Key Investing Takeaways for the Week:

– Bond yields not showing same confidence as stocks.

– Optimism has eased but pessimism is lacking.

– Rebuild in momentum would sustain stock market rally.

Two weeks ago, we discussed excessive optimism in the context of strong underlying momentum. News about the coronavirus knocked both momentum and optimism out of the market.

The S&P 500 Index has moved back to new highs, offering some indication that the focus is moving away from virus fears and concerns. A relevant question now is which re-emerges first – renewed momentum or excessive optimism?

Before getting to what we will be watching with respect to sentiment and momentum, there is a more fundamental question – have the financial markets actually moved beyond the virus? New highs on the S&P 500 (as well as new highs from the Technology and Financials sectors) would suggest the answer is yes.

The recovery in terms of bond yields and commodity prices has been more muted. It is worth noting, however, that yields were moving lower prior to virus news out of China, so there very well could be something else that the bond market is fixated on (hint: it starts with “e” and ends with “conomy”). A rise in the 10-year T-Note yield above 1.75% would seem to be a vote of confidence from the bond market.

News about the coronavirus (and the stock market reaction to it) fueled a welcome move away from the excessive optimism that emerged in the fourth quarter of 2019. Monthly survey data for January from University of Michigan and the Conference Board showed a meaningful expansion in the percentage of consumers expecting stock prices to move higher.

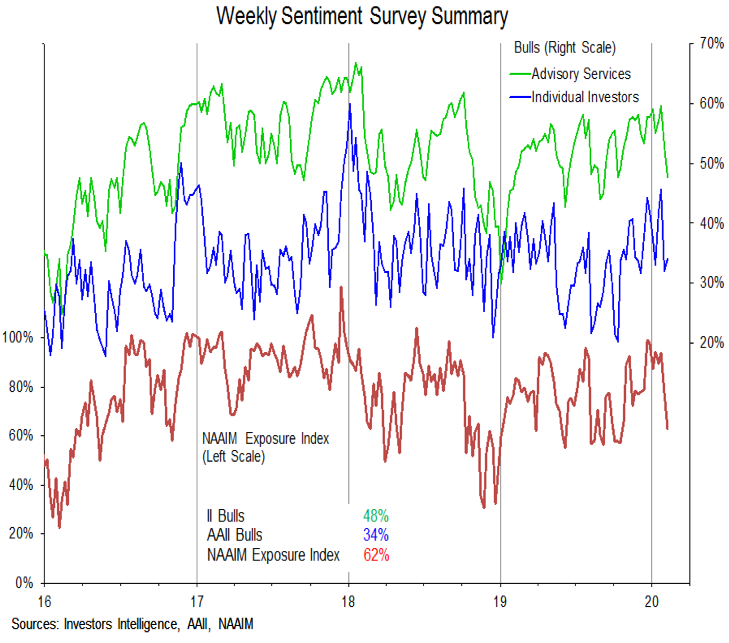

In the wake of the recent market volatility, bulls on the Investors Intelligence survey have fallen to 48% (from 59% two weeks ago) and among the individual investors on the AAII survey, bears have outnumbered bulls for two weeks in a row. Active investment managers have cut their equity exposure and the NAAIM exposure index is at its lowest level since October.

