I co-wrote this post with Craig Basinger of Richardson GMP.

You own 1,000 shares each of company A and B, each originally purchased for $100. Since buying, company A has declined to $80 and company B has risen to $120. If you need to raise some cash then which one do you sell?

If you said sell stock B then you may suffer from loss aversion. This behavioral bias often elicits itself in the form of investors selling winners and holding onto losers in their portfolios. There are a number of factors that contribute to this behavior and it is one of the more prevalent behavioral pitfalls for investors. Many studies have indicated that selling winners and holding losers detracts from long term performance.

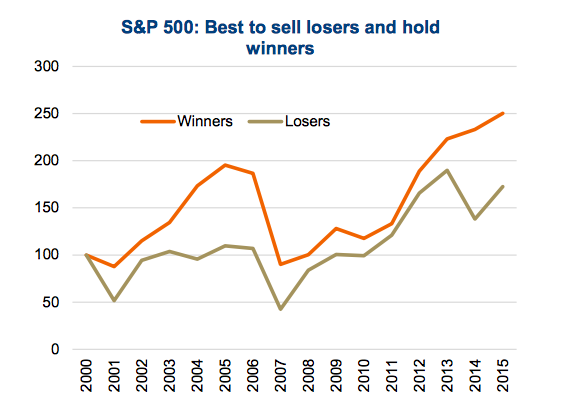

Despite the wide body of supporting research, we decided to get our hands dirty in the data. We took the TSX 60 over the past 15 years, comparing the subsequent annual performance of the best performing decile to the worse performing decile. The best performers are the winners and the worst performers are the losers (chart). The only periods in which this trend reversed were during low quality rallies that often occurred following bear markets. But it was certainly the exception, as winners dominate in most years. Similar results were found in the U.S. market as well – S&P 500 Index (INDEXSP:.INX):

What Causes Loss Aversion

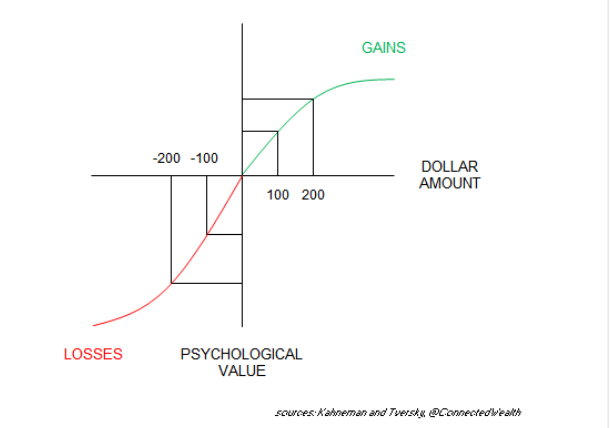

There are a few factors that contribute to loss aversion. The first is losses hurt more than gains feel good. There is an asymmetry between gains and losses. In other words, a $20 loss has a greater negative feeling than the positive feeling of a $20 gain (2nd chart). Would you play a coin toss game if heads you win $100 and tails you lose $100? Probably not. But what if heads you win $120? Chances are you would still not play as most studies found that you need $150 to $200 on a winning toss to compensate mentally for the equal chance of losing $100. The size of the winning coin toss required to offset the $100 loss may indicate your level of loss aversion.

Since losses hurt more, you sold company B as you did not want to lock in that $20 loss in company A. Which brings up another contributor to loss aversion, anchoring. Right or wrong, investors often anchor their investments as a function of how much they originally paid. I cannot count the number of times an advisor or investor has asked me about a company they own and added what they paid for it. Anchoring the investment to its cost alters how you view the investment and how you make subsequent decision. It is also evidence of narrow framing. You are comparing company A to its costs and company B to its costs in the decision of which one to sell. Comparing the prospects of each company from current levels would likely be a better strategy rather than looking at each in isolation.

Lastly there is regret. If you sell the loser at $80 and it rallies back to $100 then you will feel as though you caused that loss to be real. If you sell company B at $120 and it rallies to $140 then you will also feel regret; but, it will be reduced by the knowledge it was a profitable trade.

Strategies to Reduce Loss Aversion

While you could just ignore the original price of what you paid for an investment, that may be harder than it sounds. Using a wide framing perspective in making the decision can help. Essentially, you are not looking at each position in isolation, instead look at them in conjunction with each another and even within the entire portfolio. This wider perspective helps reduce the input of original cost into the decision process.

Don’t think of a trade as a onetime event. Professional traders who are more active don’t suffer nearly as much from loss aversion because they are making these decisions more often. The repetition enables them to make a decision about a trade and move on. Remember the coin toss that you decided to not play that had $120 win vs the risk of a $100 loss? The $120 was not enough upside to compensate for the risk of losing $100. But what if you could play 100 times? In that case everyone would want to play.

We are not saying investors should trade more but instead that they should think about each trade as part of a lifetime of investing. Repetition reduces loss aversion.

Finally, there are strategies to reduce regret. Completing a pre-mortem on the trade can help immensely. A post-mortem is an analysis after death, or in this case after a trade. In a pre-mortem you consider different scenarios as to what could happen once you sell company A or B. Yes, A could recover but currently the outlook for A is poor, which is why it is down to $80. There is also a good chance A gets cheaper. B, which is up at $120 has clearly been receiving better news.

If you sell A and it recovers then you will likely experience less regret as you did consider that scenario and dismissed it. Studies indicate that regret is higher if the decision is not seriously considered or researched.

Know your behavioral biases, understand what causes them and implement strategies to reduce or mitigate any negative impacts they may cause on your long term investment performance.

Thanks for reading.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.