The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- The last 18 months have been like an ice age for investment bankers brokering deals and young business owners looking to tap extra capital

- Several successful recent IPOs may foster green shoots for firms looking to trade on the secondary markets

- While credit markets remain tight and as fears of a global economic slowdown persist, signs are there that the next few quarters could feature some prominent ventures going public

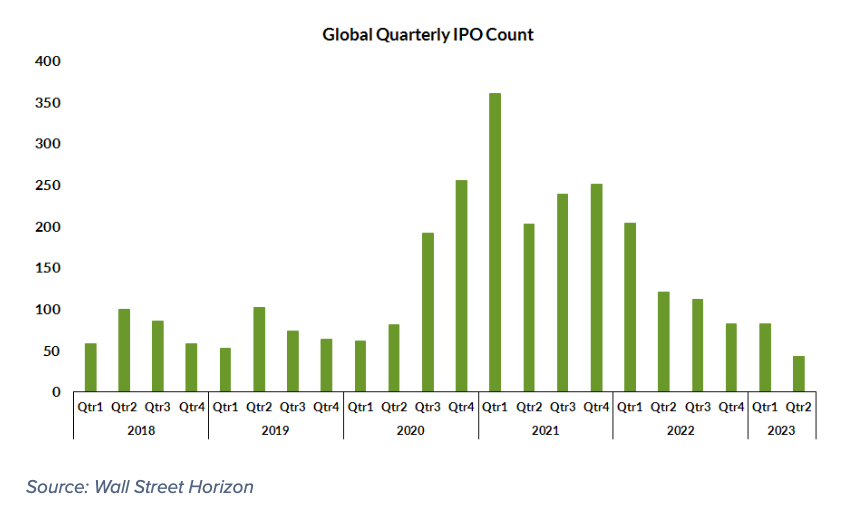

Q2 2023 marked the seventh consecutive quarter of lower year-on-year IPO activity, according to Wall Street Horizon’s data. The April through June stretch was the weakest global go-public count since early 2016. Capital markets continue to run dry as borrowing rates keep rising, and the regional banking turmoil last March didn’t do investment bankers and ambitious young private firms any favors. There are reasons for the bulls to hope, though, and we have already spotted a revival in the world of M&A.

The second half of the year could feature a kick-up in IPOs care of the AI boom and a dash of social proof, leading to some new ventures testing the secondary market waters. That will be a key theme to watch in the months ahead, but the bears can counter with the real threat of a global growth slowdown looming now through early 2024. Let’s dive into some recent firms going public and what may be in store for the back half of the year.

An IPO Freeze-Out Since Q2 2022

Cautious Capital Markets

It has been more than two years since the peak of bubbliciousness on Wall Street. Early 2021 featured hot startups and speculative SPACs taking in huge sums of investor cash, then enjoying strong initial equity returns. Many predicted the euphoria would not last, but strong IPO activity persisted throughout 2021, and even into the first several weeks of last year. Over the last 18 months, though, it has been a rare sight to witness an NYSE specialist orchestrate a successful trading open for a fresh IPO company. Is that trend changing? Our team asserts it’s possible based on the latest clues. A diverse set of new public listings has stirred up a positive tone on Wall Street, and more IPO activity may come later in 2023.

A handful of new companies garnered positive financial media coverage this past quarter:

Kenvue (KVUE): This was the first significant company to IPO this year, and shares soared better than 20% after its May 4 open, proving that a strong stock market launch is possible amid so many macro jitters. J&J’s divestiture continues to be a success for those allocated KVUE shares which are up 15% through early July. The consumer health company has worldwide operations, offering self-care, skin health products, and household-name brands like Band-Aid and Listerine. The $48 billion Consumer Staples sector firm signaled to the street that capital markets were healthy enough for a renewed period of primary and secondary market activity. Looking ahead, its Q2 earnings date is on tap, confirmed for July 20 BMO.

