If you watched CNBC yesterday, then you saw a good amount of fear. In fact, the question was asked if the S&P 500 (SPX – quote) was finally ready for a 10 percent correction.

If you watched CNBC yesterday, then you saw a good amount of fear. In fact, the question was asked if the S&P 500 (SPX – quote) was finally ready for a 10 percent correction.

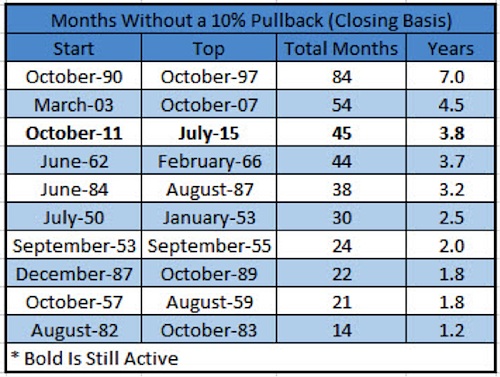

The reason everyone is wondering about when the elusive 10 percent correction will come is probably because the stock market hasn’t had one in a while.

In fact, going back to 1950 this is now the third longest streak without a 10 percent correction on the S&P 500. Take note, this is using closing prices.

Bull Markets – Months Without A 10 Percent Correction

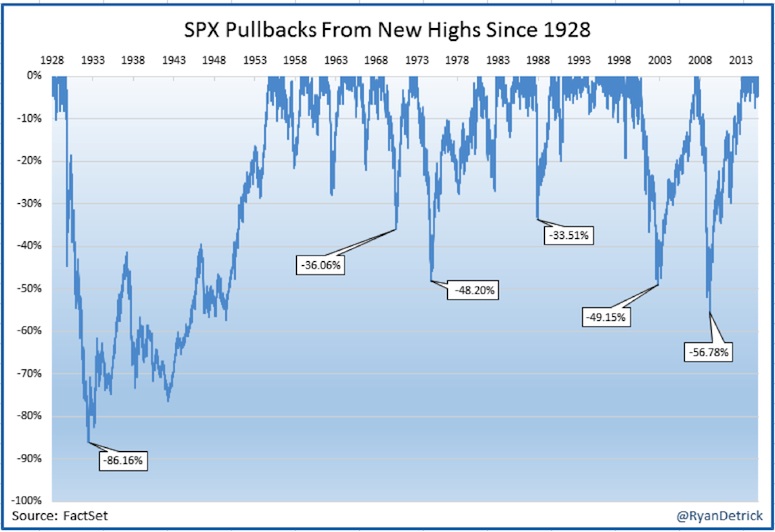

Here is another look at market pullbacks from all-time highs. This is another way to see just how persistent this bull market has been.

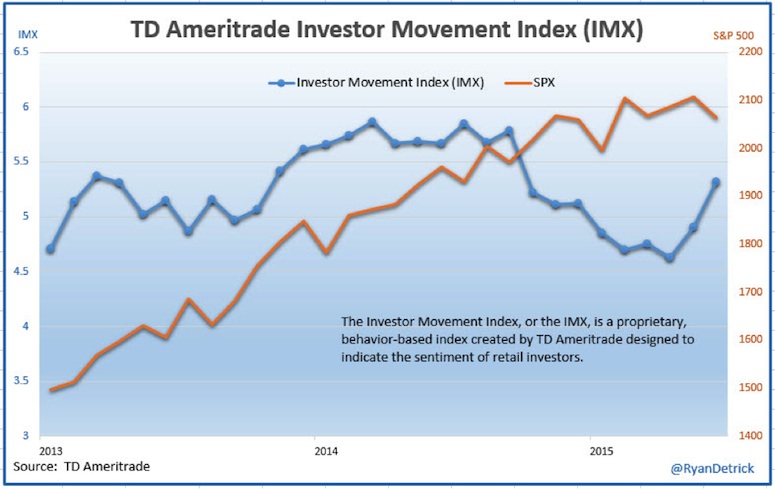

So are we about to have that 10 percent correction? First off, TD Ameritrade investors came into this month the most bullish they have been in 10 months on the stock market. That should make the contrarian ears ring.

Technically, we have two areas I’m watching here. First up is the year-to-date breakeven level around 2059. We bounced right off that area recently. And there will likely be some jockeying around it.

S&P 500 Y-T-D Chart

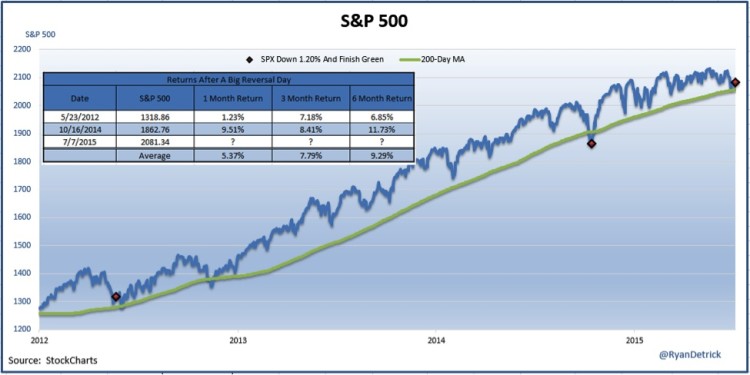

Next is the S&P 500’s 200-day moving average around 2055. This trendline has served as nice support going back several years. In fact, the reversal we saw yesterday was extremely rare and potentially very bullish. Below are the previous times the S&P 500 was down 1.20% and finished in the green. Bottom line is they all happened near the 200-day and big bounces happened soon after.

As I pointed out last week, the Volatility Index (VIX) tends to spike in July. This could suggest lower equity prices.

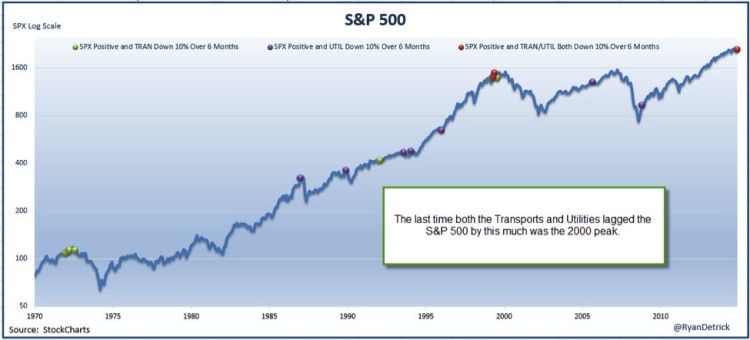

Also, we are seeing historical relative weakness from both the Transports and Utilities right now. This is another big concern the 10 percent correction could be coming.

Trust me, I wish I knew if this was the start to the 10% correction. I just listed a few reasons to be bullish and a few to be bearish. My gut says this isn’t the start of a 10% correction. When CNBC has headlines asking if it is going to finally happen and we see the big surge in fear like we did so far this week, I think we bounce before we sell-off.

Thanks for reading and good luck out there.

Twitter: @RyanDetrick

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.