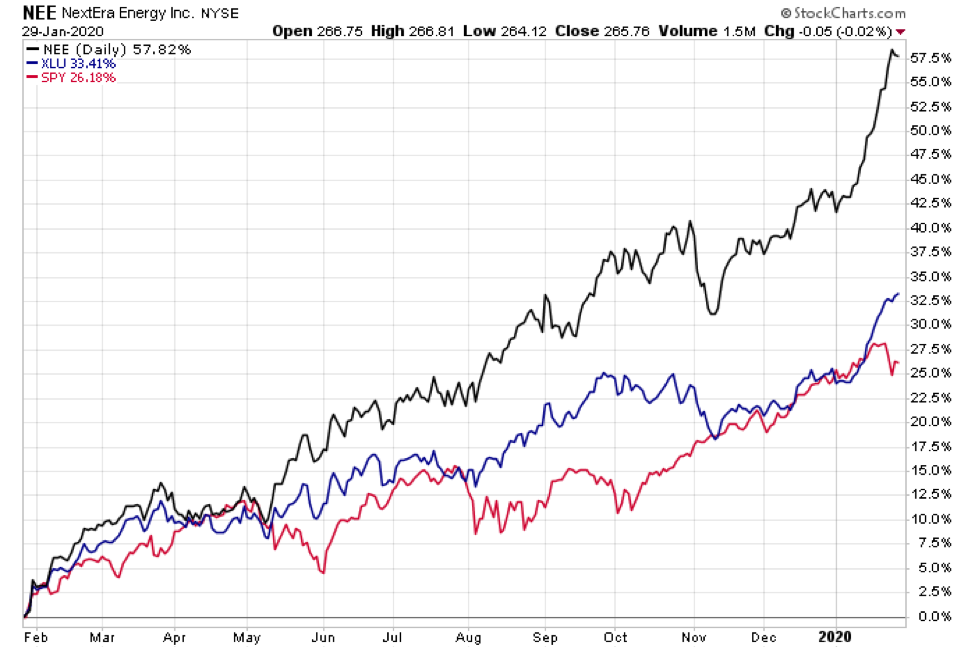

I was listening to Michael & Ben’s Animal Spirits podcast on my drive into work recently and heard them discussing how rip-roaring utilities stocks had been of late.

I pulled up the chart first thing as I got to my trading desk at work.

The Utilities Select Sector SPDR ETF (XLU) jumped out of the gate with a 10% climb in 2020. Roaring 20s indeed – for ‘boring old’ utility companies.

See the chart below.

The guys were on-point mentioning how falling interest rates have contributed to the yield-sensitive sector’s return.

Utilities stocks are typically able to carry tremendous amounts of debt because their business is very stable relative to other areas of the economy. So, any small change in interest rates, or the cost to borrow, impacts them more. Also, the “Utes” pay high dividends, so they have some bond-like characteristics – lower rates, higher yields – more demand from yield-hungry investors.

I have another spin on it though.

Take a look at the portfolio of XLU. It is concentrated with the top 4 holdings representing about a 1/3 of the total. By far the biggest weight is NextEra (NEE).

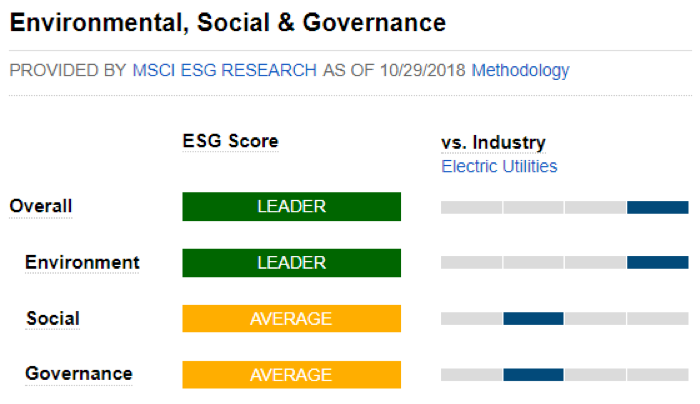

The Florida-based utility stock is aggressively moving into the renewable energy space, and of course takes pride in its green portfolio. Analyst opinions seem to back that up as well – MSCI ESG (Environmental, Social, Corporate Governance) Research deems NextEra an industry leader in the ‘Environment’ section of ESG.

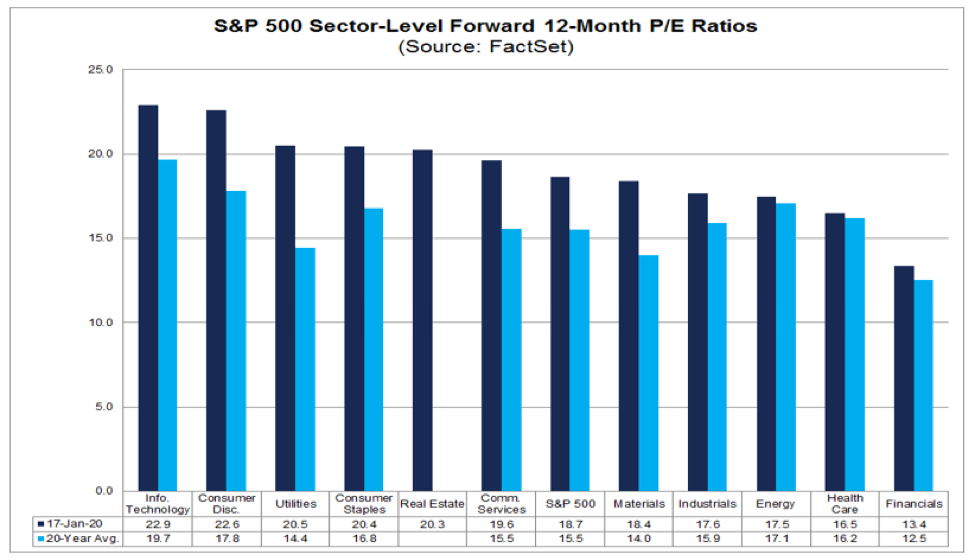

NextEra also trades at a low 30s trailing P/E ratio – more like a big cap tech stock than a traditional electric utility. Of course, maybe that’s a sign of a top!

Here’s the point – the utility landscape is changing quickly. The United States is transitioning away from coal & oil and to wind, solar & batteries. Natural gas is having its day in the sun right now, but the EIA recently released their annual outlook suggesting natural gas consumption may stagnate from the early 2020s to the early 2030s. Technology is going to be the key player in this sector.

This probably sounds ‘toppy’, but I suspect utilities may trade a rather high P/E ratio versus history given the evolution of the sector from smokestacks to smart wind & solar farms.

FactSet: Utilities trading at the biggest premium to historical average P/E

I am a Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT). I have passed the coursework for the Certified Financial Planner (CFP) program. I look to leverage my skills in an hourly-fee consultant role for financial advisors – that could be portfolio analysis, planning, writing etc. Please reach out to me at mikeczaccardi@gmail.com for more information. Connect on Linkedin.

Twitter: @MikeZaccardi

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.