Occasionally, problems reveal themselves gradually. A water stain on the ceiling is potentially evidence of a much larger problem. Painting over the stain will temporarily relieve the unsightly condition, but in time, the water stain will return.

This is analogous to a situation occurring within the banking system.

Almost three months after water stains first appeared in the overnight funding markets, the Federal Reserve has stepped in on a daily basis to “re-paint the ceiling” and the problem has appeared to vanish.

Yet, every day the stain reappears and the Federal Reserve’s work begins anew. One is left to wonder why the leak hasn’t been fixed.

In mid-September, evidence of issues in the U.S. banking system began to appear. The problem occurred in the overnight funding markets which serve as one of the most important components of a well-functioning financial and economic system.

It is also a market that few investors follow and even fewer understand.

At that time, interest rates in the normally boring repo market suddenly spiked higher with intra-day rates surpassing a whopping 8%. The difference between the 8% repo rate recorded on September 16, 2019 and Treasuries was an eight standard deviation event. Statistically, such an event should occur once every three billion years.

For a refresher on the details of those events, I suggest reading our article from September 25, 2019, entitled Who Could Have Known: What The Repo Fiasco Entails.

At the time, it was surprising that the sudden change in overnight repo borrowing rates caught the Fed completely off guard and that they lacked a reasonable explanation for the disruption. Since then, our surprise has turned to concern and suspicion.

I harbor doubts about the cause of the problem based on two excuses the Fed and banks use to explain the situation. Neither are compelling or convincing.

As we were putting the finishing touches on this article, the Bank of International Settlements (BIS) reported that the overnight repo problems might stem from the reluctance of the four largest U.S. banks to lend to some of the largest hedge funds. The four banks are being forced to fund a massive surge in U.S. Treasury issuance and therefore reallocated funding from the hedge funds to the U.S. Treasury. Per the Financial Times in Hedge Funds key in exacerbating repo market turmoil, says BIS: “High demand for secured (repo) funding from non-financial institutions, such as hedge funds heavily engaged in leveraging up relative value trades,” – was a key factor behind the chaos, said Claudio Borio, Head of the monetary and economic department at the BIS.

In the article, the BIS implies that the Fed is providing liquidity to banks so that banks, in turn, can provide the hedge funds funding to maintain their leverage. The Fed is worried that hedge funds will sell assets if liquidity is not available. Instead of forcing hedge funds to deal with a funding risk that they know about, they are effectively bailing them out from having to liquidate their holdings. If that is the case, and as the central bank to central bankers the BIS should be well informed on such matters, why should the Fed be involved in micro-managing leverage to hedge funds? It would certainly represent another extreme example of mission creep.

Excuse #1

In the article linked above, I discussed the initial excuse for the funding issues bandied about by Wall Street, the banks, and the media as follows:

“Most likely, there was an unexpected cash crunch that left banks and/or financial institutions underfunded. The media has talked up the corporate tax date and a large Treasury bond settlement date as potential reasons.”

While the excuse seemed legitimate, it made little sense as I surmised in the next sentence:

“We are not convinced by either excuse as they were easily forecastable weeks in advance.”

If the dearth of liquidity in the overnight funding markets was due to predictable, one-time cash demands, the problem should have been fixed easily. Simply replenish the cash with open market operations as the Fed routinely did prior to the Financial Crisis.

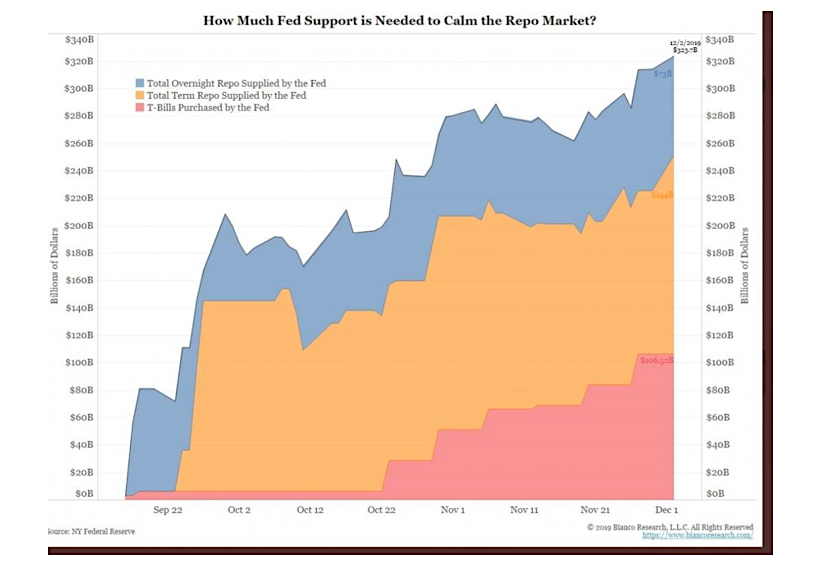

Since mid-September, the Fed has elected instead to increase their balance sheet by over $320 billion. In addition to conducting daily overnight repo auctions, they introduced term repo that extends for weeks and then abruptly restarted quantitative easing (QE).

Imagine your plumber coming into your house with five other plumbers and a bull dozer to fix what you assumed was a leaky pipe.

The graph below, courtesy Bianco Research, shows the dramatic rise in the Fed’s balance sheet since September.

