The oil market has been interesting lately and, to the surprise of many, has been the biggest silent outperformer this year.

There have been no shortage of geopolitical events to choose from, leading to a higher risk premium in oil with Brent breaking $90; whether it’s the Houthis missile attacks in the Red Sea and a massive re-route of trade, Ukraine’s drone strikes on Russian refineries, and the latest escalation between Israel and Iran driving some news outlets to use ‘WWIII’ as a click bait-y headline.

Given the run-up in oil prices, Canadian oil equities have clearly benefitted from the much higher torque. But there is a layer of even better news: The Transmountain Expansion (TMX) continues to look to be in operation by May, which would lead to much better pricing on the Western Canadian Select (WCS). With the current setup for oil markets, we often get this question from investors: How sustainable is the rally in Canadian energy names?

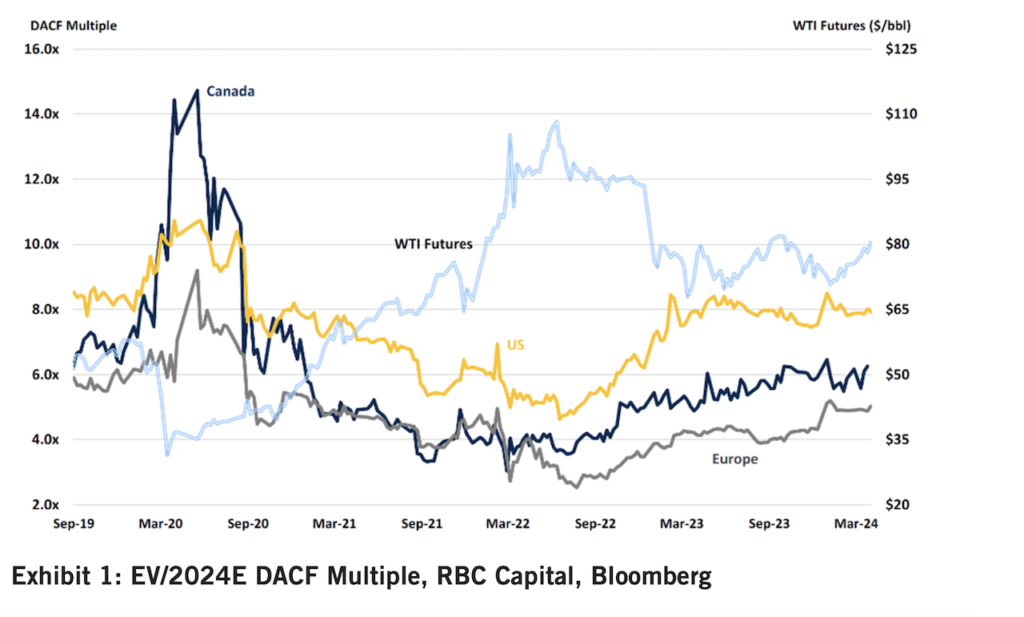

To determine whether oil equities are overstretched, we can look at the debt-adjusted cash flow (DACF) multiples of the major integrated oil names and see how the valuation has shifted in light of the recent oil move. In Exhibit 1, the DACF multiples for the Canadian integrateds have been fairly range-bound over the last year, also in line with WTI, which has been in the $70 – $85 range.

As a starting point, we can infer that the valuations of the companies have been commensurate with the movements in the underlying oil price deck and in line with where the equities should trade in the cycle historically over the last couple of years. Typically, in the commodities cycle, higher prices are usually coupled with lower multiples as market participants will usually price in lower normalized prices and vice versa. A cause of concern would be when valuation starts trending towards the 6.5x – 7.0x+ area if oil prices continue to stay in the upper bounds of the $70 – $90 range or higher.

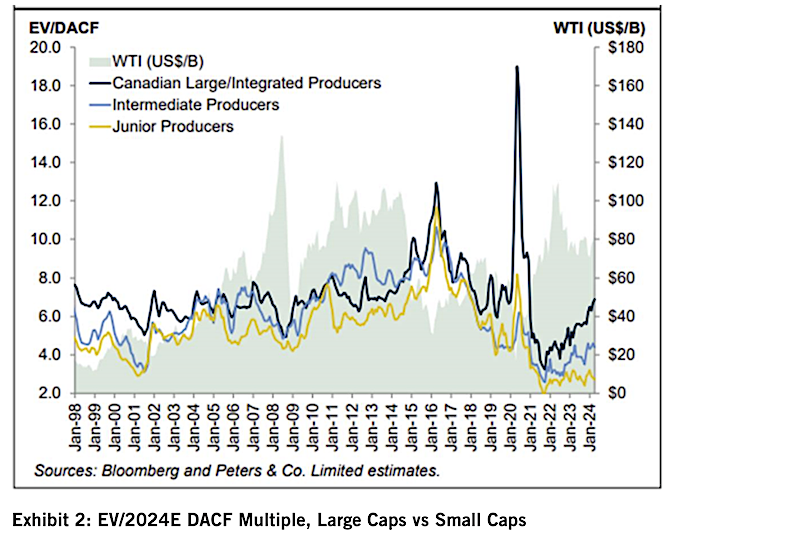

Fast forward to 2022, when the energy crisis was already happening even before the Russian invasion of Ukraine, and now we’re seeing a rush from investors to get back into the space as it becomes harder to justify to your constituents why you’re underweight energy.

Given the need to get back into the space quickly, we can see the path of least resistance from many funds to simply buy into more liquid, larger cap names to capture the beta. As the saying goes, no one gets fired for buying Microsoft. The same is probably now true for Canadian Natural Resources or Tourmaline in the energy space. The key takeaway is while we think larger cap oil equities will likely be steady as she goes, given the numerous tailwinds in macro, we think investors will get paid with asymmetric risk-reward if they do the work on some of the intermediate and junior names in the space.

Some have questioned whether the valuation gap between Canadian E&Ps and US E&Ps will tighten over time as we’ve seen a structural discount since pre-COVID. We certainly think there is a case to be made here given the impending commercial operation of the Transmountain Expansion pipeline. This will significantly increase the egress of Canadian oil, a pain point for many years that’s self-inflicted by Canadian politics. Improving egress means better pricing of WCS on the world stage, and lower volatility as a function of WTI price means investors will underwrite higher valuation multiples. Canada’s oil reserves, on a proven and probable basis, span decades. Sustaining capital expenditure to maintain an oil sands project is significantly lower than U.S. shale, where you’re on a constant treadmill to find new acreage and drill high-decline wells.

Despite all this, we don’t think Canadian E&Ps should trade at parity to U.S. E&Ps. While TMX is certainly a positive, we take stock in the fact that the pipeline will likely be full by 2027 and we end up having to ship the marginal barrels via rail once again. We will certainly see a few optimization/compression-type projects along the way that improve capacity incrementally, but only time will tell whether we will get another huge step function in Canadian egress in the coming years. TMX project was first submitted to the regulators in 2013, so it’s been a long time coming, with the latest cost overrun estimate at $30B+, or ~$800 per capita.

Final thoughts

The bottom line for those looking at the Canadian energy space is to invest for the right reasons. These include: 1) step function increase in production, 2) lower volatility from better-realized pricing of WCS, 3) attractive (but not fire sale) valuations for steady returns, and 4) outsized opportunities in the intermediates and juniors. Betting on the direction of oil, in our view, is not amongst the top reasons to invest in Canadian energy names. We would rather focus on a sustainable approach where we pick producers that can generate outsized returns on a full-cycle basis at reasonable valuations.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

The author or his firm may hold positions in mentioned securities. Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.