Investing in gold, either gold producers or bullion, has never been easy.

Of course we are not counting the “gold bugs” who believe anytime is a good time to buy gold. Gold investing isn’t easy because it changes so much from one period to the next. There are periods that gold is a hedge against inflation, other times a hedge against turmoil, sometimes it takes on a more speculative ethos, sometimes a hedge against the U.S. dollar or fiat currency devaluation. Perhaps the yellow metal is more chameleon than an indestructible element.

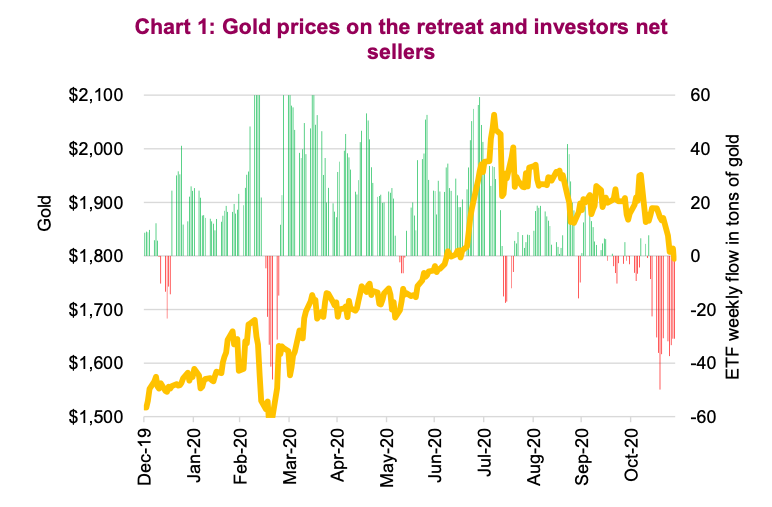

So what is gold today? Well it appears to be in transition, which tends to weigh on the price. Having started its rise in early 2019, gold really kicked into high gear during 2020. This year was a perfect environment for gold amid a bear market, pandemic, political uncertainty – the list goes on. If the price of gold equals turmoil, 2020 turmoil easily explains its rise from $1,500 to $2,075/oz. However, gold started to fall at the end of the summer and these declines accelerated in November. Gold has retreated from over $2,000 to under $1,800/oz, with gold equities following suit. This is about a 50% retracement of the 2020 gains.

Two very big events occurred in November that are clearly weighing on the price of gold. Heading into the U.S. presidential election there was certainly a flight to safety given the rhetoric of a contested election, civil unrest or even a breakdown in the process. Clearly, those fears were unfounded and as the electoral process nears its conclusion, it actually went much smoother than expected by most. Not smooth, but smoother. The vaccine news has also kickstarted a changing dynamic in the markets, injecting a clearer path towards the end of this terrible pandemic. This has likely motivated investors to dump gold exposure that they were holding to hedge their portfolio.

As turmoil and uncertainty abates, gold is losing its “turmoil” premium, resulting in the current weakness. We believe gold is in a transition phase; no longer a hedge for global turmoil and slowly becoming a hedge against reflation. This transition is not smooth but should set the stage for gold’s next move higher.

The current unprecedented fiscal and monetary stimulus is inflationary. However, the deflationary impulse from the current recession/pandemic is even bigger. As the recovery gains steam in 2021, we believe the economy will recover faster than past recessions given the unique service-industry dynamic of this contraction. In addition, there is the lagging inflationary impulse from central banks, which are relatively uniform in their stance to allow any inflation to run longer before intervening.

