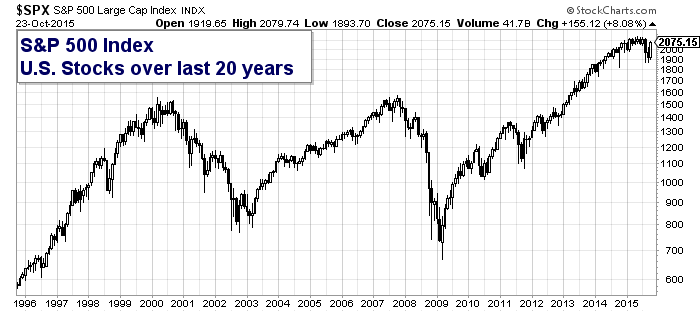

And it is an even better time to invest in stocks after a significant pullback of 20% or more that may happen once or so in a decade. The last time that happened was in 2008. See chart of the S&P 500 over last 20 years for reference.

I believe that we are at the beginning of the end of this bull market cycle. And in order to be able to take advantage of investing at the lows, you first have to move out of stocks before they start to decline sharply. That may mean that you miss a further upside while you wait, but for my retired clients who recognize the priority of protecting their nest egg, they place a higher priority on avoiding the waterfall events like the one that occurred around August 20th.

If global growth (and U.S. growth) continues to slow, it is likely that more waterfall events may occur over the next few months. I believe those who are retired or near-retirement may want to think twice about being heavily invested in stocks. I will continue to use the current recovery in stocks to decrease my global stock market exposure.

Twitter: @JeffVoudrie

Author has positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.