Key Takeaways: Stocks have moved off of their late-December lows, though the bounce lacked divergences ahead of time and energy as it has emerged.

Investor sentiment continues to offer mixed messages across indicators, with pessimism less than universal. Deteriorating business optimism could weigh on both stocks and the economy.

The weight of the evidence continues to argue for caution here.

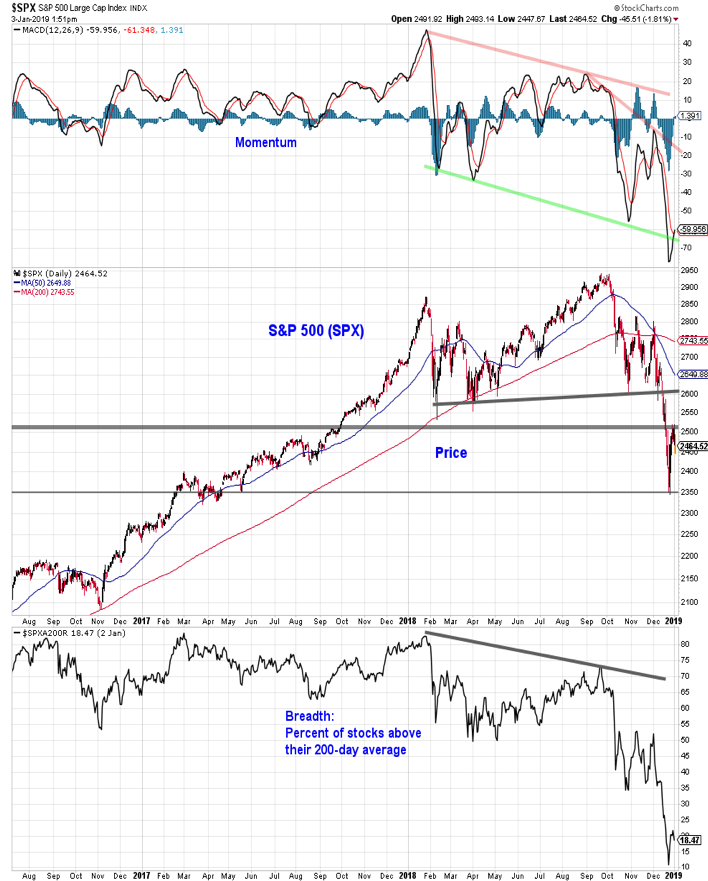

Stock market selling intensified ahead of Christmas, and while stocks did finish 2018 on an up note, it was not enough to change our overall cautious view on stocks. Importantly, both momentum and breadth made new lows as the S&P 500 marked its 2018 low on Christmas Eve.

Momentum and breadth typically bottom (and peak) ahead of price – the lack of positive divergences leaves the S&P 500 lacking a constructive set-up from which to rally. Further, the bounce off of the price lows has generally lacked the energy to push higher. We have experienced only a single day in which upside volume outpaced downside volume by better than 10-to-1 (it was 28-to-1 on December 26).

For now, resistance on the S&P 500 is near the recent peak above 2500 – a move above that level could clear the way for a move up to 2600. Support is near 2350. If near-term bottom is indeed in place, both momentum and breadth would be expected to hold up better than price if a meaningful test emerges.

The lack of positive breadth and momentum divergences at the December index-level lows increases the likelihood that those levels will be tested (and perhaps broken) in 2019.

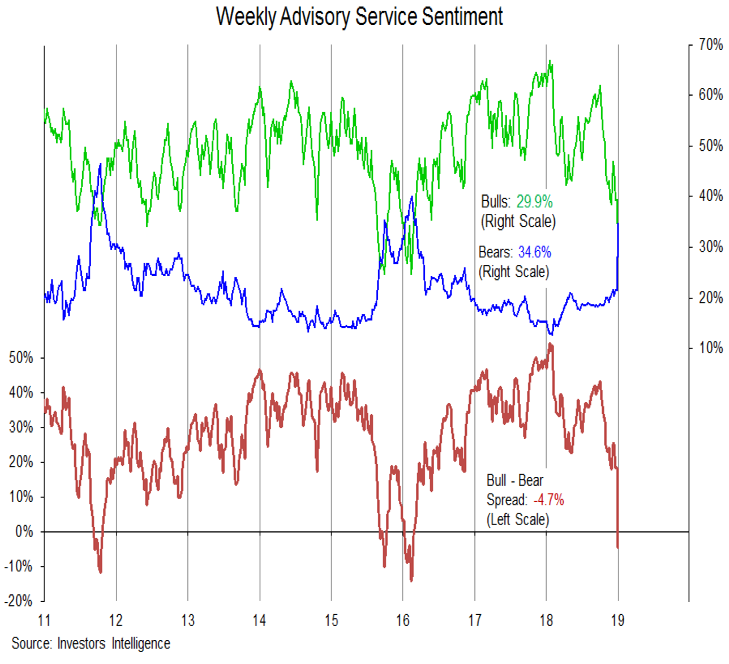

December stock market weakness did produce some meaningful shifts in investor sentiment. Advisory services, as measured by Investors Intelligence, had been stubbornly optimistic throughout the late-2018 sell-off.

