Shares of MercadoLibre (MELI) have based very well over the past year and a half. And this period of basing/consolidation could setup MercadoLibre stock for another run higher.

What makes convinces me of that? And why do I like it here? Here are a few reasons:

First, consider the damage done to markets in South America. After a deeper (and overdue) correction, MercadoLibre stock has held up nicely.

Note that MELI rallied from 7 to the 140s between 2008 and 2013, so the consolidation over the past 18 months was overdue.

In 2015, MercadoLibre stock price has based in what may be a symmetrical triangle. If this pattern plays out in the bull’s favor, we might see a rally towards 200. What’s particularly attractive is how little we’re risking with a solid area to trade against (between 115 and 120).

Do I know this idea will work out and be a glorious winner? No, but I can go to the grave accepting the risk-reward.

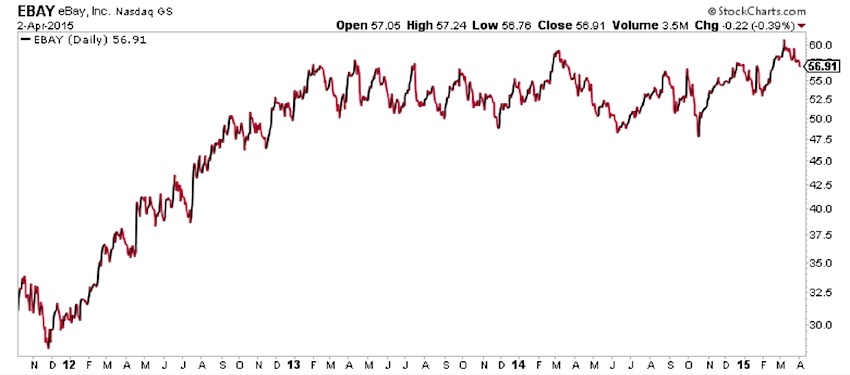

If you don’t want to go outside of the U.S., EBAY is a name of interest… and it owns nearly 20% of MELI. This and the upcoming PayPal spin-off could be two huge catalysts for the stock as it tries to break out of a very long base.

Thanks for reading!

Follow Aaron on Twitter: @ATMcharts

Author has a long position in MELI at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.