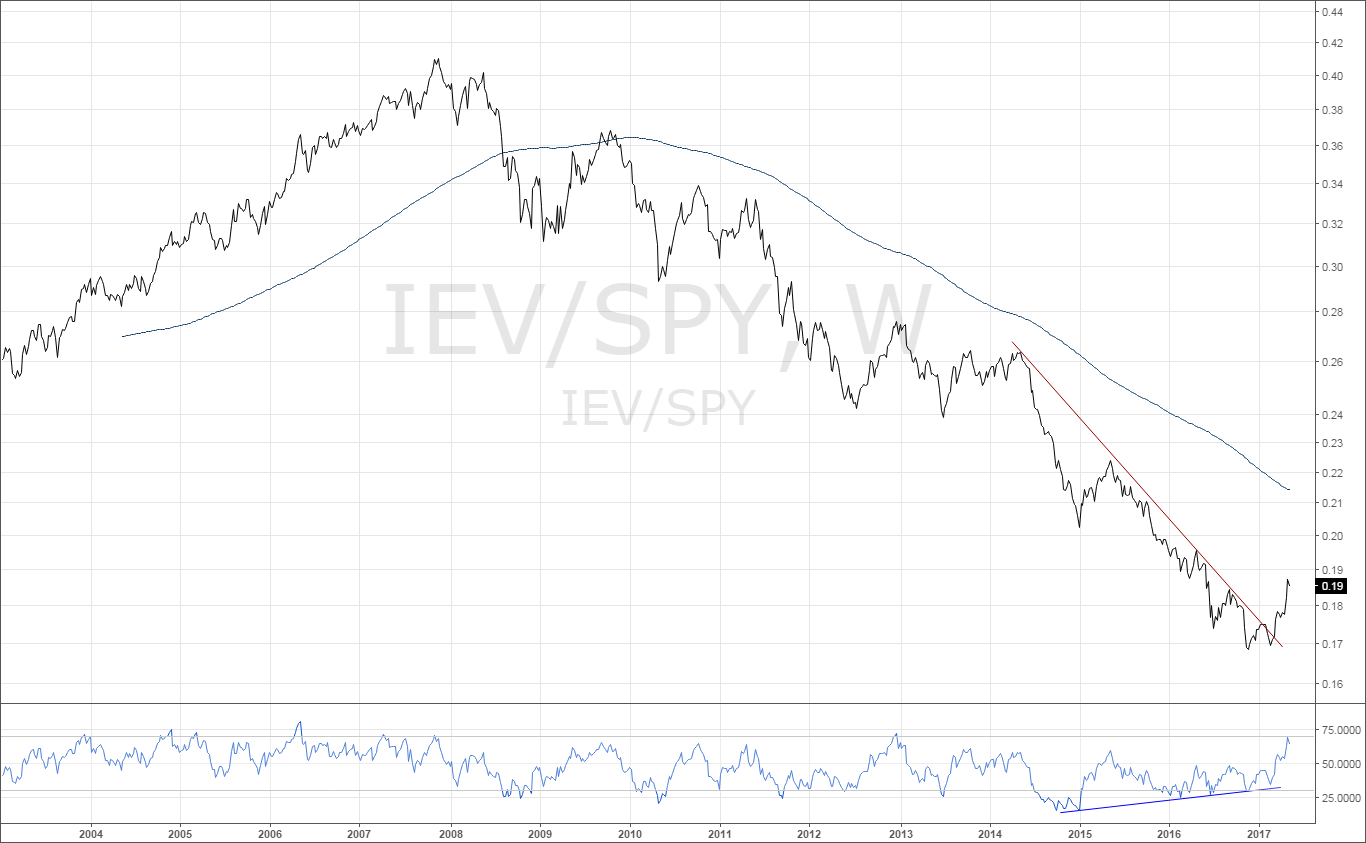

Since 2007, Europe has been in a clear downtrend relative to the S&P 500 (NYSEARCA:SPY).

Back in March, we had a decisive breakout above the 2014 downtrend line.

And while we are not out of the woods yet, this is a positive development for European markets and traders, in my opinion.

Reviewing the iShares Europe ETF (NYSEARCA:IEV), I realized that Ireland is excluded. Their neighbors UK, France, Germany, Switzerland, Spain, Netherlands, Italy and Sweden are all included. Could this be a mistake forgetting them?