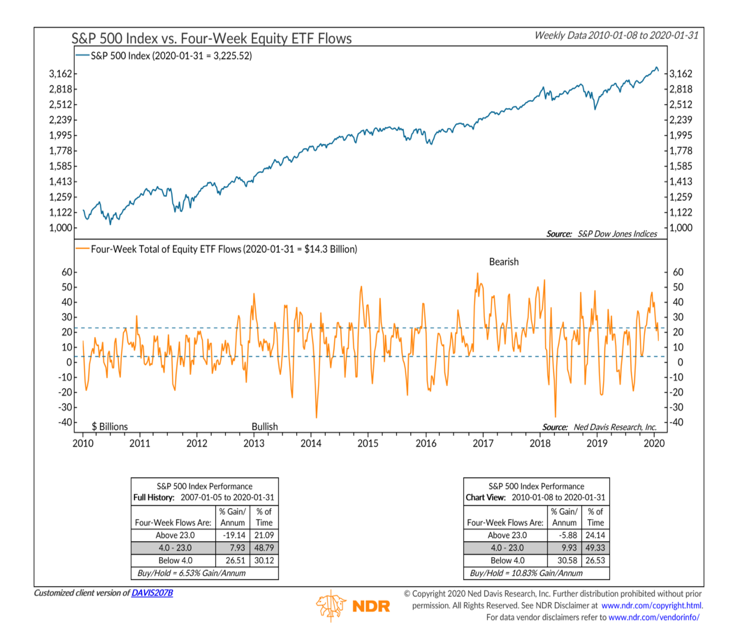

So far, the shift in sentiment has been more of a move away from excessive optimism than toward excessive pessimism. Weekly equity ETF inflows have slowed, but remain positive. As stocks have rallied back to new highs, there is evidence that the drop in optimism may have been short-lived.

Daily data shows equity ETF inflows re-accelerating this week and put/call ratios have turned sharply lower as complacency has returned. All of this comes in an environment when household exposure to equities remains historically high.

Resurgent optimism that is not accompanied by an improving momentum backdrop could represent a near-term headwind for stocks.

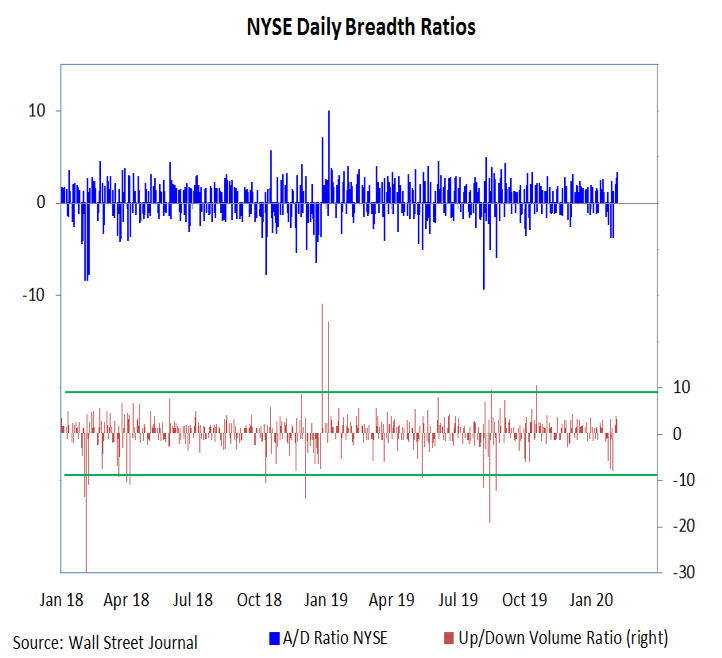

The loss of momentum after the recent round of selling can be described in various ways – though most of them border on being esoterically technical. Perhaps the most straight forward way of saying it is that volume was more heavily tilted to the downside as stocks were selling off than it was tilted to the upside when stocks rallied. Accompanying the index-level weakness was a contraction in the percentage of stocks trading above their 50-day or 200-day averages. Thus far, the expansion in the new high list has lagged the recovery in the indexes.

The decline was significant enough to unwind upside momentum, but too brief to allow for truly oversold conditions to emerge. The S&P 500 finished the month of January in the red (after being up more than 3% mid-month), but neither the index-level move nor the internals reached “washed out” levels.

Without an oversold bounce fueling the initial stages of a rally, it may be difficult for a momentum tailwind to re-emerge. Nonetheless, a surge in upside volume and/or another round of breadth thrusts (currently 76% of stocks are above their 10-day averages – getting above 90% would be a sign of strength) would argue that a momentum tailwind has been rebuilt.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.