Last week emerged as the most volatile of the year but at the close on Friday, the S&P 500 Index INDEXSP: .INX, Dow Jones Industrials INDEXDJX: .DJI and NASDAQ Composite INDEXNASDAQ: .IXIC were down less than 1% from the previous week.

The trade war with China, once again, appears to be the cause of the stock market’s gyrations.

Last week Chinese officials allowed China’s currency (the yuan) to fall against the U.S. dollar as a retaliatory measure against the U.S. levy of 10% tariffs on an additional $300 billion in Chinese goods. A weaker yuan could undo the impact of the new U.S. import tariffs by making Chinese goods cheaper and U.S. exports more expensive.

The U.S. Treasury then designated China a currency manipulator. China, with an economy that is faltering and revolts breaking out, desperately needs a trade deal. It remains possible between now and the enforcement of the new tariffs on China that an agreement could be reached.

The U.S. economy has been on fundamentally solid ground, which has been support for the stock market. The concern is that business confidence is down due to trade and that weak global growth is impacting the U.S. This is seen in the July ISM numbers that show manufacturing near contraction levels (below 50) while the service sector, the largest driver of the economy, is down four of the past five months to the lowest level in three years.

Futures prices are suggesting at least one more cut in the fed funds level later this year, which should help support the stock market and the economy.

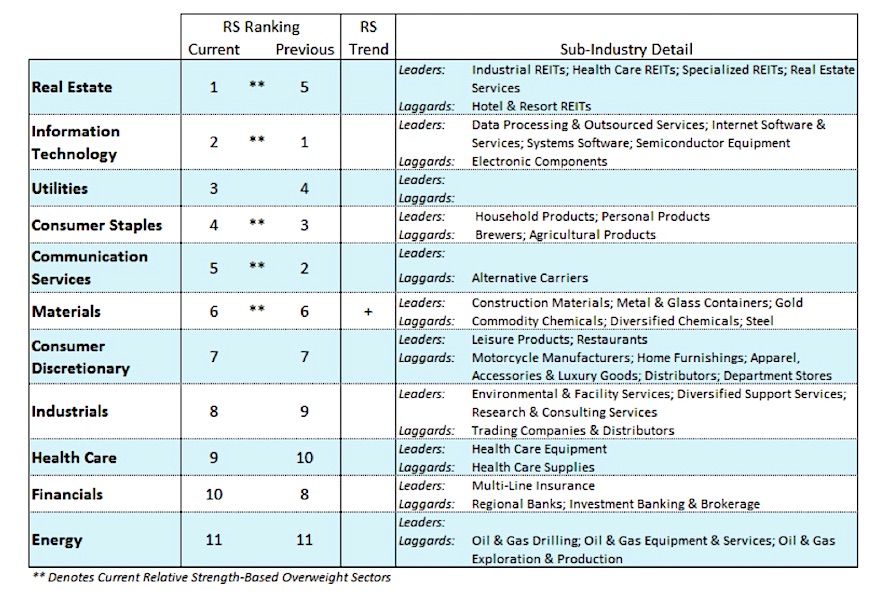

The past several weeks we have experienced unusual volatility in sector leadership. We currently favor the defensive areas of utilities, consumer staples and real estate investment trusts (REITs). Additionally, we favor the strong information technology and consumer discretionary sectors. We have recommended since early this summer that investors balance portfolios with high quality corporate bonds and gold. Gold soared above $1,500 an ounce and hit new record highs in dollar terms for the first time since 2013.

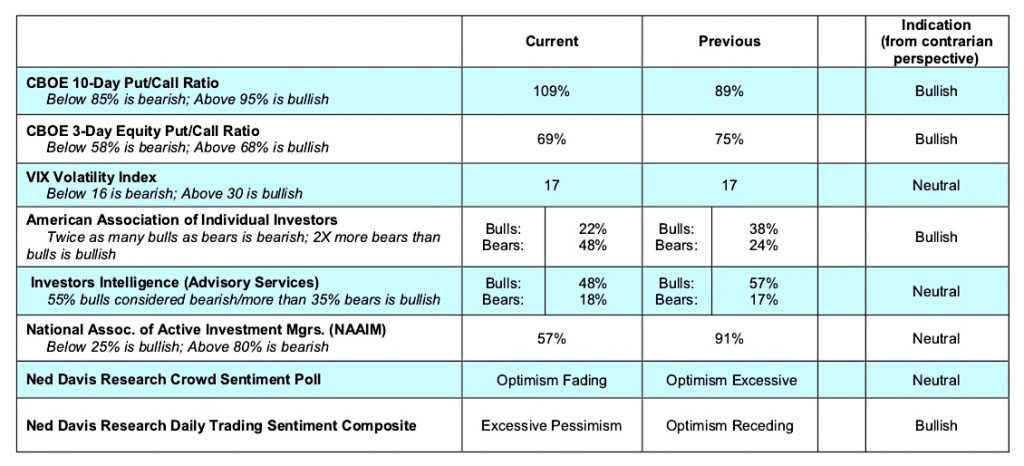

Last week witnessed an unusual swing in investor sentiment from excessive optimism one week ago to excessive pessimism.

From a contrarian view point, this holds bullish ramifications for the market. The most recent survey from the American Association of Individual Investors (AAII) showed the bullish camp plunging to 22% from 38% in one week’s time while the bears doubled from 24% to 48%. The report from the National Association of Active Investment Managers (NAAIM) told a similar story with the allocation to stocks from this group of aggressive players dropping to 57% from above 90% the previous two weeks. The message was the same from Investors Intelligence (II) which showed the bulls dropping from 57% to 48%.

Furthermore, the Chicago Board of Options Exchange (CBOE) reported a surge in the demand for puts causing the CBOE put/call ratio to move on a buy signal. The CBOE Volatility Index, which measures the level of fear in the market, surged to the highest level since December 2018. The significance of the rapid change in investor psychology offers near-term support for the stock market.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.