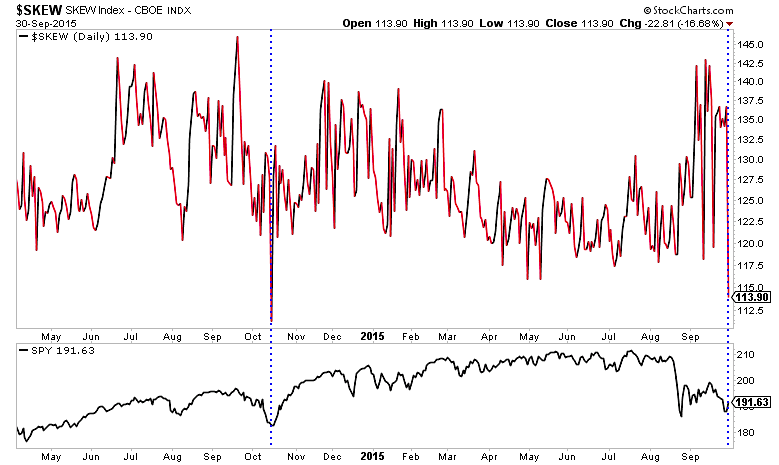

The CBOE SKEW index measures the market’s perception of tail risk looking one month out in time. On Wednesday, all of a sudden this indicator dropped to a level not seen in a year.

For the record, the last time we saw a reading this low: The day of the October 2014 stock market bottom.

Is this a meaningful market low? It could be. Or at a minimum, it may be tradable – I’m on high alert at this point. If you missed it, check out some good reasons to be bullish. We also saw some very interesting gap-ups in stocks and sectors to trade against across the board on Wednesday.

In all fairness, the CBOE SKEW index is simply one indicator to stow away with your research. BUT the drop is definitely notable. Ultimately, the price action will be the final arbiter so we’ll have to see if the August stock market lows continue to hold on the S&P 500.

Thanks for reading. Trade ’em well!

Read more from Aaron on his blog.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.