Based on the purported cash shortfall excuse, one would expect that the increase in the Fed’s balance sheet would have easily met demands for cash and the markets would have stabilized. Liquidity hole filled, problem solved.

However, as witnessed by the continuing growth of the Fed’s balance sheet and ever-increasing size of Fed operations, the hole seems to be growing. It is worth noting that the Fed has committed to add $60 billion a month to their balance sheet through March of 2020 via QE. In other words, the stain keeps reappearing and getting bigger despite increasing amounts of paint.

Excuse #2

The latest rationale used to explain the funding problems revolves around banking regulations. Many Fed members and banking professionals have recently stated that banking regulations, enacted after the Financial Crisis, are constraining banks’ ability to lend to other banks and therefore worsening the funding situation. In the words of Randy Quarles, Federal Reserve Vice Chair for Banking Supervision, in his testimony to the House Financial Services Committee:

“We have identified some areas where our existing supervision of the regulatory framework…may have created some incentives that were contributors”

Jamie Dimon, CEO of JP Morgan, is quoted in MarketWatch as saying the following:

“The turmoil may be a precursor of a bigger crisis if the Fed doesn’t adjust its regulations. He said the liquidity requirements tie up what was seen as excess reserves.”

Essentially, Quarles and Dimon argue that excess reserves are not really excess. When new post Financial Crisis regulatory requirements are factored in, banks only hold the appropriate amount of reserves and are not exceeding requirements.

This may be the case, and if so, the amount of true excess reserves was dwindling several months prior to the repo debacle in September. Any potential or forecasted shortfalls due to the constraints should have been easily identifiable weeks and months in advance of any problem.

The banks and the Fed speak to each other quite often about financial conditions and potential problems that might arise. Most of the systemically important financial institutions (SIFI banks) have government regulators on-site every day. In addition, the Fed audits the banks on a regular basis. We find it hard to believe that new regulatory restraints and the effect they have on true excess reserves were not discussed.

This is even harder to believe when one considers that the Fed was actively reducing the amount of reserves in the system via Quantitative Tightening (QT) through 2018 and early 2019. The banks and the regulators should have been alerting everyone they were getting dangerously close to exhausting their true excess reserves. That did not occur, at least not publicly.

Theories and Speculation

A golden rule we follow is that when we think we are being misled, especially by market participants, the Fed, or the government, it pays to try to understand the motive. “Why would they do this?” Although not conclusive, I have a few theories about the faulty explanations for the funding shortage. They are as follows:

- The banks and the Fed would like to reduce the regulatory constraints imposed on them in recent years. Disruptions demonstrating that the regulations not only inhibit lending but can cause a funding crisis allow them to leverage lobbying efforts to reduce regulations.

- There may be a bank or large financial institution that is in distress. In an effort to keep it out of the headlines, the Fed is indirectly supplying liquidity to the institution. This would help explain why the September Repo event was so sudden and unexpected. Rumors about troubles at certain European banks have been circulating for months.

- The Fed and the banks grossly underestimated how much of the increased U.S. Treasury debt issuance they would have to buy. In just the last quarter, the Treasury issued nearly $1 trillion dollars of debt. At the same time, foreign sponsorship of U.S. Treasuries has been declining. While predictable, the large amount of cash required to buy Treasury notes and bonds may have created a cash shortfall. For more on why this problem is even more pronounced today, read our article Who Is Funding Uncle Sam. If this is the case, the Fed is funding the Treasury under the table via QE. This is better known as “debt monetization”.

- Between July and November the Fed reduced the Fed Funds rate by 0.75% without any economic justification for doing so. The Fed claims that the cuts are an “insurance” policy to ensure that slowing global growth and trade turmoil do not halt the already record long economic expansion. Might they now be afraid that further cuts would raise suspicion that the Fed has recessionary concerns? QE, which was supposedly enacted to combat the overnight funding issues, has generously supported financial markets in the past. Maybe a funding crisis provides the Fed cover for QE despite rates not being at the zero bound. Since 2008, the Fed has been vocal about the ways in which market confidence supports consumer confidence.

The analysis of what is true and what is rhetoric spins wildly out of control when we allow our imaginations to run. This is what happens when pieces do not fit neatly into the puzzle and when sound policy decisions are subordinated to public relations sound bites. One thing seems certain, despite what we are being told, there likely something else is going on.

Of greater concern in this matter of overnight funding, is the potential the Fed and banks were truly blindsided. If that is the case, we should harbor even deeper concern as there is likely a much bigger issue being painted over with temporary liquidity injections.

Summary

In the movie The Outlaw Josey Wales, one of the more famous quotes is, “Don’t piss down my back and tell me it’s raining.”

I do not accept the rationale the Fed is using to justify the reintroduction of QE and the latest surge in their balance sheet. Although I do not know why the Fed has been so incoherent in their application of monetary policy, my theories offer other ideas for thinking through the monetary policy maze. They also have various implications for the markets, none of which should be taken lightly.

I am just as certain that I am not entirely correct as I am certain that I am not entirely wrong. Like the water spot on the ceiling, financial market issues normally reveal themselves gradually. Prudent risk management suggests finding and addressing the source of the problem rather than cosmetics. I want to reiterate that, if the Fed is papering over problems in the overnight funding market, we are left to question the Fed’s understanding of global funding markets and the global banking system’s ability to weather a more significant disruption than the preview we observed in September.

Twitter: @michaellebowitz

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.