That seems to have changed with this week’s data. Bulls on the II survey dropped to 30% from 39% the previous week and near 50% at the beginning of December. Bears jumped to 35% from 21% and the Bull-Bear spread moved from +17% to -5%. This data is now approaching the excessive pessimism that was present at the 2011 and 2016 cyclical bear market lows (the bull-bear spread dropped below -10% in both instances).

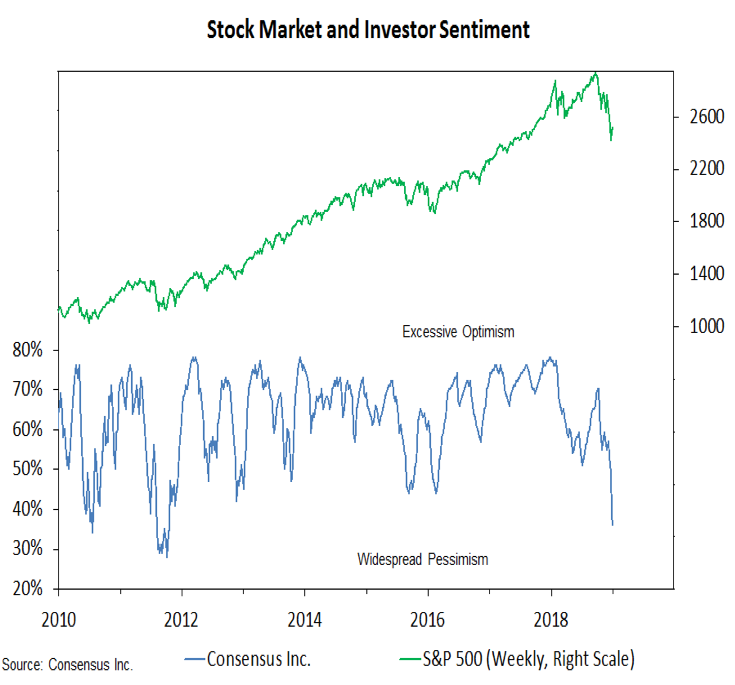

Similarly, data compiled by Consensus Inc. shows a significant shift from the excessive optimism that was present at the beginning of 2018 and which was reemerging over the course of the summer. The bullish percent in this survey dropped from 70% in early October to this week’s reading of 36%, the lowest level since 2011.

Excessive pessimism alone is unlikely to spark a bounce but it can provide fuel for a rally. The problem in the current case, as we will show in a moment, is that even as these investor sentiment indicators are moving toward pessimism, other indicators suggest investors are already taking a more constructive view on stocks.

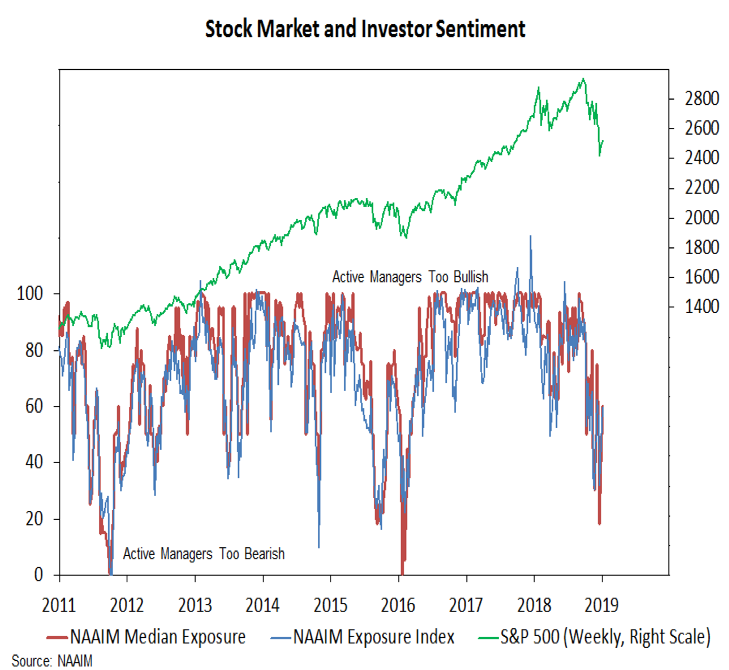

While the shifts in sentiment on the Investors Intelligence and Consensus surveys could provide fuel for rally attempts in the first quarter, they are being diluted by evidence from the AAII and NAAIM data showing that investors have already turned more optimistic.

Over the past two weeks, the NAIAM exposure index has moved from 32% to 59% after failing to reach the bearish extremes present during previous cyclical bear markets. Likewise, the AAII data showed that over the past three weeks bulls have jumped from 21% to 33% and bears have fallen from 49% to 43%.

At this point, the mix of data is not sufficient to suggest that investor sentiment overall has reached a pessimism extreme that could fuel an extended rally attempt in stocks.

A longer-term look at sentiment is worth monitoring for its implications for both stocks and the economy. The animal spirits that emerged in the wake of the 2016 election could be dissipating as unconcluded deals overseas and at home may be weighing on confidence.

Continued weakening in small business optimism could weigh on economic growth and that added uncertainty could further challenge the overall weight of the evidence back drop for stocks. Stocks perform best as optimism is building after excessive pessimism has been reached and the economy does best when optimism is high and rising. Neither the economy nor the stock market hold up well when confidence is retreating from elevated levels.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.