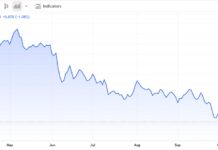

Looking at the crude oil price chart from November 2022 until the present, what do you see?

Oil bulls will see strong bottoms around $65.

Oil bears will see major tops between $90-$95.

Opportunists will see volatility and a reason to sit aside as at $73-$74 oil is in the middle of the range.

I see a neutralizing slope on the 50-day moving average (blue).

I see a flat slope on the 200-day moving average (green).

I see major price support around $72 and good resistance at $80.

I also see a fundamental powder keg.

Between the newest Hurricane and the Middle East potential for disruption to Iranian oil fields, this is hardly the time for complacency.

In fact, thank you China for selling off, as this might have given traders a cheaper entry in oil with a good risk.

What will we do?

The simplest plan is to look at $75 as pivotal.

Bullish above, negative below.

Then, over $80, bulls can build the position.

Below $70 bears can rejoice.

Except for a few stocks, the major stock market ETFs we follow (the Economic Modern Family) remain in a sideways range.

And for now, so does crude oil.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.