Commodities have been one of the few winners in 2022. But with elevated commodity prices, consumers are now left with an ugly dose of inflation on everyday costs (food, energy)…

And with falling stock prices, they are getting a dose of deflation in their investment portfolios. Not a good combination.

Today, we take a closer look at the bull market in commodities and why we may be at a key trading juncture.

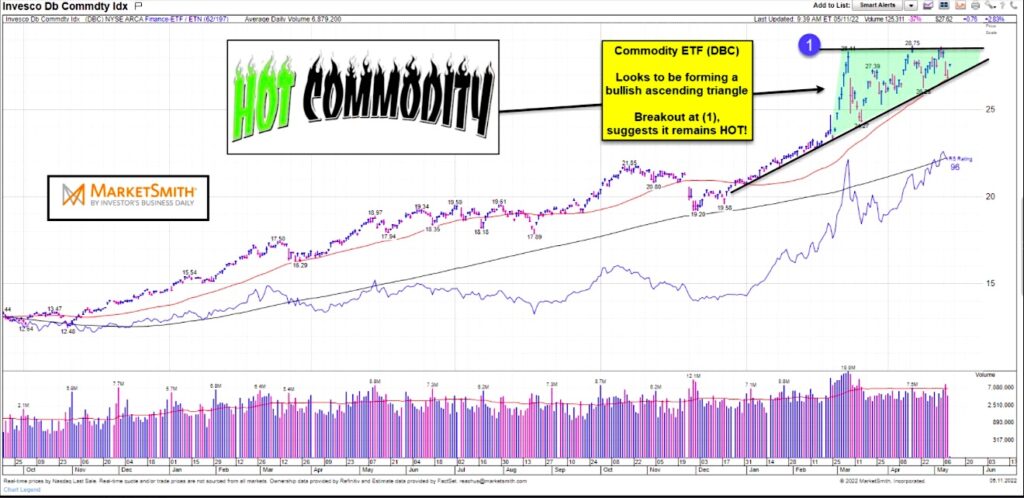

Below, you can see a chart of the popular commodity ETF $DBC. And highlighted in green is a trading pattern that looks to be a bullish ascending triangle. A breakout at (1) would suggest that commodities (and inflation) will remain red-hot.

Seems like right now would be a good time to put this on your watch list… whether it’s for your portfolio or pocket book! Stay tuned!!

$DBC Invesco Commodity ETF Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.