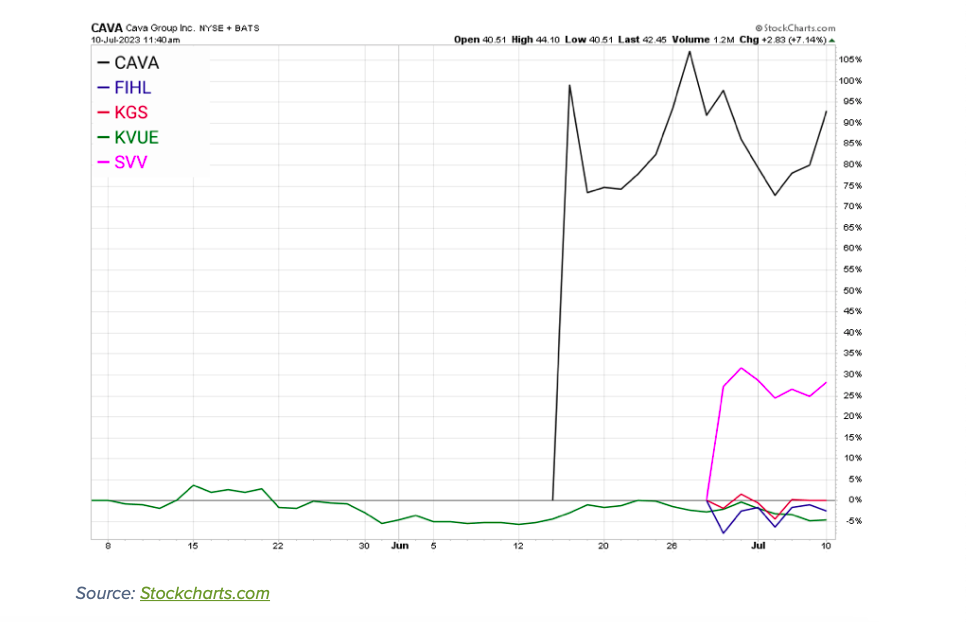

CAVA Group (CAVA): Following Kenvue’s successful IPO, a company about one-tenth the size nearly doubled in its debut. It was shades of 2021 again when the modest Mediterranean restaurant chain dipped into the market. While volatile since its June 15 initial trading day, the stock remains up by some 80% relative to its offering price. Despite not yet profitable, CAVA is now valued higher than Wendy’s, Shake Shack, and even Papa John’s. Early buyers hope more healthy gains are on the way.

Savers Value Village (SVV): June 29 was unofficially IPO Day on the NYSE as three companies rang their respective opening bells. SVV has been the winner among the trio. The Washington-based second-hand merchandise retailer would seem to be in a good position given ongoing trade-down activity among American consumers. SVV was a leveraged buyout company, backed by private equity firm Ares Management and it was a solid exit, with shares priced at $18 then catching a day 1 bid to above $23.

Kodiak Gas Services (KGS): Another private-equity portfolio company was not as much of a success back on June 29. KGS, a $1.2 billion Energy sector small cap, is about flat relative to its IPO price through July 7, but the small oil & gas name’s public launch was at least a sign that the IPO market is getting pumped up.

Fidelis Insurance (FIHL): The last of the three amigos is a Bermuda-based reinsurance company that faces macro challenges should a global growth slowdown ensue over the second half. After dropping 7% in its debut, shares have gotten back to the flat line relative to the go-public price.

A Few 2023 IPO Winners: Kenvue, CAVA, Super Value Village

What To Watch For

Looking ahead, the IPO market is not expected to see a flurry of new public listings in the coming weeks. Historically, July and August tend to be weak months for IPO activity. There is optimism, however, that the final four months of the year will bring about a pickup in equity offerings. While it may not be a floodgates scenario, the increased number of firms testing the secondary market waters is a minor hopeful sign.

Keep your eye on Arm, a major international semiconductor company that may IPO with a valuation estimated near $50 billion. You might recall Nvidia going after Arm Holdings back in September 2020—that proposed deal was scrapped due to antitrust concerns among regulators.

The other monster public share issuance might come via Stripe, a global payments processor that has endured some tough times lately. The San Francisco and Dublin-based financial services enterprise reduced its headcount not long ago and is biding its time amid much uncertainty in the tech space.

Other companies that could be poised for IPO primetime include Reddit, Instacart, Chime, Discord, and Panera. One more thing: We’ll be watching what happens in China. Late last week, there were signs that the regulatory clampdown on companies domiciled in that nation may be loosening. Could we see a few prominent Chinese companies test the IPO waters?

The Bottom Line

The IPO market is part art, part science. Up-and-coming companies, and even some established firms, want to be sure there is ample demand for their shares before committing their stock to the secondary markets. Private equity, meanwhile, is always looking for green shoots to signal that their investments pay off, and investment bankers are always champing at the bit to underwrite quality deals. As the IPO situation turns modestly more sanguine after a dearth of activity, investors should keep on top of the latest key events among newly listed companies.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.