The equity markets soared last week supported by comments from Federal Reserve Chairman Jerome Powell announcing a more gradual rise in interest rates due to the fact that the Fed is close to meeting its goals of full employment and 2.00% inflation.

The shift in policy by the Federal Reserve has allowed for an explosive rally that turned a losing month for stocks into solid gains. The S&P 500 (NYSEARCA: SPY) and Dow Jones Industrials (NYSEARCA: DIA) recorded just under 2.0% gains, with the NASDAQ squeezing out a modest 0.3% for November.

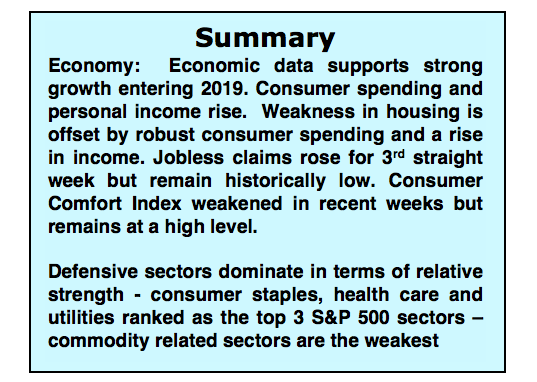

The markets have been held hostage by the notion that the U.S. economy was in jeopardy of slipping into recession due to a potential policy error by the Fed and/or a trade war with China. But that hasn’t been the case thus far.

And stocks are poised to add on to last week’s gains early this week on news over the weekend that the U.S has agreed to temporarily suspend additional tariffs on China that were scheduled to be implemented in early January.

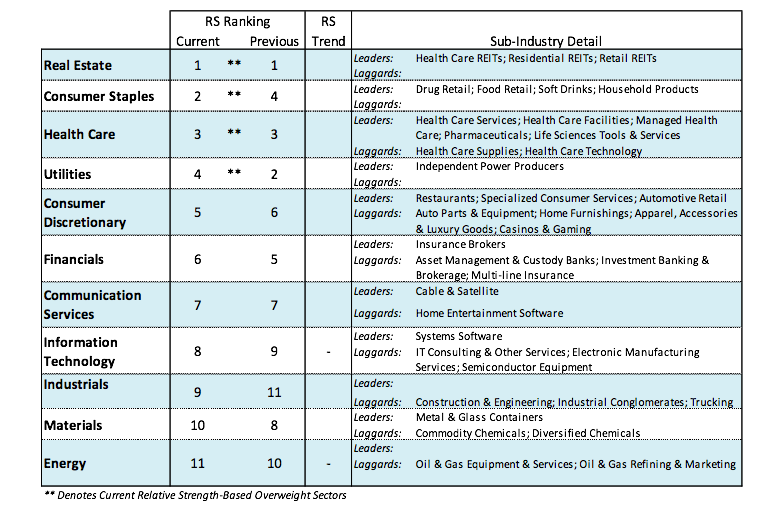

The recent rally in the stock market has been led by defensive sectors including utilities, consumer staples and health care. If the current rally is to be sustainable, we should soon see the buying spread to other sectors including energy and industrials.

Although last week’s events relieved some fears of a pronounced business slowdown, the markets still have to address the fact that differences with China on trade remain formidable and that the economy and corporate profit growth may have peaked.

According to FactSet, analysts expect earnings to grow at double-digit levels for the fourth quarter but expect more moderate growth in early 2019. The focus of attention this week will be on the November Employment Report issued on Friday. Consensus estimates are that the economy created 200,000 jobs last month with the unemployment rate steady at 3.7%. We expect the markets to remain volatile as uncertainty continues regarding slower global growth, an upcoming Federal Reserve rate increase, lower earnings estimates and trade talks with China remaining in the headlines.

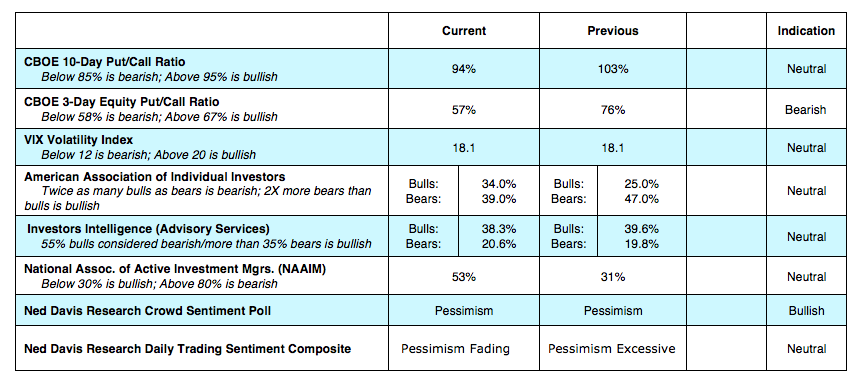

Technically, the majority of stock market indicators suggest a cautious approach. The exception is the strong seasonal pull of December, which historically is the strongest month of the year and up 75% of the time. Nevertheless, market breadth, price trends and investor sentiment remain problematic. Despite the strong rally last week, 536 NYSE issues hit new 52-week lows and only 91 reached new high ground. Additionally, less than 50% of S&P 500 issues are trading above their 200-day moving average and only 38% of S&P 500 industry groups are in defined uptrends.

The low percentage of groups in uptrends was last seen during the 2015-2016 cyclical bear market. Additionally, measures of investor psychology do not show the level of investor fear necessary to trigger a buy signal.

Last week witnessed a plunge in the demand for put options. Puts are bought in anticipation of a market decline; using contrary opinion this is a negative. The latest data from Investors Intelligence, which tracks the opinion of Wall Street letter writers, shows 38% bulls and 21% bears. This contrasts with 25% bulls and 39% bears at the 2016 market bottom. This valuable indicator, while moving in the desired direction, remains at a distance from showing excessive pessimism that typically accompanies an important market low.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.