An interesting anecdote on Twitter recently prompted the need for further discussion about stock buybacks, along with the concomitant benefits and costs to shareholders.

An interesting anecdote on Twitter recently prompted the need for further discussion about stock buybacks, along with the concomitant benefits and costs to shareholders.

“Stocks wouldn’t be this high were it not for all the buybacks…” Yes, except the buybacks happened, so stock prices are this high.

— Myles Udland (@m_udland) April 23, 2015

Stock buybacks are perceived by many as a byproduct of low interest rates because companies can issue debt at low yields and use the proceeds to reduce the share float of their stock. This cycle of capital flows is something that has accelerated significantly over the last several years as many public companies attempt to reduce their outstanding shares and keep a steady bid under equity prices.

Nevertheless, detractors will point out that they are also expanding their balance sheets with burdensome bonds rather than using the money to pay dividends or for other positive measures. Of course, companies don’t always fund stock buybacks with bonds; they also use free cash flow as well.

My take on this process is neutral from a financial standpoint. I would rather focus on price instead of second guessing the fiscal decisions that some of the smartest CFOs on the planet are implementing.

Observing the PowerShares BuyBack Achievers Portfolio (PKW) is one method of analyzing this trend. This ETF is based on the NASDAQ US BuyBack Achievers Index, which screens U.S. stocks that have had a 5% reduction or more in their outstanding share float over the last 12 months. The end result is a portfolio of over 200 stocks with well-known names such as Apple Inc (AAPL), Home Depot Inc (HD) and International Business Machines (IBM) topping the list.

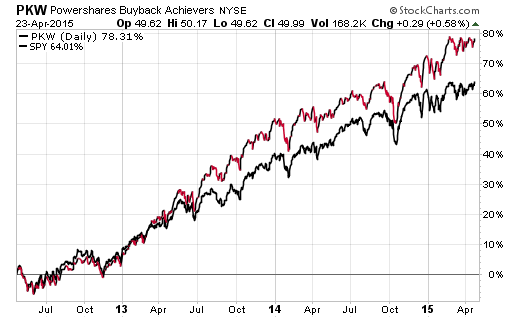

Over the last 12-months, PKW has gained 16.94% compared to 14.87% in the SPDR S&P 500 ETF (SPY). Much of that outperformance has come here in 2015, as the 25% allocation to small and mid-cap stocks within PKW have boosted returns. A 3-year look back (shown below) provides an even wider variance in total return.

PKW – Powershares Stock Buybacks Achievers Chart

The evidence seems clear that stocks implementing aggressive buyback plans are showing modest relative momentum across multiple industries and market cap segments. The sector dispersion in PKW is most highly concentrated in consumer discretionary, technology, and industrial names. Predictably, there is a wide variety of high quality companies represented within this ETF because of the focus on shareholder value.

I have owned PKW for my growth clients for some time now as it has continued to offer an alpha-seeking mentality with a unique subset of stocks. I consistently evaluate the underlying holdings and regularly track its progress relative to other growth-oriented ETF opportunities. So far it has continued to add value despite its 0.68% expense ratio, which is somewhat higher than strict passive alternatives.

Lastly, I think it’s important for investors to forget the “if/then” narrative that seems to be a psychological barrier to living in the present and investing for the future.

If the Fed had never….

If big banks had never….

If stock buybacks had never….

Stop worrying about what the world might look like if those things had never happened, because they did and we are where we are. Focus on the present and the things that you can control in order to get the most out of your investment portfolio.

Follow Dave on Twitter: @fabiancapital

The author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.