The equity markets ended 2019 with the best gains in six years followed by new record highs recorded in the first week of the new year.

Stocks ran into resistance at the end of last week with the news of a U.S. military strike that killed the leader of the Iranian military. The immediate impact caused the equity markets to suffer small losses while oil, gold and bonds ended the week higher.

Given the stock market’s nearly straight up move since the third quarter of last year, rising tensions with Iran could be the catalyst for a short-term pull-back.

But with economic fundamentals improving and the Federal Reserve remaining accommodative, the outlook for 2020 remains positive.

In addition to the Middle East turmoil, the Institute for Supply Management’s Manufacturing Index was reported and unexpectedly fell in December to the lowest number in ten years.

The report asserted global trade to be the most significant cause of the slowdown and stated there are signs several industry sectors could improve as a result of the U.S. China Phase One Trade Agreement on tap to be signed mid-January.

Additionally, the United States Mexico Canada Trade Agreement is set to be signed by the end of this week. This will be a major boost to Wisconsin dairy farmers, Detroit auto workers and businesses in all fifty states.

What does a U.S./Iran conflict mean to investors?

Gold and oil have surged due to the escalation of tensions between the U.S. and Iran, and may continue until things begin to settle down. Iran has vowed retaliation for killing its top general but most analysts expect that Iran may instigate some low-level clashes but will stop short of major conflict. An escalated conflict in the Middle East could, however, impact the global GDP and investor sentiment and be the catalyst for a short-term pull-back.

Given the aging business cycle, is there a risk of recession in 2020?

History shows that recessions rarely occur in election years. The U.S. economy, by most forecasts, is expected to expand moderately in 2020 but not slip into a recession. The best predictors of past recessions have been an inverted yield curve, durable goods purchases, housing starts, the strength of the labor market and consumer confidence.

These economic indicators are mostly favorable. The yield curve is sloping upward and economic fundamentals look solid. The weekly unemployment claims number needs to get above 500,000 to signal a recession. Currently those numbers are well under 250,000. The flashing yellow light is business confidence which has declined the past four months. With the recent positive trade developments, we expect business confidence to improve.

In the current low interest rate environment, how much weighting of a portfolio should shift from bonds to income-oriented stocks?

We believe that stocks will outperform bonds this year and that yields will remain low with a possible slight drift up in interest rates. Investors who need to be more conservative should remain in short-term bonds with less risk. Yields on bonds are certainly low, but at least they remain in positive territory. Investors who are willing to take more risk can look at dividend-paying stocks such as REITS, utilities as well as some of the energy stocks and pipeline operators but should understand that there are moderate risks with equities.

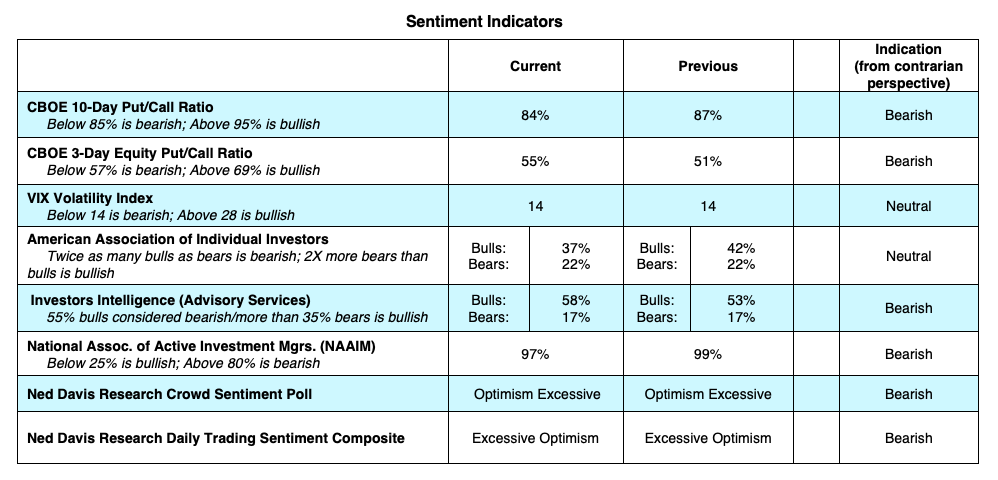

The Bottom Line: We expect to see positive returns in both stocks and bonds in 2020 backed by solid economic fundamentals including an accommodative Federal Reserve, several very positive trade agreements, a resilient labor market and a strong consumer. The main concern for us is that investor expectations may become too exuberant. According to Ned Davis “stocks are in the highest quintile of historical valuations dating back to 1925.”

With the stock market at record highs and with geopolitical tensions in the headlines, it’s probably smart to diversify to buffer bouts of volatility.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.