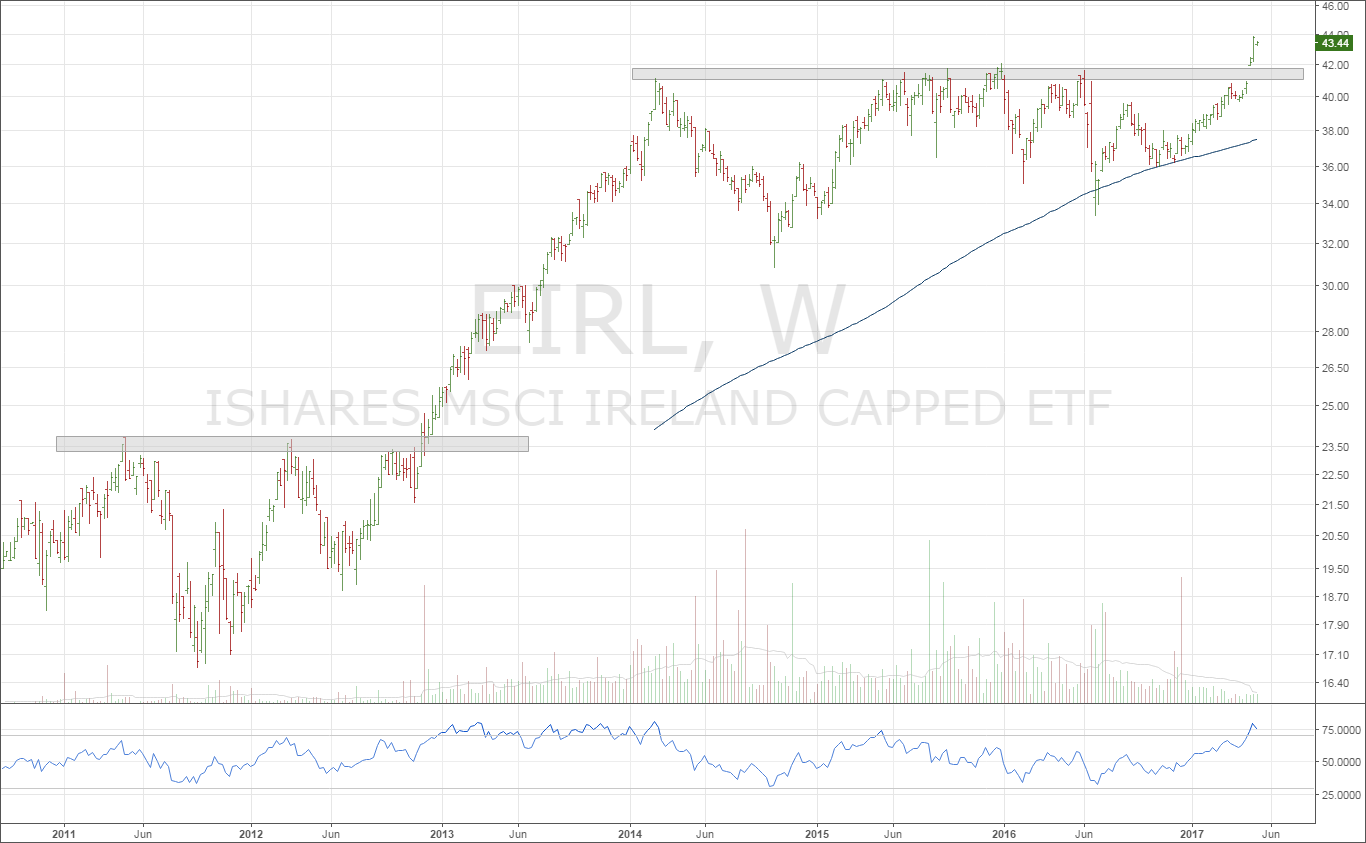

Here is a chart of the Ireland ETF (NYSEARCA:EIRL), breaking out of a 3 year long base on a decisive gap higher along with a rising 200 week moving average. For the entire 3 year consolidation, momentum has stayed in a bullish range, which is another big positive.

Following the base breakout in 2011-2012, Ireland ran for 71% gain into 2014. Are about to go on another run this time around?

For context here is the chart of the Irish Stock Exchange Index.

While EIRL is already up 15% in 2017, this does not keep me away from wanting to be long. What is more important is the potentially huge breakout we have just experienced. If EIRL can hold above the now turned support level of 42, I think this is a great uncorrelated and not talked about holding for investors’ portfolios.

When investors cannot go a day without hearing about Russia, China or North Korea, hopefully soon they will start hearing about Ireland instead.

What happens in this index may be an indicator of where we head Q2. Thanks for reading.

ALSO READ: Are Micro-Cap Stocks Indicating A Risk-Off Market?

StockTwits: @Alpha_Eye

(EDIT) post publication addition: “The author has a long position in EIRL at the time of publication”.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.