Technical Outlook

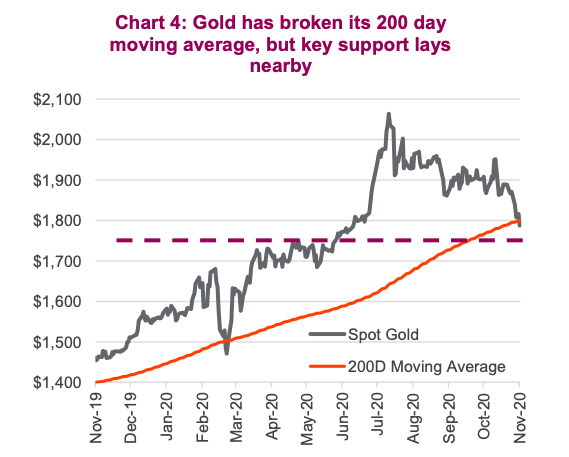

While we maintain our long-term bullish outlook for gold, the broader risk environment in the short term remains volatile as the recent corrective phase continues to play out. The market action last Friday (November 27) is a key example. On a low-volume day, spot prices dipped below the psychologically important $1,800 level. This fed into a quick selloff to new near-term lows. The consolidation has overshot a number of key support levels for the year, with the next major support around $1740-$1750/oz. This coincides with the highs, which were tested multiple times from April to June, as well as the 38.2% retracement level of the 2018/2020 rally. See Chart 4 below.

Certainly, we are not in the business of market timing, as any investor who has been humbled by big swings in the market will admit. But at current levels, the risk/reward looks rather attractive.

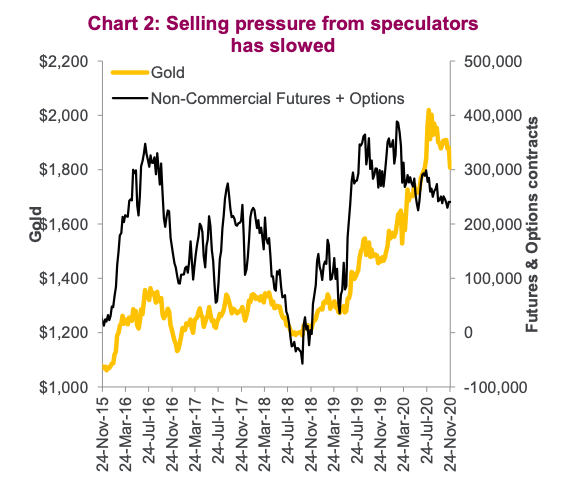

RSI momentum at the August peak reached a level not even experienced during the decades-long bull run starting in 2000. A consolidation/ correction was due; however, the recent selling pressure has caused gold prices to become oversold on a number of momentum indicators. At current levels based on the stochastic1 indicator has fallen to the lowest levels since April 2019. Once this phase of retail selling via ETFs diminishes, it’s our belief that it will set the stage for the next leg higher. We’re already beginning to see some constructive signs in the futures market. Non-commercial net futures position is beginning to tentatively rise, suggesting that institutions are using the current period of weakness to rebuild long positions, or at the very least ease up on the selling (Chart 2).

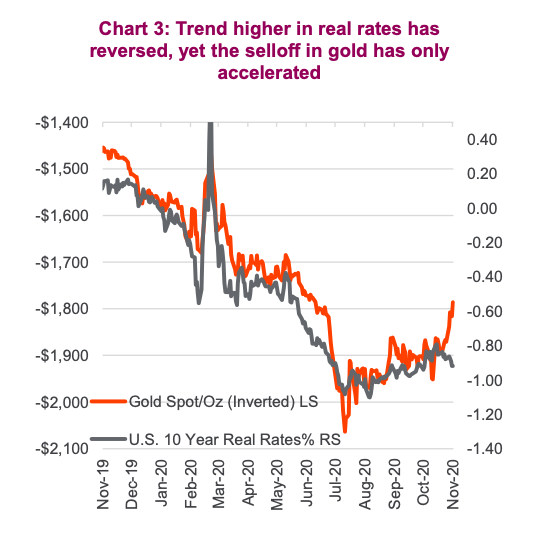

Real rates have been the largest recent driver of gold prices. Gold hasn’t been trading with the U.S. dollar much, which would have been a positive for prices given USD weakness. Real rates have risen off of the August lows, but as Chart 3 shows, they have actually begun to move back lower recently breaking the rising yield trend while the price of gold continues to plummet.

So, will the U.S. dollar reassert itself as an influence on gold? Perhaps, and we would also argue that this would provide a tailwind. If real rates remain a key driver, the recent pullback should also provide some steadiness for the gold market.

Investment implications

We did expect this awkward transition phase to develop at some point and we don’t know how long it will last or if gold will head lower. That being said, we believe this is creating a re-up opportunity as being long some gold over the next few years carries a lot of merit for a portfolio. For Canadian investors, we believe gold will become a hedge against potential continued U.S. dollar weakness and rising inflationary pressure.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.