This bear market started off in an orderly fashion. Thanks to inflation, central banks hiked rates at speeds not seen in many decades and longer yields rose quickly from very low levels. As a result, markets came down as higher rates/yields beget lower valuation multiples.

When we say “orderly,” we are not downplaying the volatility or pain — we’re simply saying the market was being repriced. Even most investors were relatively apathetic to the declines. Whether that was because of some outsized gains in the previous year and a half, or recency bias that this bear would be similar to 2020 (i.e., down fast and back up, blink and you missed it), apathy has given way to emotions once again.

If you can characterize bear markets, moving from repricing or multiple contraction to more emotional-driven behaviour is a natural progression. As we see money flowing very quickly into cash proxies and product, the apathic patience of the first phase has given way to classic run-and-hide behaviour.

Good news, bad news

With emotions elevated, the risk of a capitulation event is much higher. The good news is this would likely mark the bottom of the bear market; the bad news is it likely has not occurred yet. Nonetheless, this market is fragile, having absorbed the Fed going from about 0% to now pricing in 4.5% in Q1 of 2023, and rising global bond yields. And don’t forget global bonds have now erased $125 trillion in wealth while global stocks have erased $30 trillion. These are measured in U.S. dollars (USD), so exaggerated by the rise of USD versus all other currencies, but certainly a negative wealth effect is afoot.

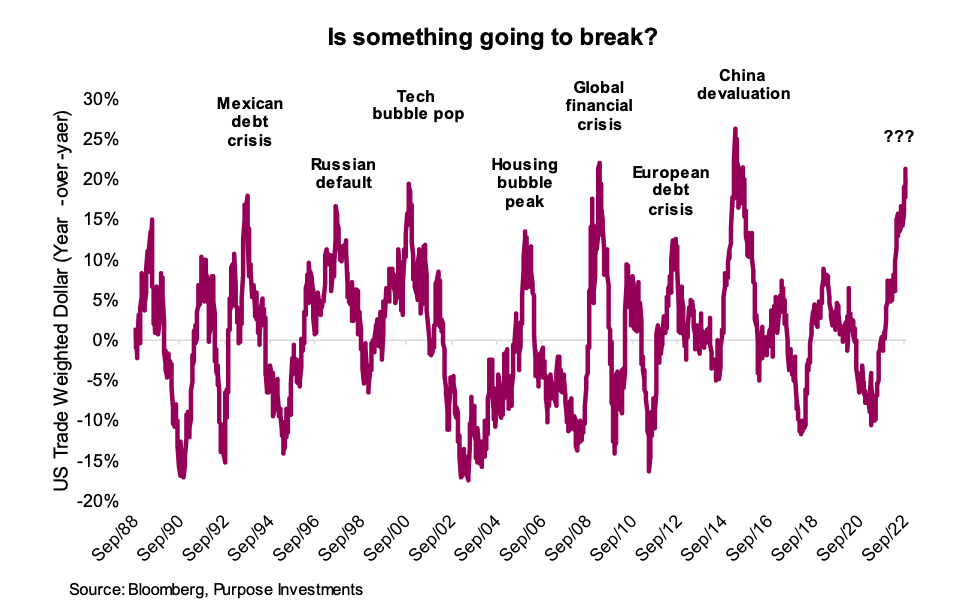

Talking about the USD, this too is applying much pressure to the markets, financial systems and many economies. The chart above shows the year-over-year change in the U.S. trade weighted dollar (USD versus a basket of other global currencies). A rise in the USD like the last few months has coincided with many of the past market events that really roiled markets.

Current scenario: Cart-in-front-of-horse, or horse-in-front-of-cart?

Does the USD spike because of a crisis? Or does the spike help cause the crisis? This is important because so far there does not appear to be a crisis or breakdown in the market. (Yet.)

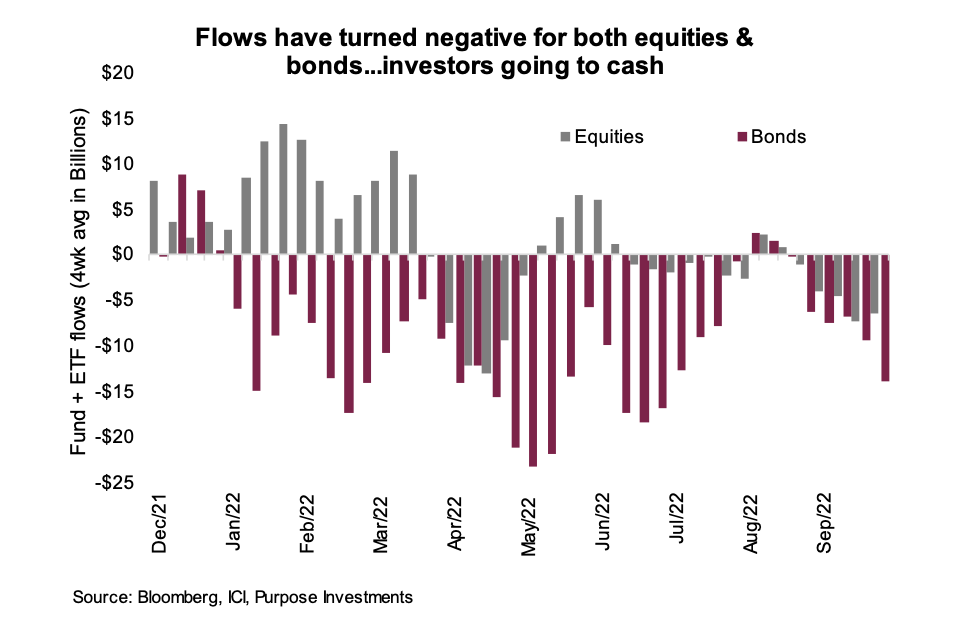

Fund flows are certainly adding to the stress, measured by mutual fund & ETF flows. This is U.S. data, but it is similar in Canada. Bond outflows have remained resilient this year as investors flee higher yields — effectively selling low, but the mob is the mob.

Equity inflows remained during the early months of this bear market as the buy-the-dippers tried one more time. But that cohort appears spent and flows have turned negative in September. If you are wondering where the money goes, it is cash. Cash vehicles have been ballooning.

This is precisely the same behaviour we see in any bear market. And while it may feel good and even be right with a potential event ahead, the market outflows and cash inflows ALWAYS persist for quarters and even years after the markets’ bottom. Remember, as an investor if it feels good, you are likely doing it wrong.

Impact on portfolios

2022 has not been an enjoyable year for investors or advisors, and certainly not for portfolio managers. The risk of some sort of event that triggers a final capitulation is high, given emotions and stresses in the markets and economy. And while the bottom does not appear to be put in just yet, we are likely getting much closer to the final bottom.

Does it need a final capitulation? Perhaps, but that’s not a certainty. Could an improvement in upcoming U.S. inflation data kick off a strong rally in both equities and bonds? Perhaps … The various paths forward from current levels are very divergent, which makes going in on risk assets or going to defensive cash both potentially perilous.

While an event may be looming, we would also note that the TSX is yielding 3.4% and trading at only 11x earnings. This was the valuation trough during the 2020 pandemic. Much bad news is priced into many markets, including the bond market.

This is a dangerous time to make any outsized bets. Stay diversified and if you look forward 12 months, even with a potential recession, both equities and bonds likely have a higher probability of being higher than today’s levels. But the path from here to there will likely be a wild one.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.