It is no secret that the stock market has been strong over the last year. I attribute this to the undercover bear-market that took place between 2015 and 2016. Brexit ended up being a fear-mongering shakeout along with the U.S. Election.

However, since the New Year, as the S&P 500 Index (INDEXSP:.INX) trends higher, it’s Equal-Weighted Index (INDEXNYSEGIS:SPXEW) trends lower.

Does this matter? And, if so, is it sending a warning to investors.

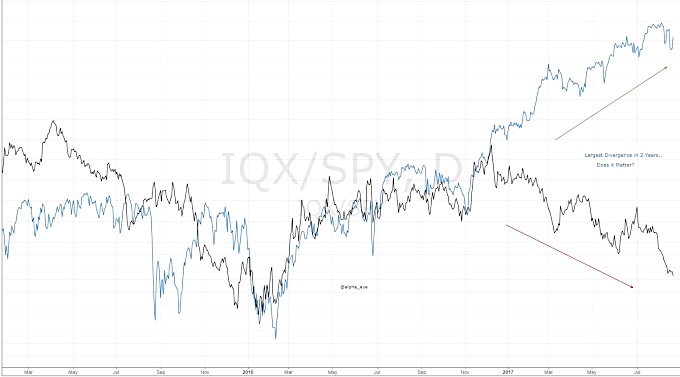

Here is a look at the largest divergence between the two indexes in the past two years:

Equal-Weight S&P 500 relative to the S&P 500 (black); S&P 500 Index (blue).

I do not think this divergence signals a need to get short the market, but I do think it is warranting some caution. Trends can continue on longer than one thinks. I would attribute the S&P 500 “ignoring” this divergence due to the sector rotation that has been in full effect when needed, which is a bullish characteristic.

Here is a longer-term look at the same ratio:

Equal-Weight S&P 500 relative to the S&P 500 (black); S&P 500 Index (blue).

Its important to note that we only have one major top and bottom as evidence as the Equal-Weight S&P 500 Index has only been in existence since 2003.

It’s also important to note that the S&P 500 had no issue rallying since 2012 as the Equal-Weight Index was flat relative to the S&P500. My concern with this chart is that if the ratio cannot stabilize and we continue trending downwards. This looks like a big ‘ole top in the ratio. This could pose a problem and should not be ignored in my book.

Lastly, here is the S&P 500 High-Low Index:

We are now at levels below the entire Post-Election rally. In my opinion, we are starting to see more concerning levels of breadth. We want to take it a week at a time and see this ratio reverse higher ASAP. At the end of the day, it doesn’t matter until it matters… right?

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.