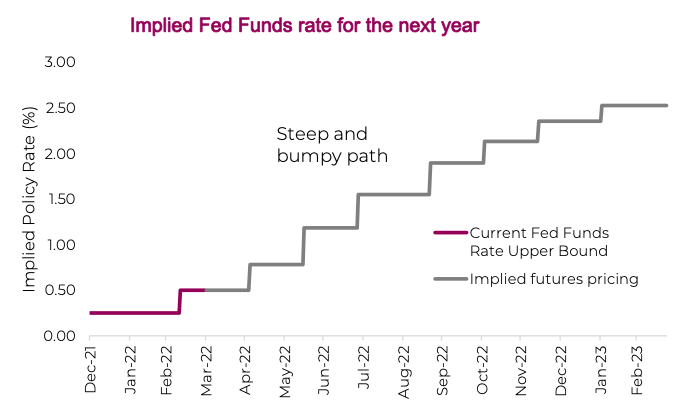

As we welcome a new quarter, markets appear confident that the worst of 2022 is in the rear-view mirror. However, we are still very cautious regarding the outlook for risk-markets over the course of the next 12 months. Recession talk aside, the path higher for bond yields and central bank rate hikes is disquieting.

Central banks are under pressure to quickly normalize rates to tackle inflation. We don’t know exactly where “neutral” rates sit but the long-term overnight rate going back to 1960 is around 4.8%. BCA research estimates neutral to be in the 3.5% range. The market is discounting more quarter-point rate hikes than there are Fed meetings this year. It’s aggressive, and some strategists doubt they will be able to pull it off. The one thing that could tame the hawkishness is sustained weakness within financial markets. The central bank playbook to tackle inflation is to dampen economic growth. Stock expectations just don’t seem to be reflecting this.

Coping with a path of financial tightening is sure to induce some stress pockets. How the market deals with potentially multiple 50bps moves remains to be seen. It’s been 22 years since these have happened and one could argue the market is more sensitive to these moves today given asset prices and debt levels. Besides rate hikes there are numerous other reasons to remain cautious including a U.S. mid-term election, China slowdown, energy prices, potential global food shortages and of course a prolonged war in Ukraine with no lasting resolution in sight.

We don’t doubt this relief rally could keep going or even make new highs. But 2022 is the year of volatility and we believe another correction looms. Earnings expectations are high, and it’s our belief that, given the difficult macro backdrop, equity fundamentals face downside risk. In the fall we wrote about how monetary stimulus being pulled back is in effect draining the punch bowl. Over the rest of the year, we’ll see how markets handle the punch bowl punching back. We doubt they will be as cool and collected as Chris Rock was during the Oscars.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.