Several large cap tech stocks peaked in late summer to early fall and many have under-performed the broader stock market since then.

Today’s featured stock is one of those: EBAY.

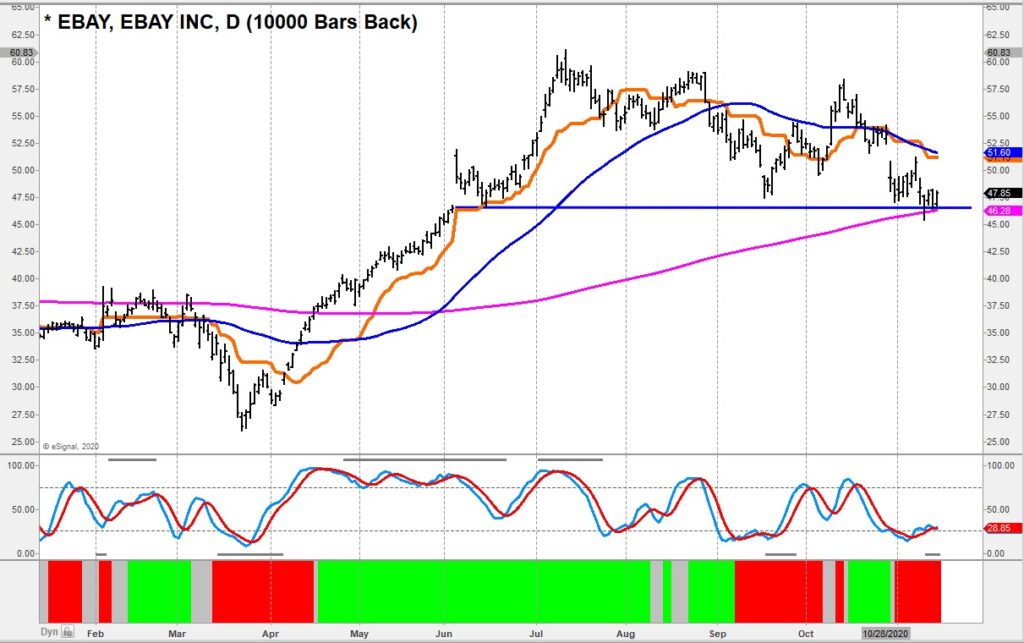

EBAY’s stock price has traded in a broad (yet lower) consolidation pattern and is now testing its rising 200-day moving average. This price support area is fortified by the June gap (support) that was filled last week.

This dual support area should provide strong support for a rally attempt. If nothing else, the current economic environment (uncertain) should be helpful to EBAY sales heading into the holidays and make the stock a good hedge against other more vulnerable stocks.

The falling 50 day moving average stands in the way as price resistance, so watch these technical levels.

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.