As most readers are aware, we have been long Gold and recently reiterated our trading stance this week.

With gold trading higher, this has opened up opportunities in the Gold and Silver mining space.

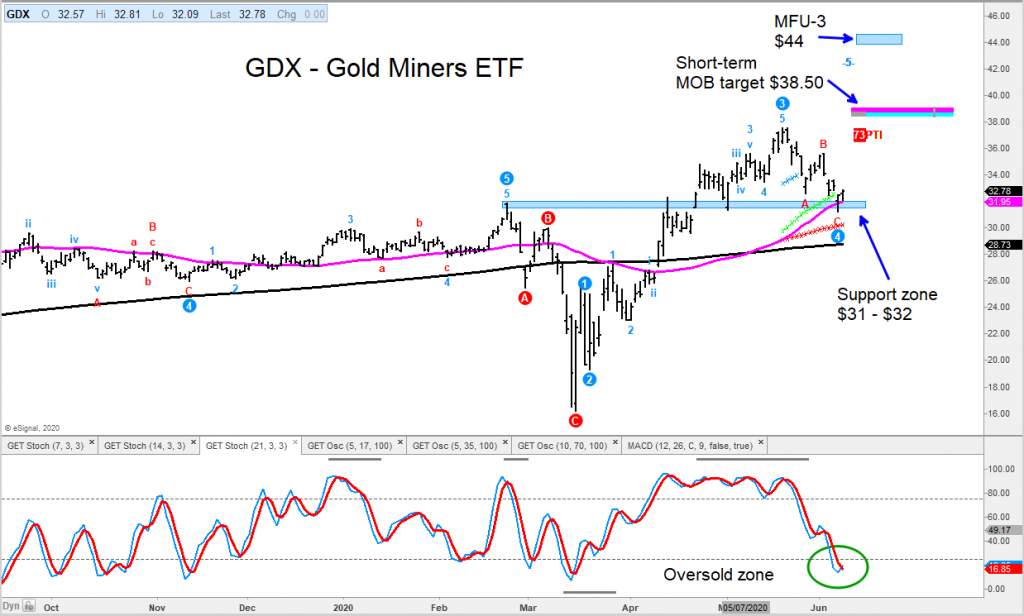

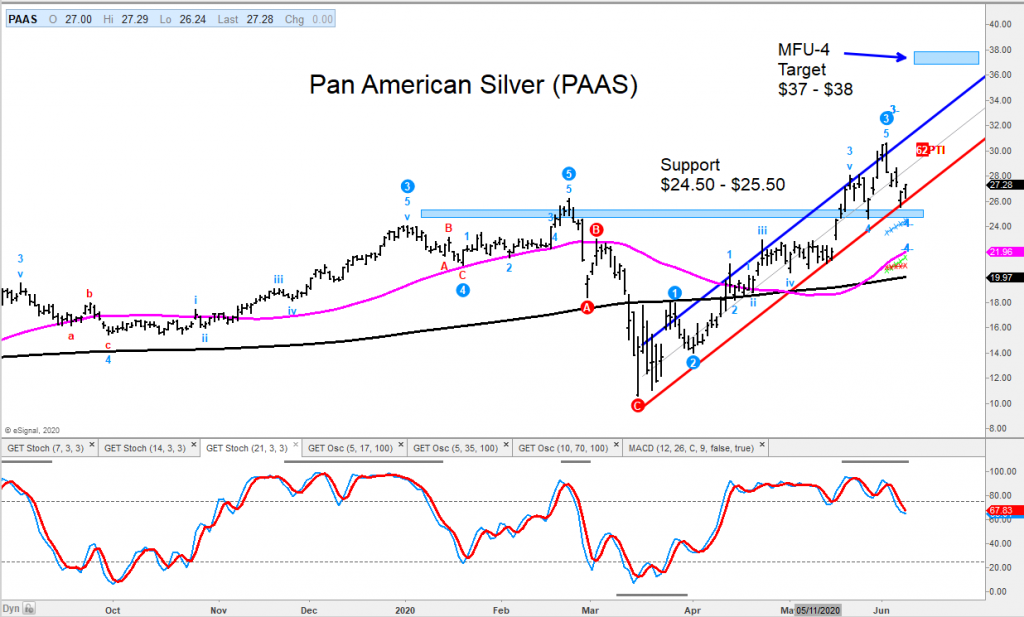

I currently have institutional clients long the Gold Miners (GDX) and wanted to provide an update on our view of GDX, as well as our favorite silver play Pan American Silver (PAAS).

Charts for both GDX and PAAS can be see below.

Gold Miners ETF (GDX)

Pan American Silver (PAAS)

The author has a long trading position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.