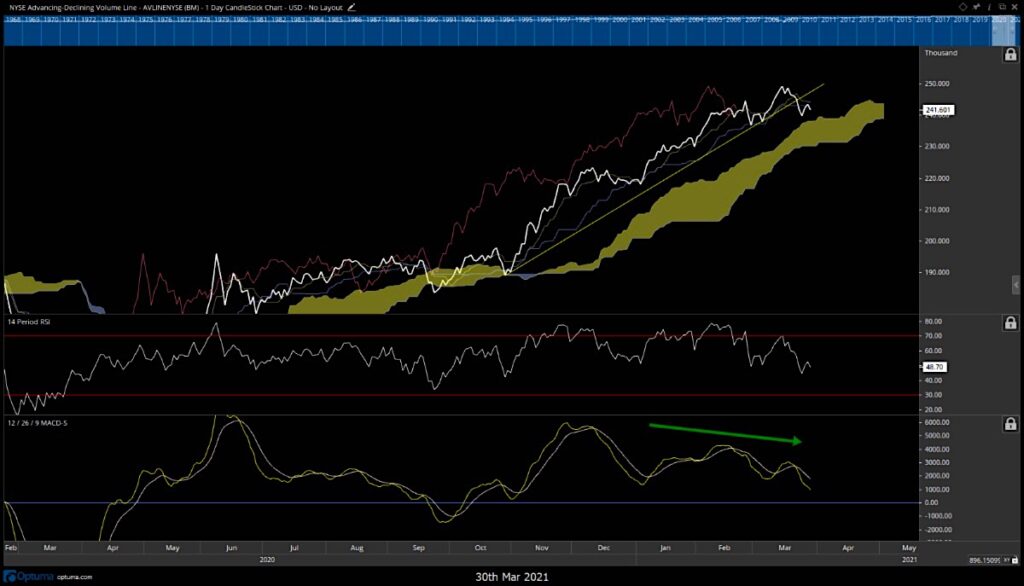

The Advance/Decline (A/D) line for NYSE Composite has rolled over to break a multi-month uptrend, something that bears watching closely given the recent uptick in stock market rotation and above-average volatlity in growth stocks.

Momentum gave some advance warning of this a couple months ago, but the decline is something that often happens ahead of broader market weakness (something that has largely proven elusive for the main stock indices).

Understanding that this is bearish and concerning, we still need to follow the price action / trend.

While an index rally back to new highs is still probable for the S&P 500 and Dow Industrials, one has to keep a close eye on breadth. The recent push into Defensive names looks important and different than what we’ve seen in recent months. As well, market cycles seem to indicate a good likelihood of a mid-April peak.

Until trends are broken, we’ll have to simply rely on price confirming some of these recent divergences, but they’re certainly significant in showing something material happening “under the hood” which isn’t immediately apparent when simply looking at weekly price action of the broader US indices.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @MLNewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.